- The Krypto market handled the market beneath final week when the US tariffs swung the market, inflicting buyers to flee into as gold as gold.

- Crypto costs, which had been barely recovered on Monday and Tuesday, continued down the pattern when the uncertainty occurred.

- In the meantime, the ETF influx remained optimistic over a number of days of drainage.

Bitcoin

Bitcoin's pattern award for the final week after the announcement of President Trump's tariffs in Canada, Mexico and China. Traders fled into so far as gold, whereas threat property equivalent to crypto handled beneath.

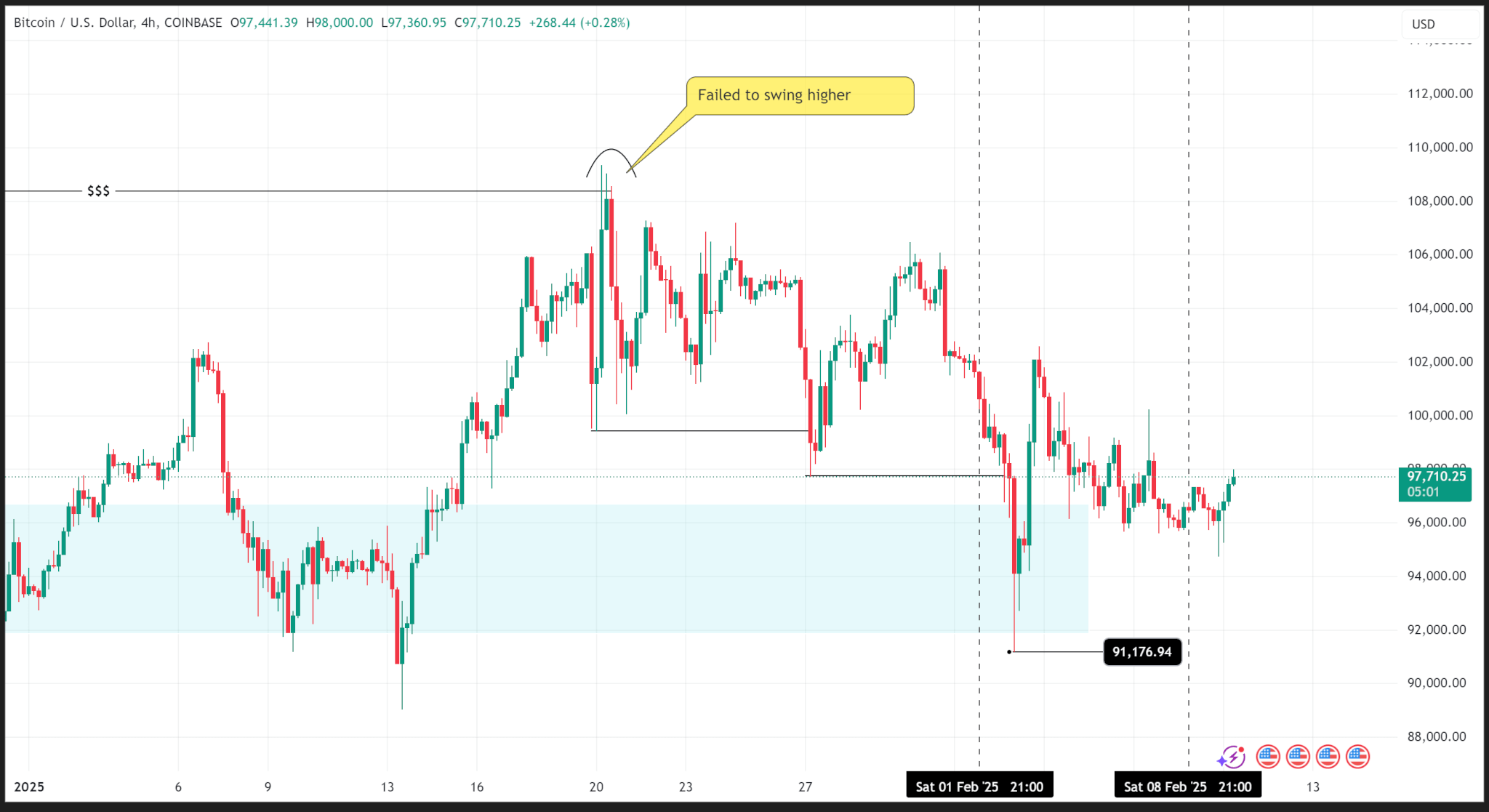

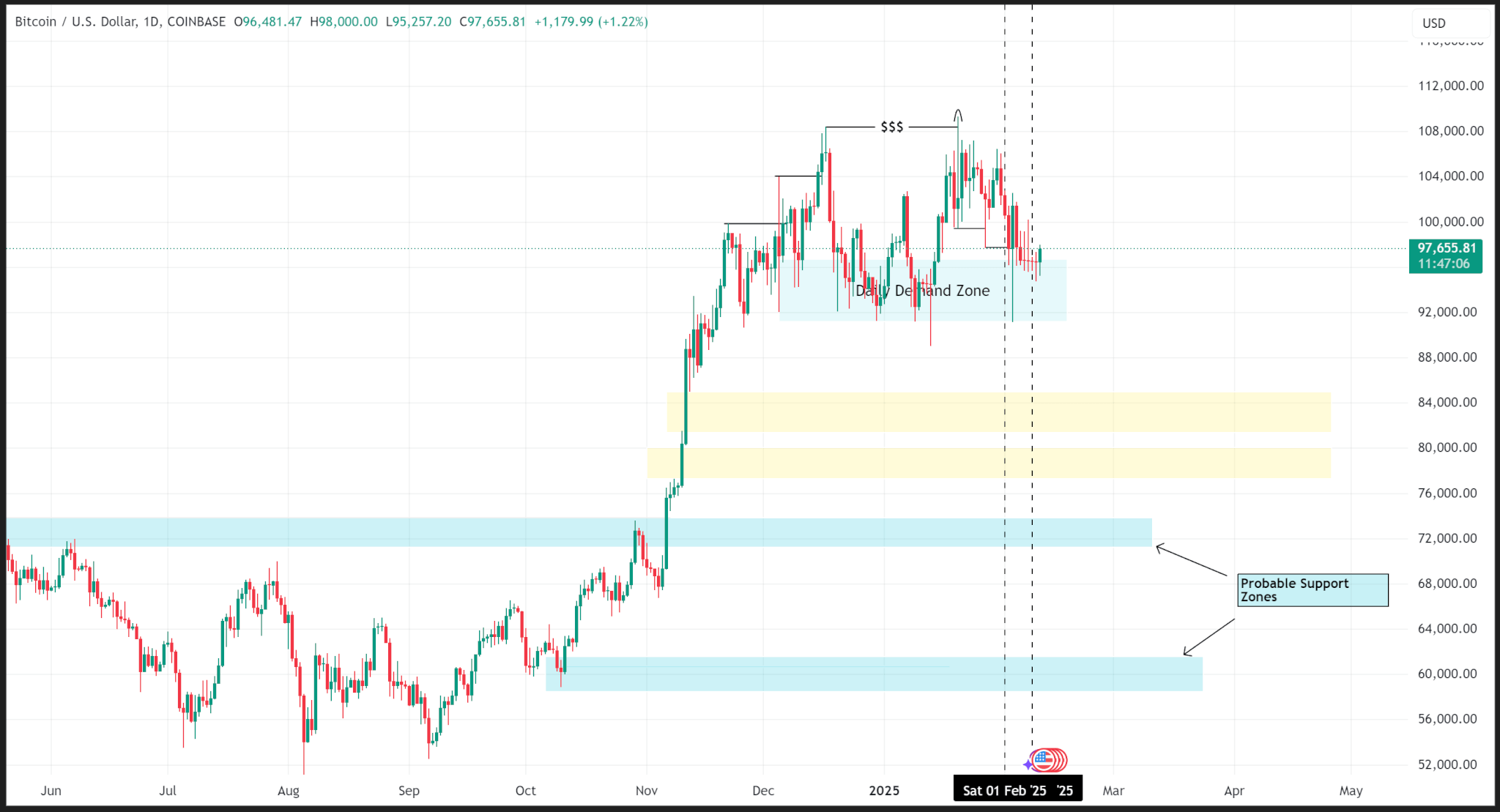

Nevertheless, tariffs are a catalyst for a sooner worth drop, as a result of the value of costs reveals that BTC has already dropped in its substructure after failed to show greater than $ 108,000 three weeks in the past.

