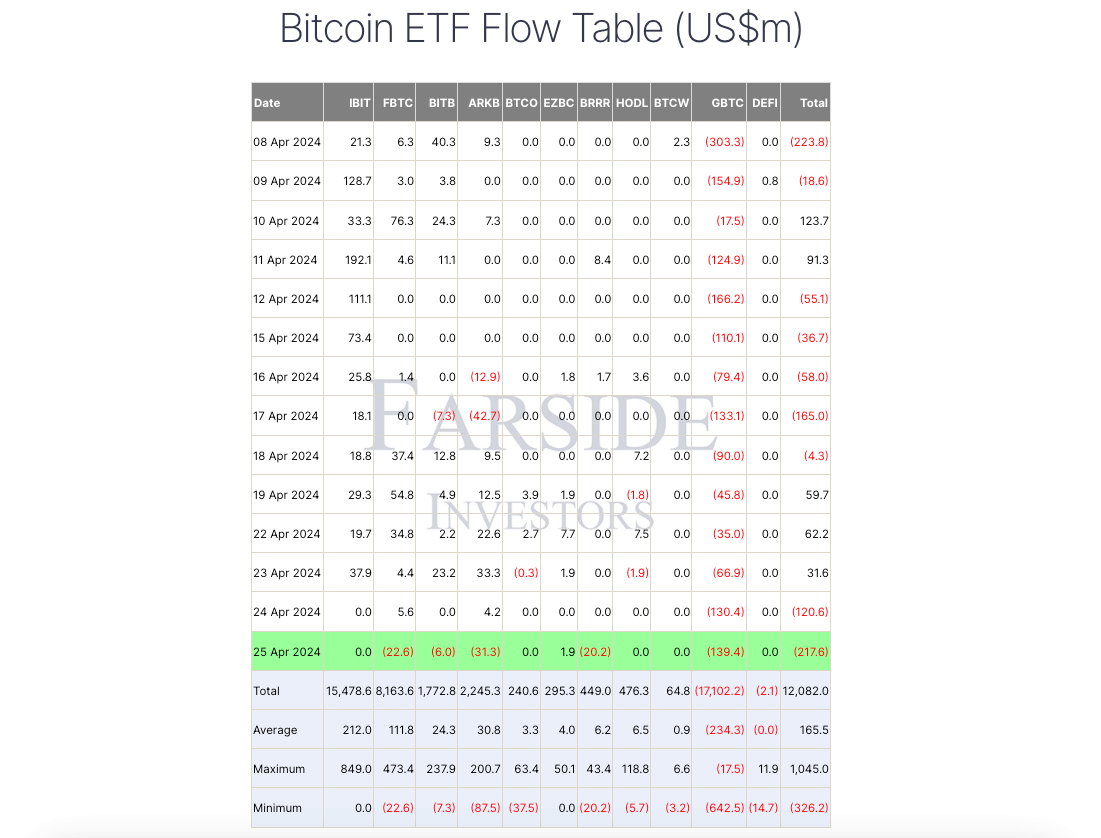

Investor curiosity in spot bitcoin exchange-traded funds (ETFs) seems to be waning, with outflows totaling $218 million over the previous day.

In response to information from Farside Buyers, BlackRock's IBIT Bitcoin ETF noticed zero flows for the second day in a row, whereas Constancy's FBTC noticed its first every day web outflow totaling $23 million.

Different US bitcoin funds noticed important every day outflows. Greyscale GBTC fund continued its outflow, shedding $139.37 million, whereas Ark Make investments and ARKB 21Shares exited $31.34 million. As well as, the Valkyrie fund noticed an outflow of $20.16 million and Bitwise noticed a detrimental stream of $6 million.

In distinction, Franklin Templeton's EZBC emerged as the one fund with every day web inflows, attracting $1.87 million.

Regardless of these outflows, web inflows into ETFs since their January launch have exceeded $12 billion.

Why are Bitcoin ETFs seeing outflows?

Earlier within the week, James Butterfill, head of analysis at CoinShares, defined that these outflows signaled waning curiosity amongst ETP/ETF traders, fueled by hypothesis a few potential delay in price cuts by the Federal Reserve.

In the meantime, some market consultants famous that the slowdown was mandatory to present the market a breather. Bloomberg senior ETF analyst Eric Balchunas mentioned Constancy's FBTC and BlackRock's IBIT broke information for the very best web belongings within the first 72 days since launch.

He he mentioned:

“The league proudly owning IBIT, FBTC et al reveals how overheated all of it has been to be sincere.”

Constancy FBTC and BlackRock IBIT are notably notable as they’re market leaders and collectively handle over $27 billion in belongings.

Nonetheless, there’s anticipation surrounding Morgan Stanley's introduced plan to permit its 15,000 brokers to suggest spot bitcoin ETFs to shoppers, which may probably reignite curiosity out there.

UPDATE: Up to date caption to make clear tides.

Talked about on this article