- The crypto market plunged 6.48% (roughly $240 billion) yesterday as Bitcoin's fall from $101,000 to a every day low of $93,000 triggered $750 million in liquidations.

- Main cryptocurrencies have began to get well, with some alts already seeing double-digit worth will increase.

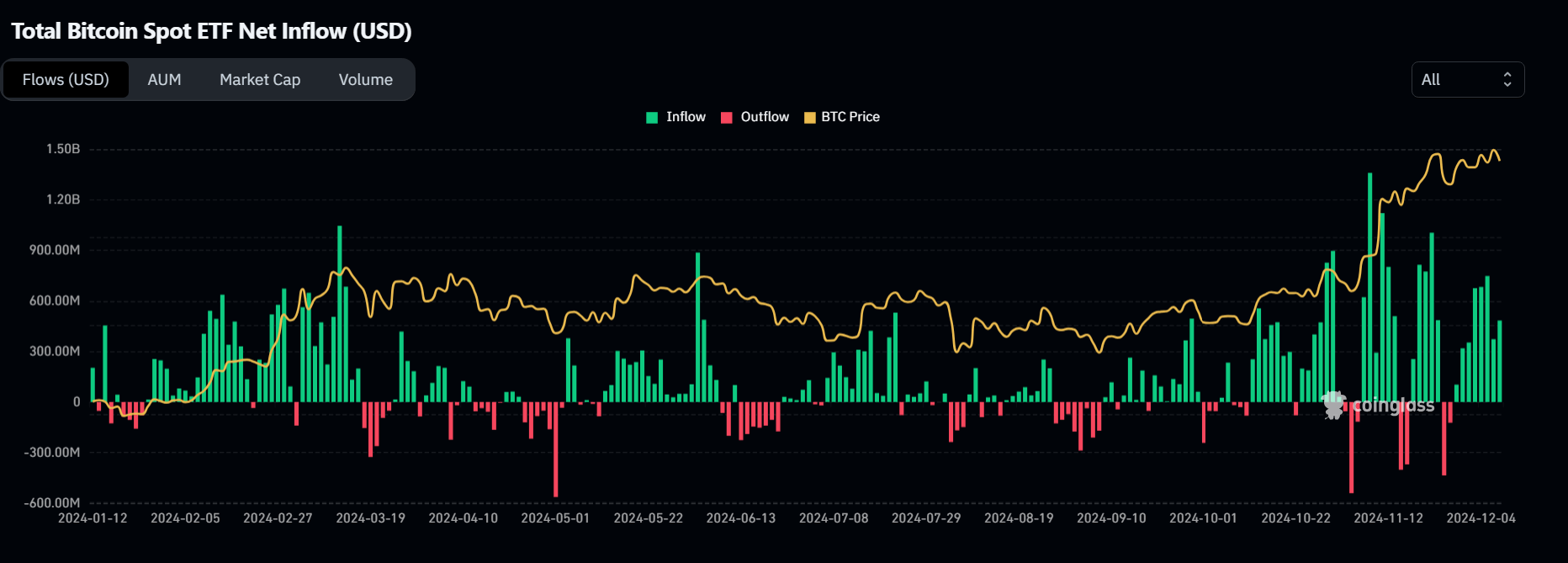

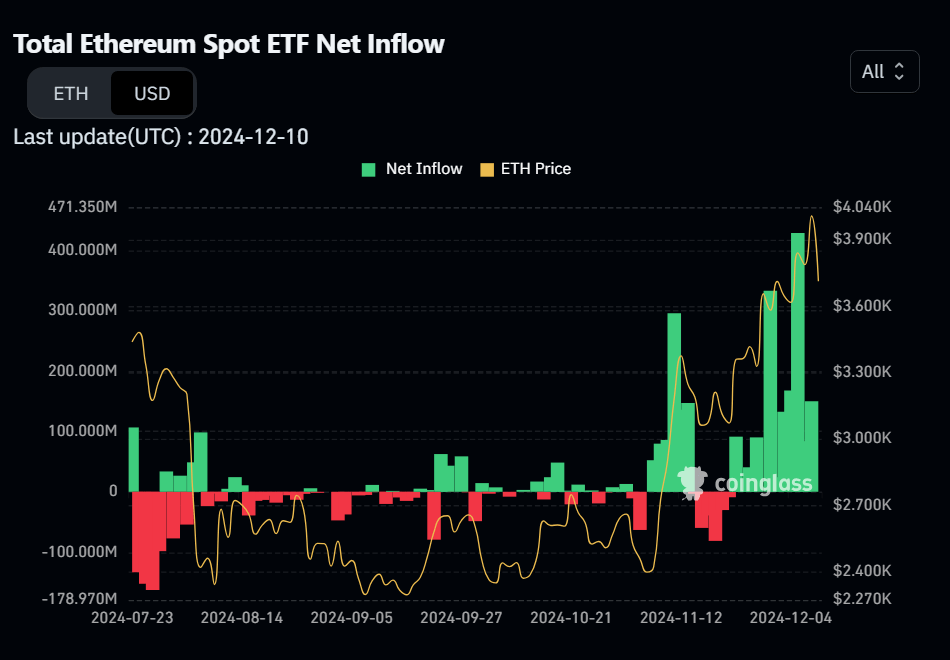

- In the meantime, Bitcoin and Ethereum spot ETFs proceed to see optimistic inflows.

