- A researcher at Bitcoin Journal reviewed knowledge on the chain and concluded that BTC is unlikely to fall to $50,000.

- The researcher noticed new capital inflows absorbing the availability of BTC from long-term holders.

- He famous that BTC’s MVRV Z-Rating is at 2.68, indicating that the market is in the midst of a bullish cycle.

In line with Dylan LeClair, head of analysis at Bitcoin Journal, Bitcoin is experiencing a full-fledged bull market regardless of the latest retracement, confirming the improbability of BTC falling to $50k. LeClair expressed this sentiment just lately publish on X, group updates on the present state of the Bitcoin market.

The researcher reviewed knowledge from the chain and located an interaction between long-term holders paring down their holdings and a rise in new capital inflows. One of many metrics studied was provide distribution, particularly from the angle of Bitcoin’s realized market capitalization.

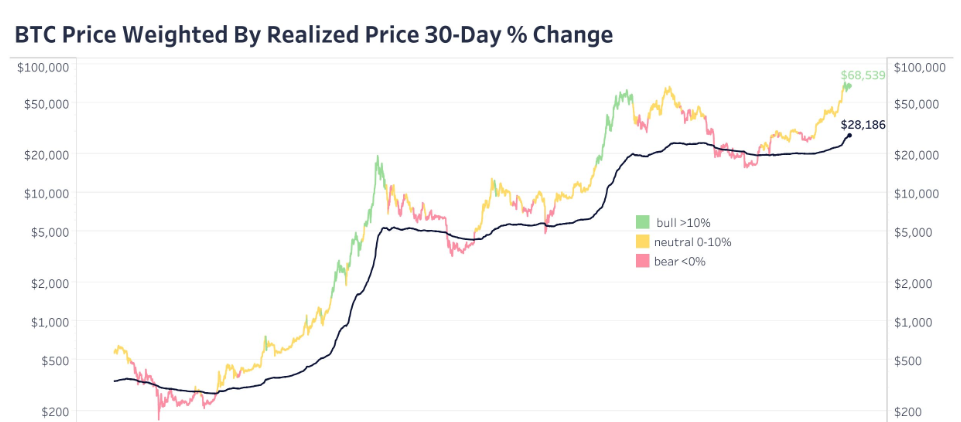

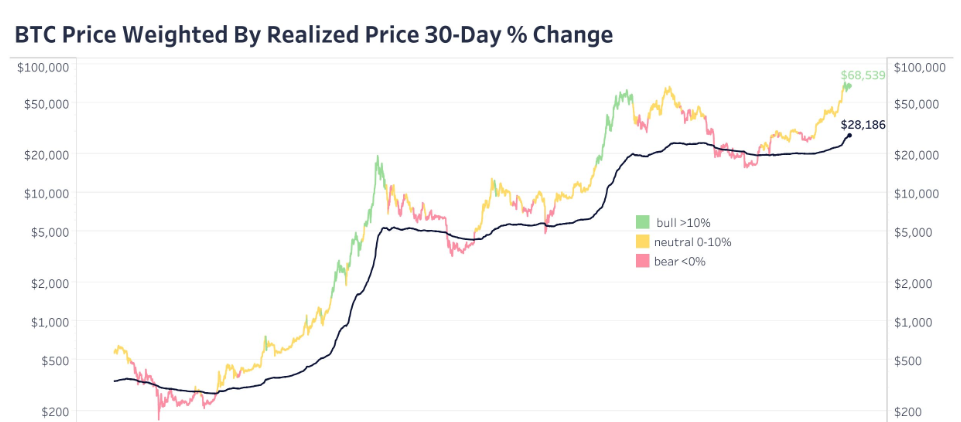

LeClair famous that Bitcoin’s realized market capitalization is witnessing a excessive constructive charge of change. This metric, which displays the worth of every BTC on the worth it final moved on-chain, means that outdated Bitcoin holders are splitting up their holdings and basically taking income.

Apparently, LeClair famous that new capital inflows are absorbing this provide impressively. In line with him, this phenomenon sometimes happens throughout bull cycles and reappears.

As well as, LeClair famous that whereas previous efficiency is not any assure of future outcomes, traditionally vital appreciation within the worth of Bitcoin has occurred throughout realized market capitalization progress, significantly above 10%.

As well as, LeClair highlighted that Bitcoin’s Market Worth to Realized Worth (MVRV) Z-Rating presently stands at 2.68. The researcher mentioned this quantity exhibits that the market is about midway via the present bull cycle.

The analyst believes that the present stage, mixed with the continued realized cap progress, suggests that there’s room for additional progress earlier than such a peak is reached.

LeClair additionally analyzed the derivatives market, highlighting the bottom open curiosity in bitcoin perpetual futures in latest months. He famous that this pattern means lowered leverage and frothy hypothesis, additional supporting a wholesome bull run.

As well as, the analyst famous BlackRock’s latest transfer to replace its Bitcoin ETF prospectus to incorporate main monetary establishments reminiscent of Citadel, Goldman Sachs, UBS and Citigroup. “The massive guys desire a piece of the motion,” LeClair famous.

The analyst concluded by drawing parallels between the present part and the part noticed in 2020 earlier than a big enhance in costs. LeClair stays bullish on bitcoin over the long run, viewing it as a hedge towards the inevitable devaluation of conventional currencies.

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shall not be accountable for any losses incurred on account of using mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.