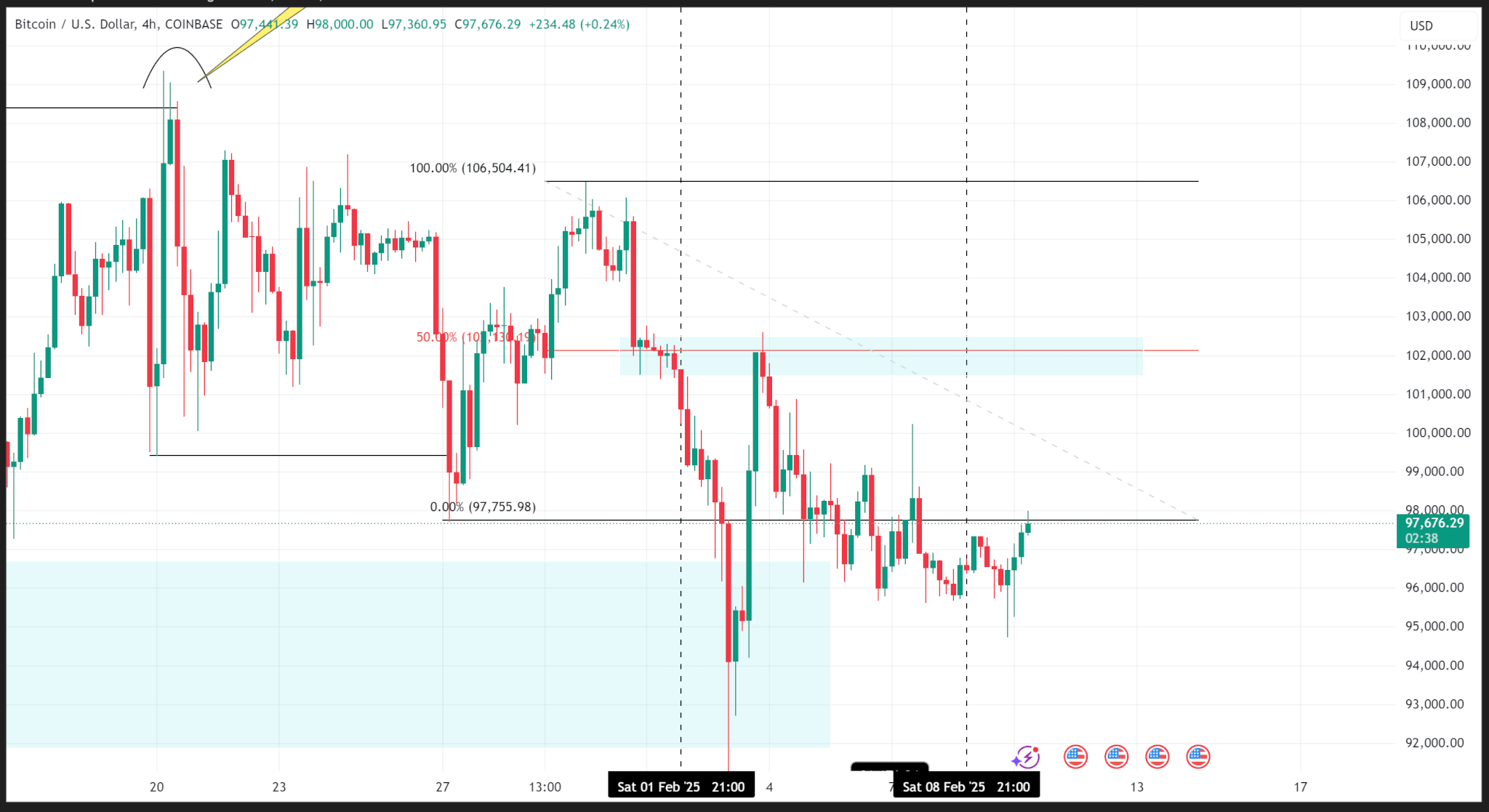

Over the previous two weeks, BTC has created two consecutive minimal minimums on the noun and firstly of final week traded right into a each day demand zone and recorded a weekly minimal of $ 91,176.94.

After buying from the demand zone, the value elevated to the inner bid zone to $ 102,000, verified 50% Fibonacci ranges, and this zone launched at $ 96,475.03.

