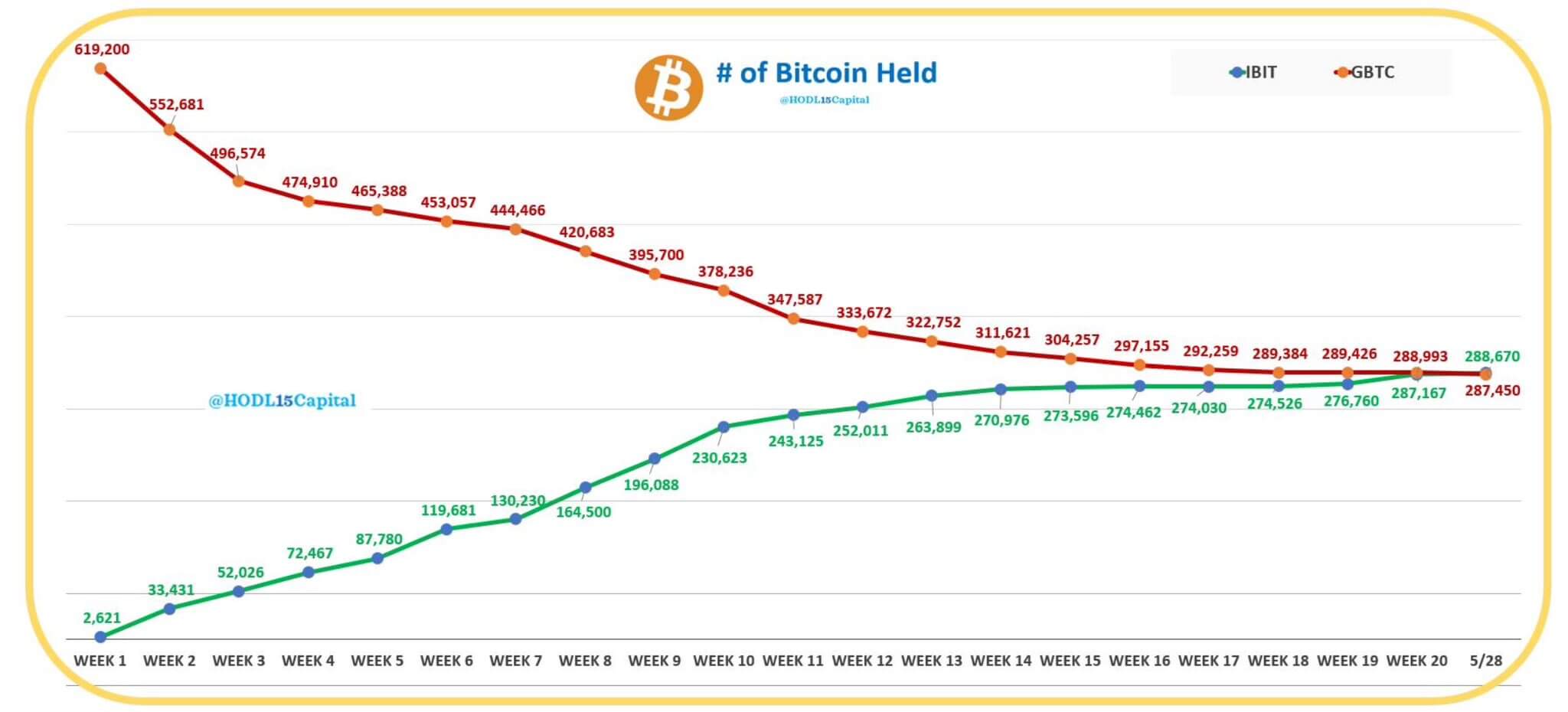

- BlackRock's IBIT flipped Grayscale's GBTC holdings of Bitcoin ETFs.

- IBIT holdings rose to 288,670 BTC in comparison with 287,450 for GBTC.

One of many massive Bitcoin information at this time is that BlackRock's iShares Bitcoin Belief (IBIT) has turn out to be the biggest Bitcoin exchange-traded fund (ETF) on this planet, surpassing Grayscale's Bitcoin Belief (GBTC).

On Might 28, inflows into IBIT reached $103 million, whereas GBTC noticed an outflow of $105 million. Total, the spot bitcoin ETF market noticed internet inflows for the eleventh straight buying and selling day on Might 28, totaling over $45 million.

IBIT overtakes GBTC as the biggest Bitcoin ETF

Whereas Grayscale's spot BTC ETF noticed an outflow of $105 million, or 1,540 BTC, BlackRock's IBIT noticed an influx of practically $103 million, or plus 1,501 BTC.

BlackRock now holds 288,670 BTC for its IBIT ETF, whereas Grayscale's GBTC holdings additional dwindled to 287,450 BTC.

Notably, when spot bitcoin ETFs debuted in January, Grayscale's ETF held 620,000 bitcoins. Nonetheless, as knowledge from HODL15Capital shared at X present these have dwindled shortly as BlackRock, Constancy and others have swelled previously 4 months.

In response to HODL15Capital, the Grayscale outflows occurred amid the charge problem (1.5% for GBTC vs. 0.2% for friends).

“Grayscale held 620,000 BTC on the time of the conversion (10/1/2024), which was greater than 3% of the circulating provide, however refused to cut back the charge (1.5% vs. 0.2% for companions), even after buyers withdrew 330,000+ BTC. A lot for a “differentiated” technique,” famous HODL15Capital.

Bloomberg message revealed on Wednesday notes that BlackRock's BTC holdings reached $19.68 billion on the shut of buying and selling on Tuesday, in comparison with $19.65 billion in BTC for Grayscale. Constancy's FTBC, which noticed an influx of $34.3 million on Might 28, at the moment holds $11.1 billion.

IBIT's flip of GBTC comes as BlackRock revealed in a regulatory submitting that its funds purchased IBIT shares.

Particularly, the BlackRock Strategic Revenue Alternatives Fund (BSIIX) he purchased $3.56 million in shares of IBIT within the first quarter. In the meantime, Strategic World Bond Fund (MAWIX) holding $485,000 value of ETF shares.