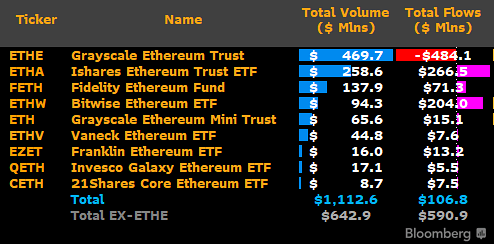

- The U.S. spot Ethereum exchange-traded fund market noticed a web influx of $106.7 million in early buying and selling.

- BlackRock's ETHA led with inflows of $266.5 million, whereas Grayscale's ETHE noticed probably the most outflows.

9 spot ETFs launched on July 23 after receiving SEC approval following closing regulatory filings.

Collectively, they generated greater than $1 billion in buying and selling quantity as BlackRock led the inflows with its iShares Ethereum Belief fund. As anticipated, Grayscale's Ethereum Belief noticed important outflows.

ETH spot ETFs noticed web inflows of $106 million

In keeping with market knowledge, BlackRock's ETHA noticed probably the most demand with traders elevating $266.5 million on the primary day.

In the meantime, Bitwise had the second largest influx with $204 million for its ETHW product. Constancy noticed the third-highest influx for its FETH, with $71.3 million recorded within the ETF's buying and selling debut.

Whereas Grayscale's ETHE noticed an outflow of $484.1 million, Ethereum Mini Belief ETH noticed a modest influx of $15.1 million. The opposite 4 funds noticed $13.2 million for Franklin Templeton's EZET, $7.6 million for VanEck's ETHV, $7.5 million for 21Shares' CETH, and $5.5 million for Invesco Galaxy's QETH.

The quantity of enterprise exceeded 1 billion {dollars}

ETFs noticed whole quantity whole over $1.1 billion, knowledge shared by Bloomberg ETF analyst James Seyffart confirmed. Excluding the ETH buying and selling quantity of over $469 million, the overall for the opposite eight, all of which noticed inflows, is round $642 million.

In the meantime, whole ETH inflows minus outflows reached greater than $590.9 million.

Seyffart Commenting on the Total Efficiency of US Spot Ethereum ETFs he referred to as it's a “very strong first day”

In keeping with knowledge from SoSoValueComplete web belongings within the ETF have been $10.24 billion as of July 23. The worth represented about 2.45% of Ethereum's market cap, which on the time of writing was $413 billion.