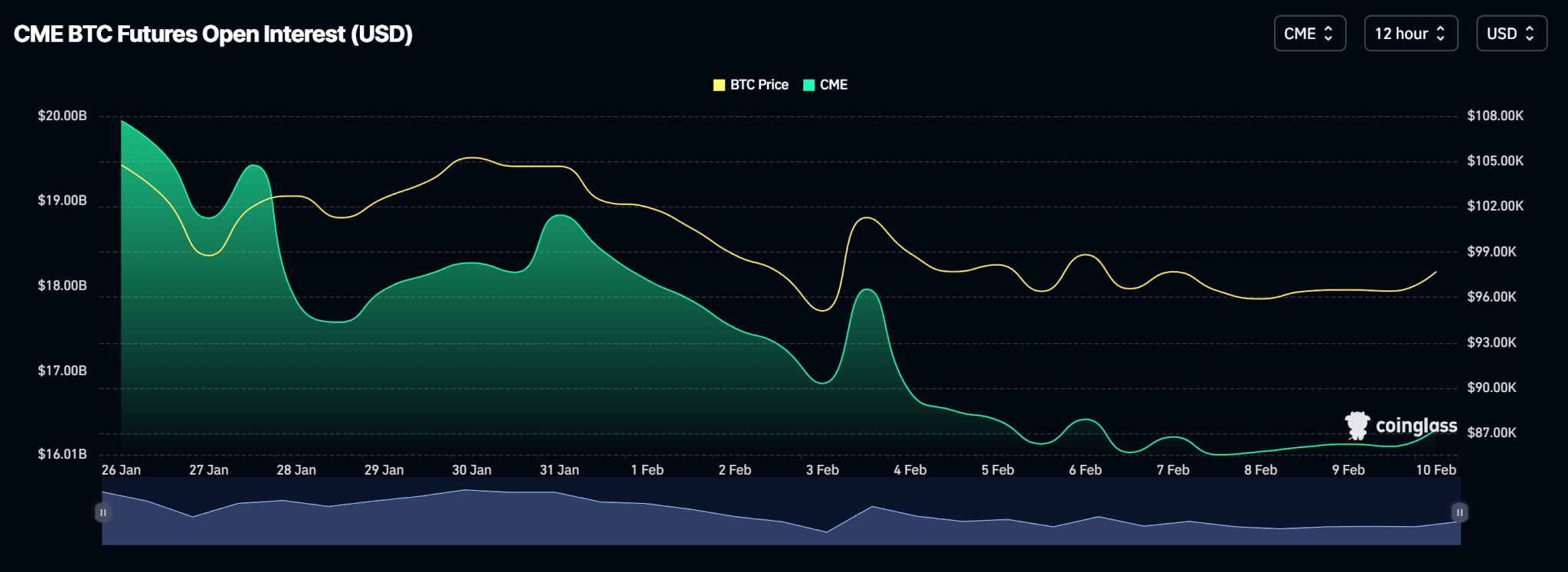

The CME, the place they’re most traded with Bitcoin futures, has been open final week when merchants concluded contracts due to the uncertainty brought on by Trump's tariffs.

In the meantime, the BTC ETF spot recorded a optimistic week as a result of clear flows had been 208.30 million USD, even over two days of huge runoffs.