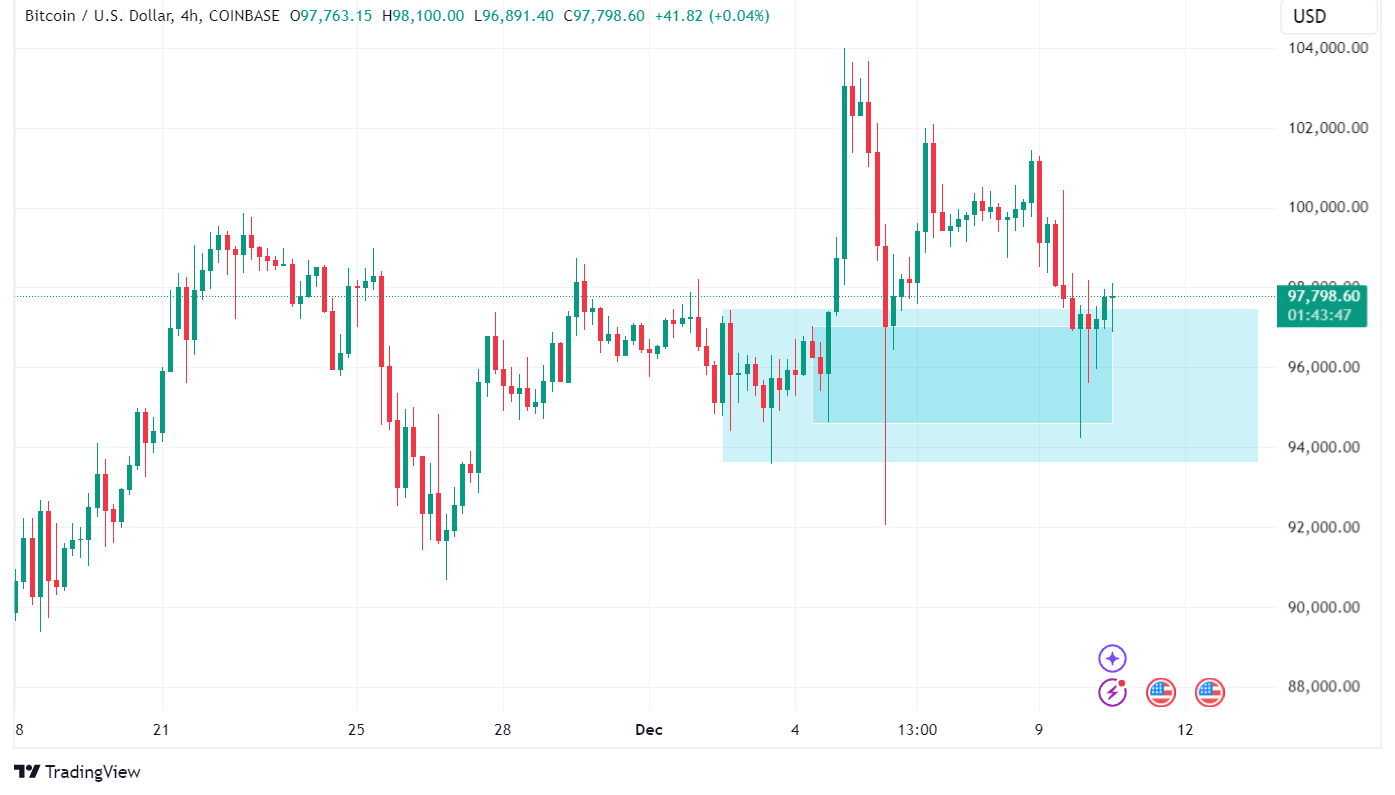

Bitcoin bled in yesterday's buying and selling session, falling from the day's opening worth of $101,151 to a low of $94,270 earlier than closing larger at $97,314 through the US afternoon session. With a market dominance of over 56%, the biggest crypto by market cap weighed on your complete market as main altcoins posted double-digit losses.

