Bitcoin noticed a big drop over the weekend, with BTC falling from $70,090 on April eleventh to $64,400 on April thirteenth. Regardless of preliminary issues in regards to the creating wider battle within the Center East and the start of a possible market decline, the value of Bitcoin has managed to stabilize at round $66,000 since April fifteenth.

With the intention to perceive the character of those swings – whether or not they point out a mere short-term correction or sign a extra vital shift – it’s important to look at the habits of assorted market members, significantly short- and long-term holders.

Brief-term holders (STH) and long-term holders (LTH) react in another way to market volatility. STHs are often extra delicate to cost modifications and exterior occasions and have a tendency to promote their holdings throughout market downturns. In distinction, LTHs usually preserve their positions by way of volatility, reflecting a dedication to the long-term worth of Bitcoin.

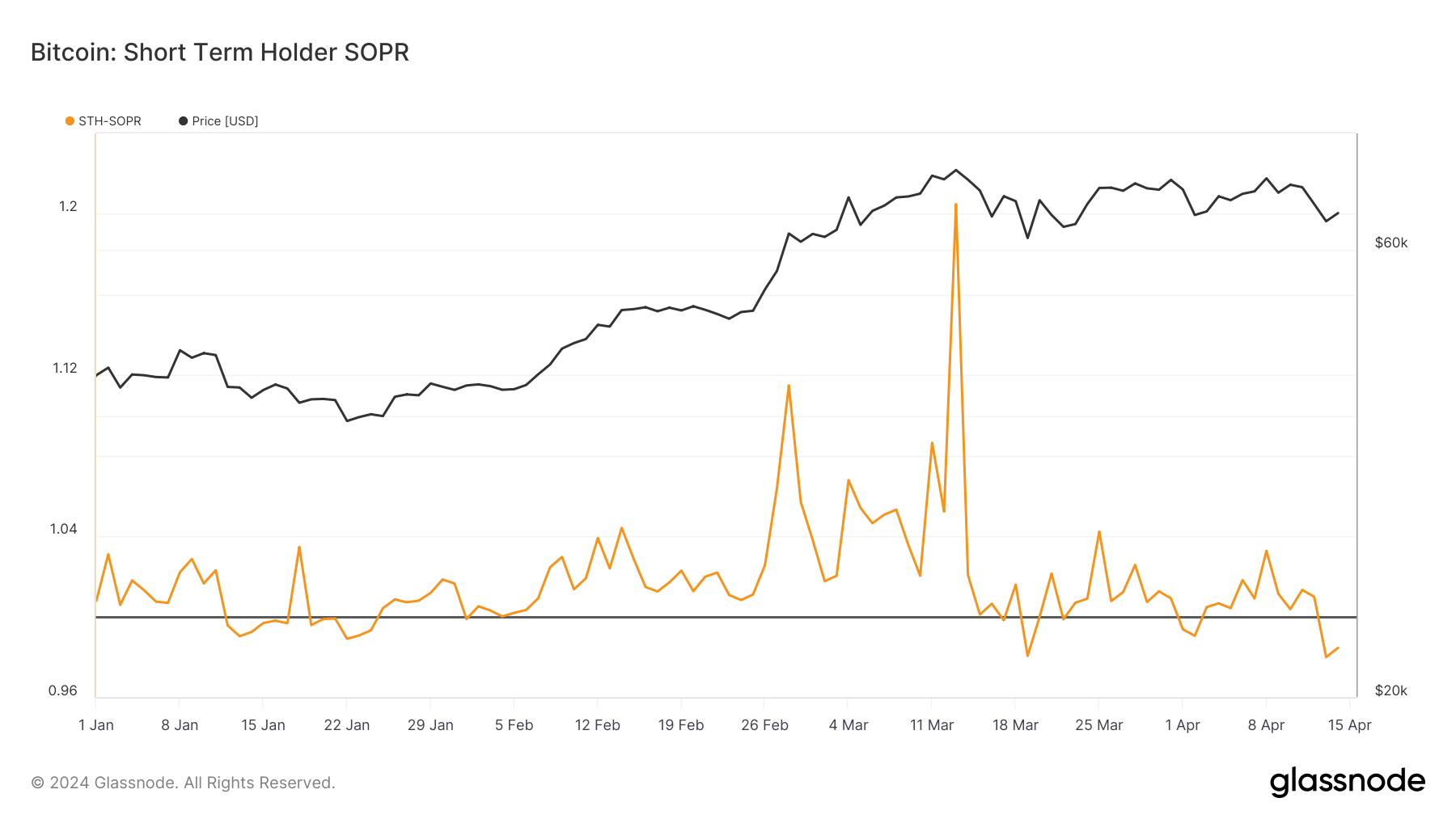

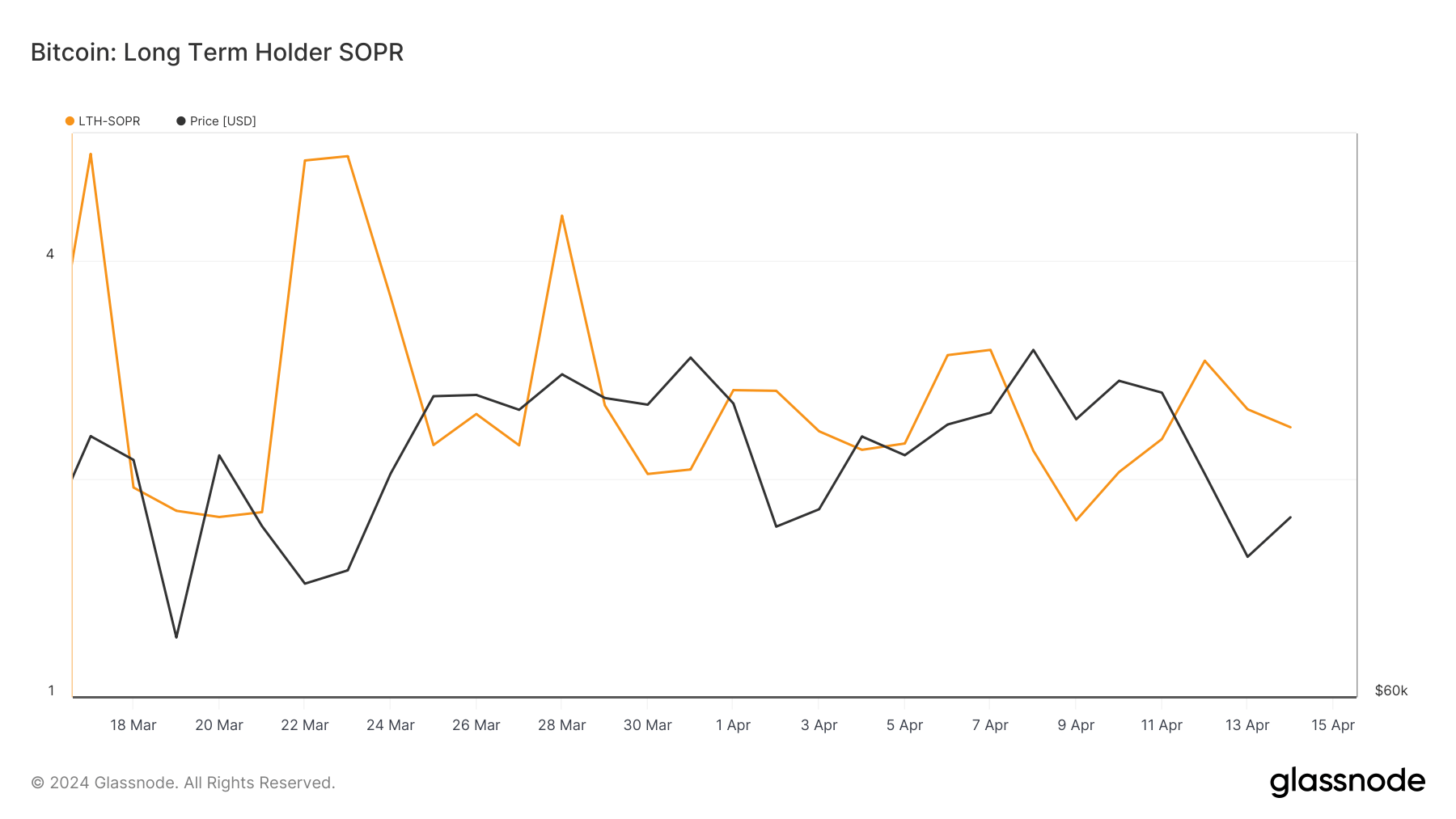

Probably the greatest metrics that assess rapid market reactions is the Spent Output Revenue Ratio (SOPR), which measures the revenue ratio realized by cash transferring on the chain. SOPR values above 1 point out that cash are promoting at a revenue on common, whereas values beneath 1 point out that they’re promoting at a loss. A special understanding requires splitting this metric into STH SOPR and LTH SOPR to seize the totally different habits of the 2 teams.

In the course of the STH plunge, SOPR dropped sharply from 1.009 on April 12 to a yearly low of 0.979 on April 13, signaling that short-term holders are promoting their bitcoins at a loss. This metric recovered barely to 0.984 by April 14, nonetheless beneath the breakeven 1 threshold.