Value Outlook

Assuming that the value stays above the demand zone within the each day framework, then the general construction of bitcoins ought to stay bull, regardless of a fall in costs on the substructure.

Nevertheless, each day closure underneath the demand zone, IE, beneath 90,000 USD, may cause a sale to help ranges of round $ 84,000 or decrease.

BTC trades for $ 97,624.73 from publishing.

Ethereum

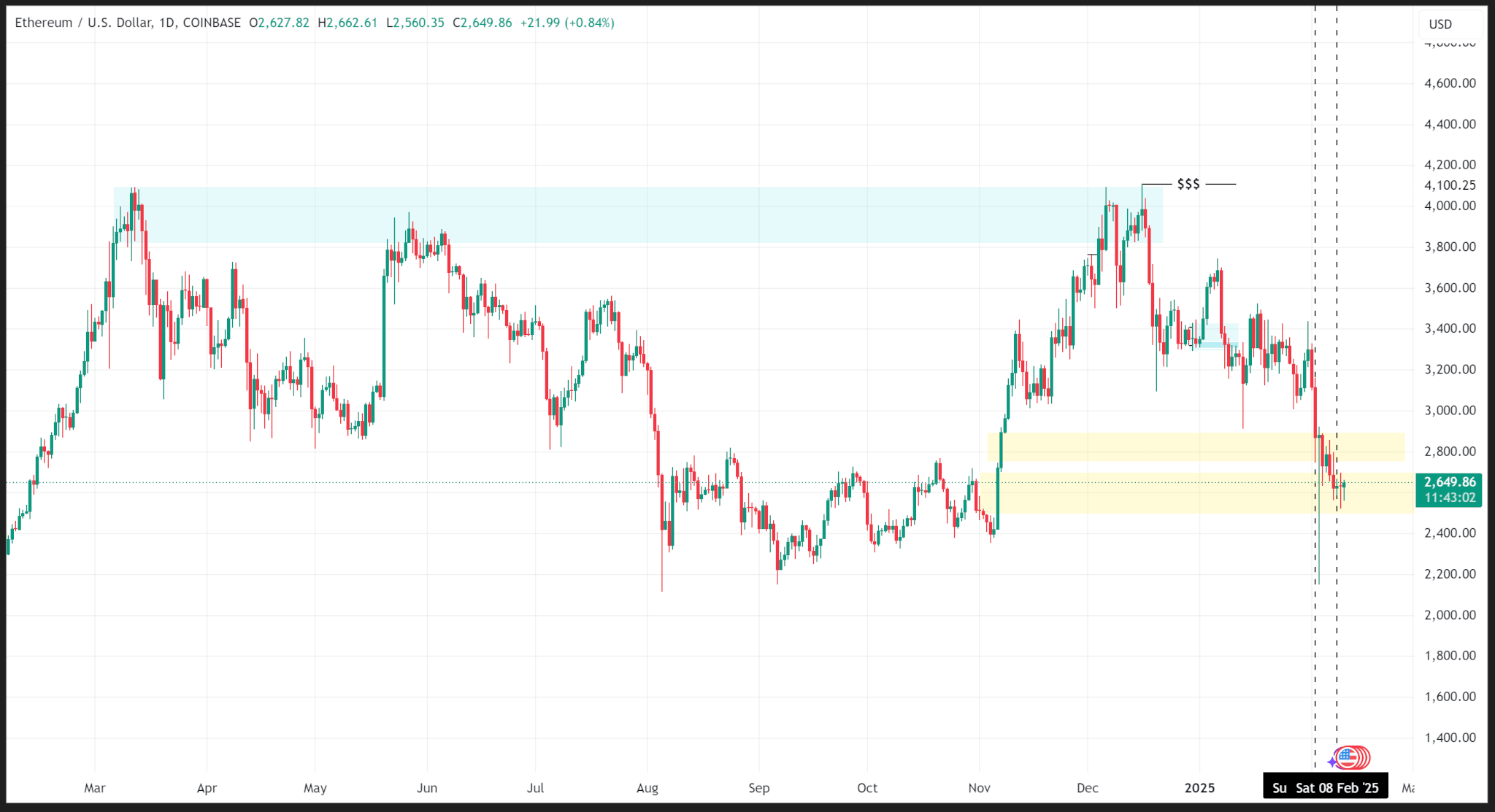