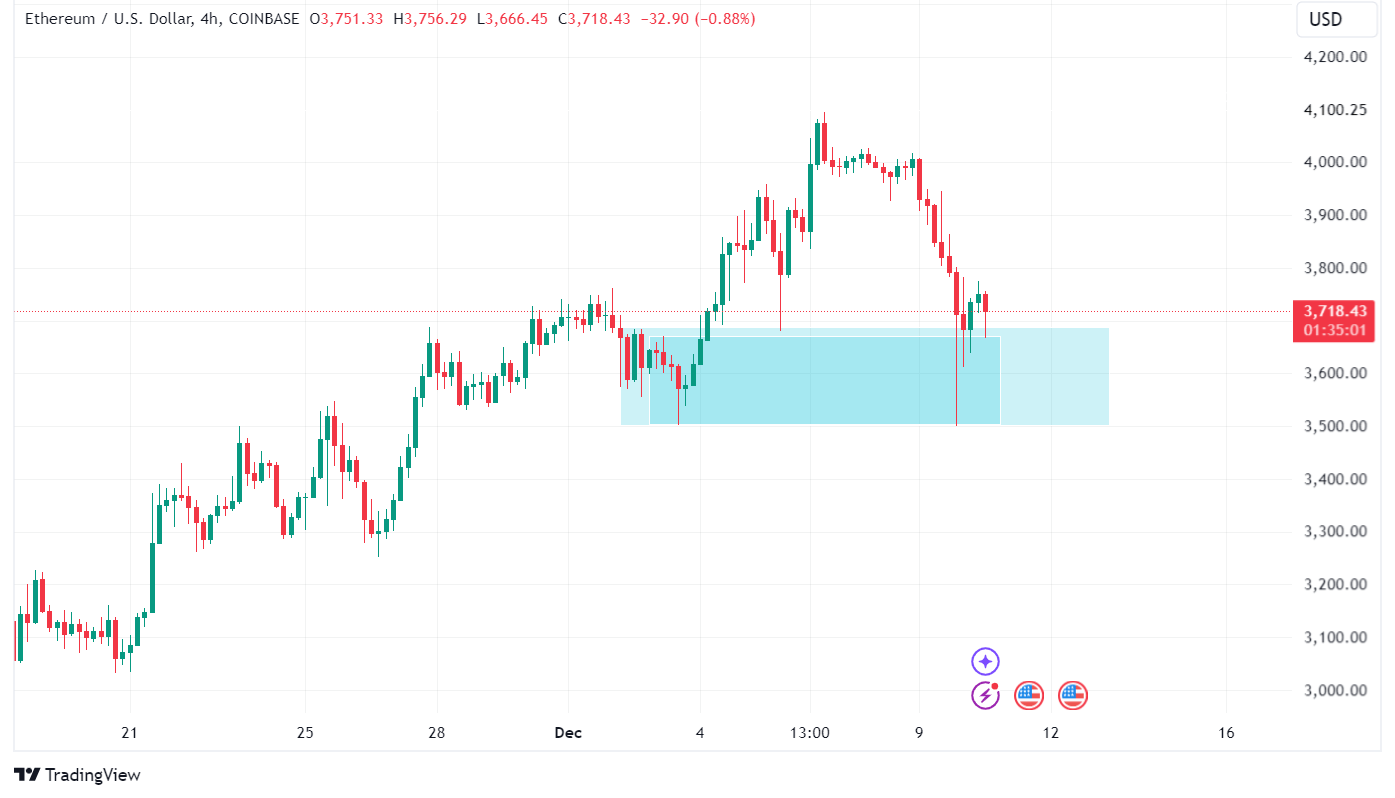

Nonetheless, at the beginning of at present's US buying and selling session, some main altcoins seem to have discovered help. Ethereum hit a every day low of $3,506 yesterday and is up 5% on the time of writing, whereas Solana is up 6.9% from yesterday's lows.