Initially of the 12 months, when Bitcoin peaked above $73,000, the STH SOPR peaked at 1.204, indicating worthwhile promoting by quick holders. Moreover, the value of Bitcoin spent on STH on April 13 was $65,130, exceeding the spot buying and selling worth of $64,900, indicating {that a} vital variety of STH have been being offered at a loss.

Lengthy-term holders, then again, have proven a lot higher resilience. When the value of Bitcoin fell beneath $70,090, the LTH SOPR rose from 2.271 on April 11 to 2.913 on April 12, indicating that long-term holders have been nonetheless promoting at a considerable revenue regardless of the decline. This quantity adjusted barely to 2.358 by April 14, however remained effectively above the inflection level.

SOPR alone, we will see that the weekend’s decline didn’t have an effect on the boldness of long-term holders. Whereas long-term holders’ balances have been roughly up within the final week, those that offered throughout the dip have been small in quantity and took income.

In the meantime, the habits of short-term holders confirmed panic, with many selecting to chop losses and promote their BTC. This means a reactionary method to market information and worth actions, additional confirming the long-term development related to STH.

The distinction within the responses of the 2 cohorts demonstrates the significance of segment-specific evaluation and reveals that whereas short-term sentiment could fluctuate, the long-term outlook stays strong.

The publish Bitcoin’s Weekend Plunge Shakes Brief Holders appeared first on fromcrypto.