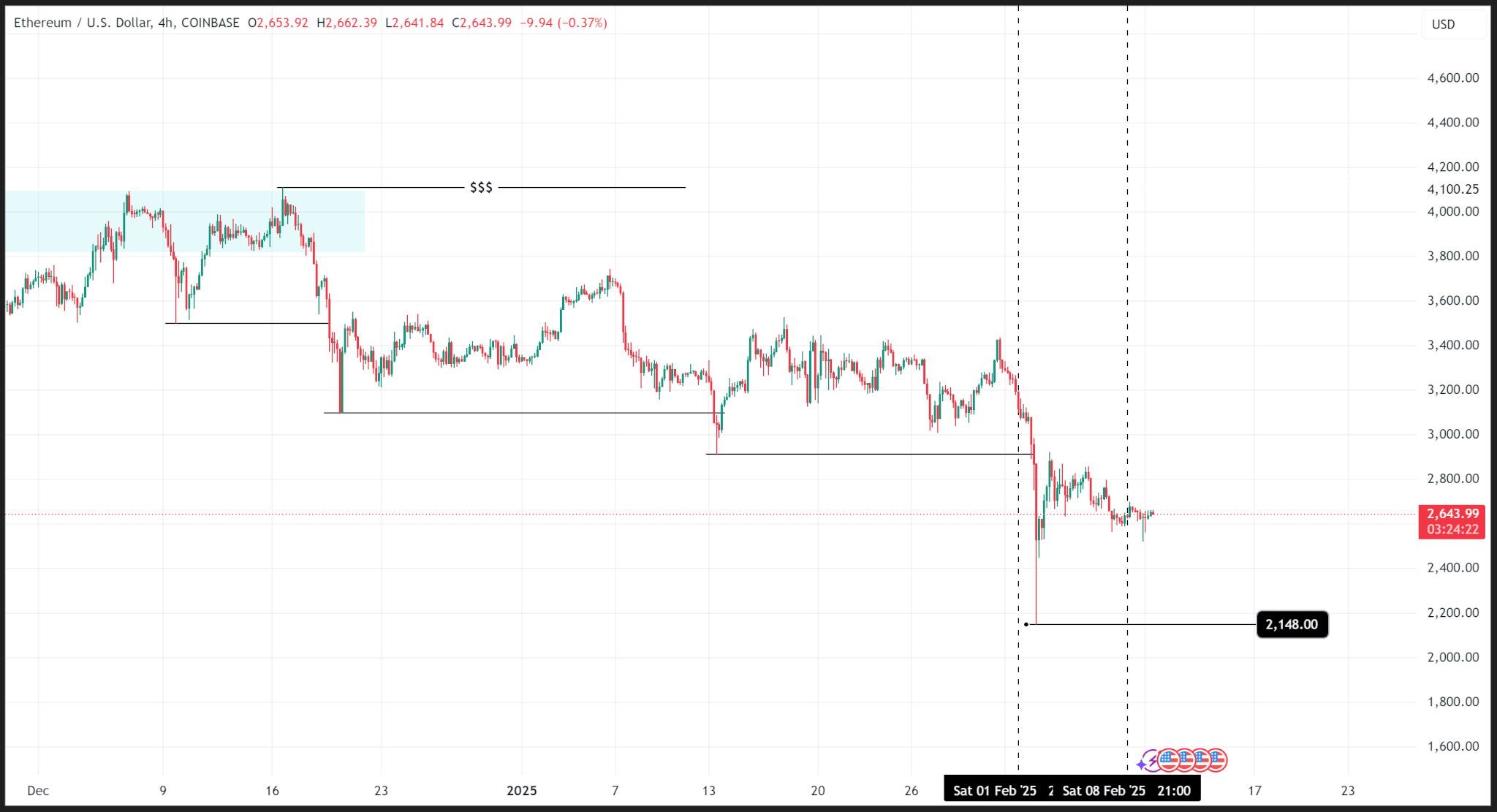

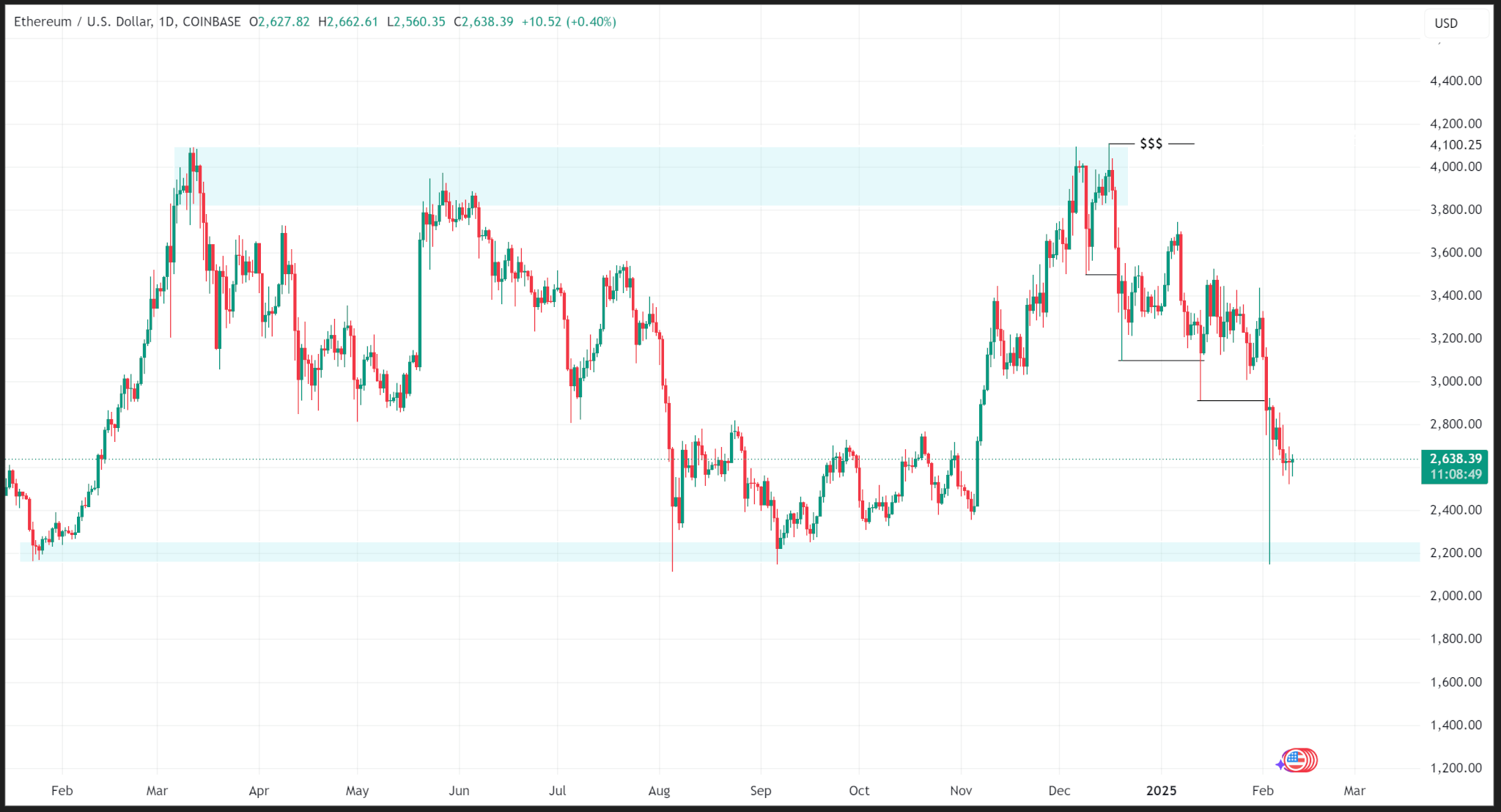

After failing to interrupt over the very best March 2024, the Ethereum worth was from mid -December 2024 on its substructure.