Is the sale over?

Bitcoin worth has pushed right down to the help zone with an higher restrict of $97,463, and whereas many of the promoting stress appears to have subsided, its worth continues to be hovering across the help as a particular initiative shopping for motion is but to happen.

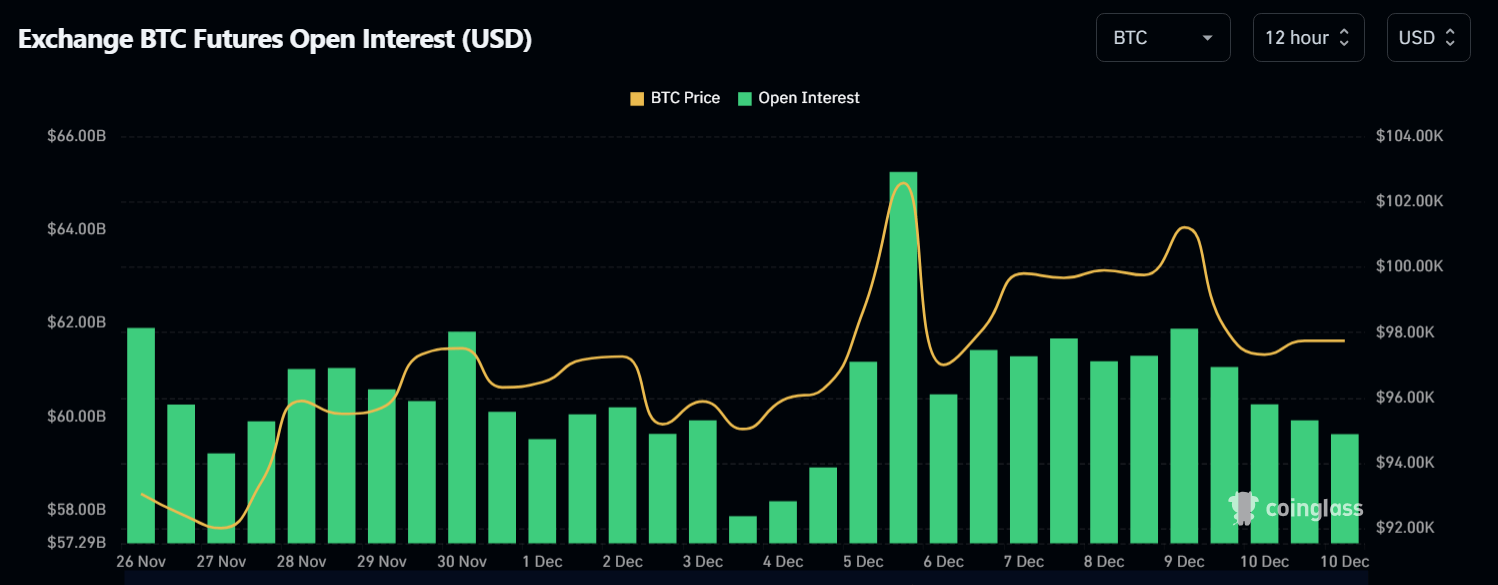

Open Curiosity has declined since yesterday as liquidation and profit-taking led to extra positions being closed. Nonetheless, an indication of a resumption of the uptrend could be growing open curiosity mixed with optimistic worth motion, indicating the opening of recent positions.

Ethereum's worth motion is much like that of the second largest cryptocurrency by market cap, hovering round a help stage and ready for both a shopping for motion initiative to push costs larger or sellers to push the worth down.