At a 4 -hour timeframe, the value recorded by a decrease minimal with the final minimal of $ 2,148.00 firstly of final week. The worth has improved since then and final week closed to $ 2,632.16.

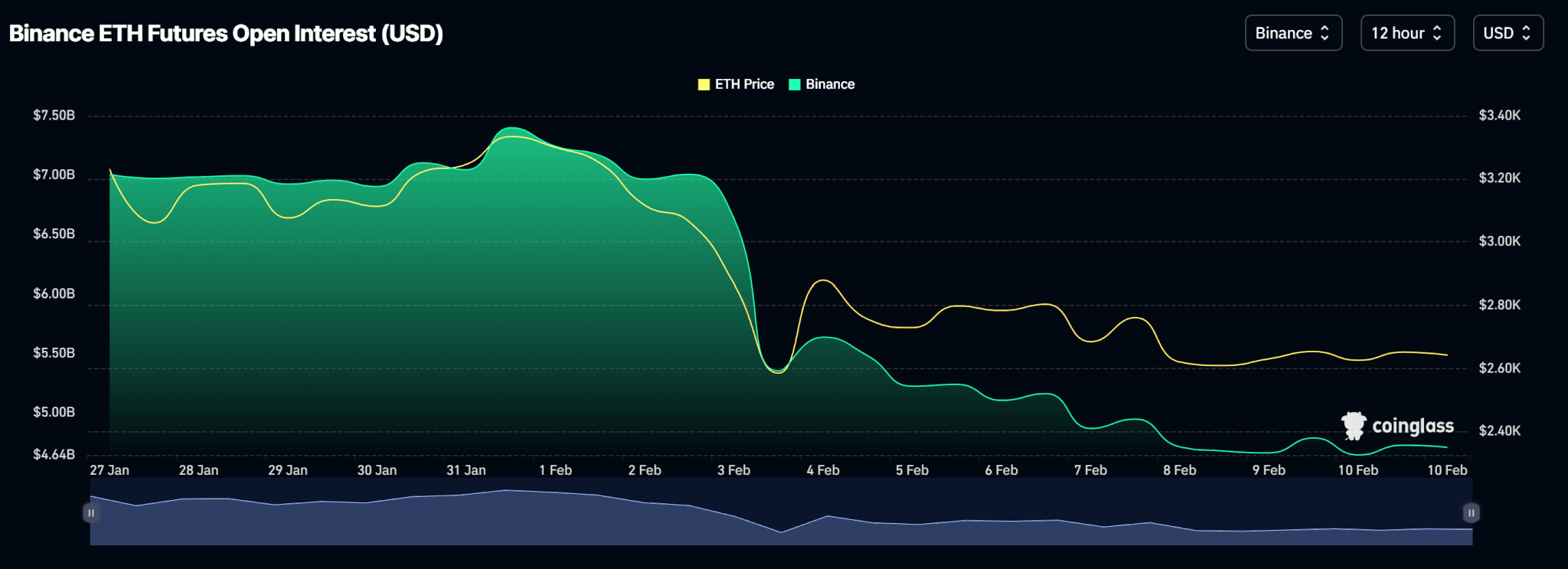

Open curiosity on Binance, the place probably the most trades with futures to Ethereum, reveals a lower within the variety of open contracts, which may very well be one other catalyst for worth falling.

In the meantime, Spot ETH ETF has seen the optimistic inflow of all all days of final week, besides Friday, when he recorded no tide (or drain), a complete of 420.20 MN on this week.

Value Outlook

One other possible zone for dropping the value of ETH is the principle help zone round $ 2,200. Since Trump plans to retailer 25% of metal and aluminum tariff, in addition to a brand new spherical of retaliation tariffs on enterprise companions, uncertainty may quickly push there.

ETH trades for $ 2,640.05 from publishing.

(Tagstotranslate) evaluation