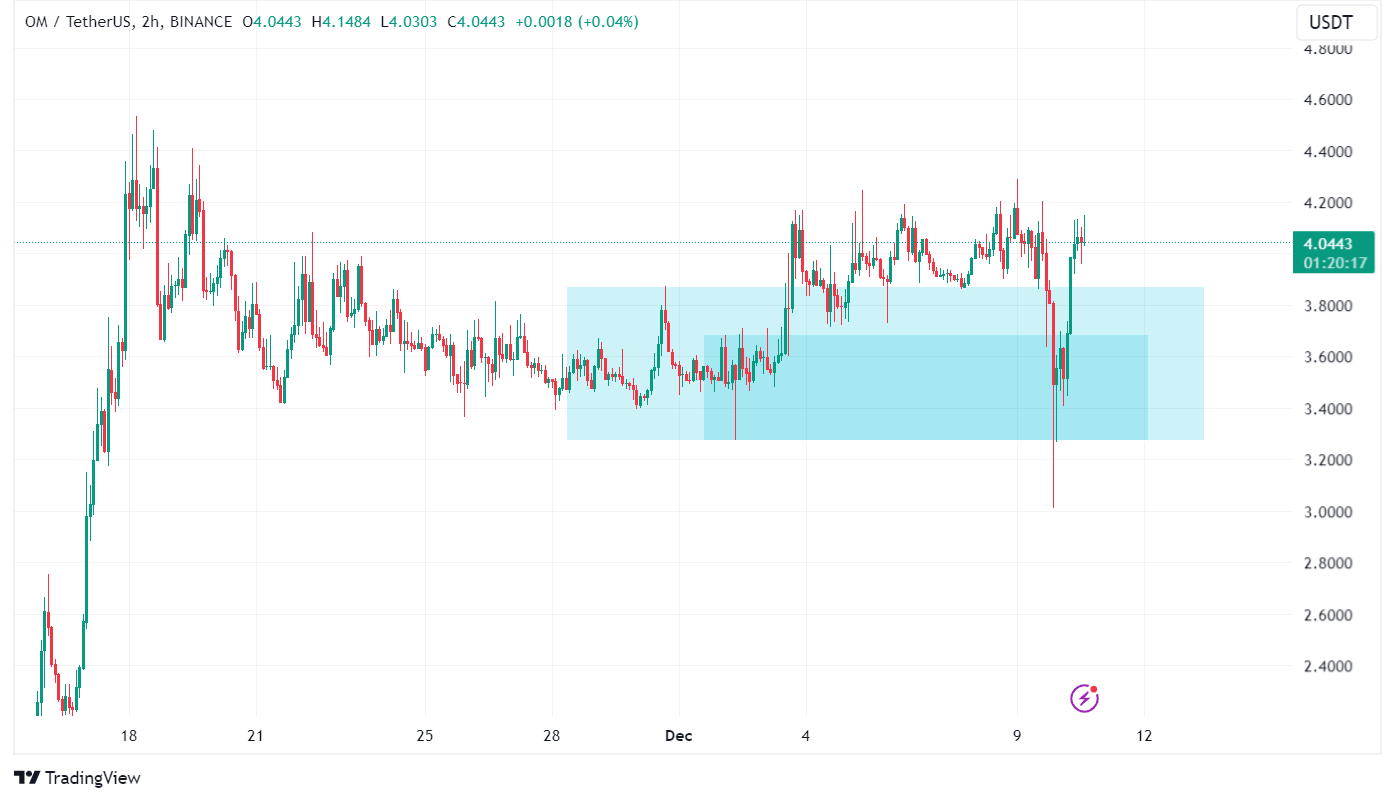

Elsewhere, some altcoins have virtually utterly shaken off yesterday's hunch, posting double-digit every day positive aspects on the time of writing. Mantra is a superb instance of this as its worth has climbed 14.11% since yesterday's shut on the time of writing.

The influx of spot crypto ETFs stays regular

Yesterday's dip doesn’t point out broader bearish sentiment as inflows into US crypto spot ETFs stay optimistic. US spot bitcoin ETFs noticed inflows of $2.77 billion final week and $483.60 million yesterday.

Ethereum ETFs adopted the same sample, posting weekly inflows of $836.8 million and $149.80 million respectively yesterday.

Bitcoin is buying and selling at $97,900 as of publication, whereas Ethereum is buying and selling at $3,600.