Within the heated political local weather within the US, monetary analyst Michael A. Gayed not too long ago famous that the rising nationwide debt of greater than $35 trillion is a extra vital risk to democracy than political management. Gayed factors out that rising debt ranges are outstripping each tax income and inflation, creating an unsure fiscal surroundings.

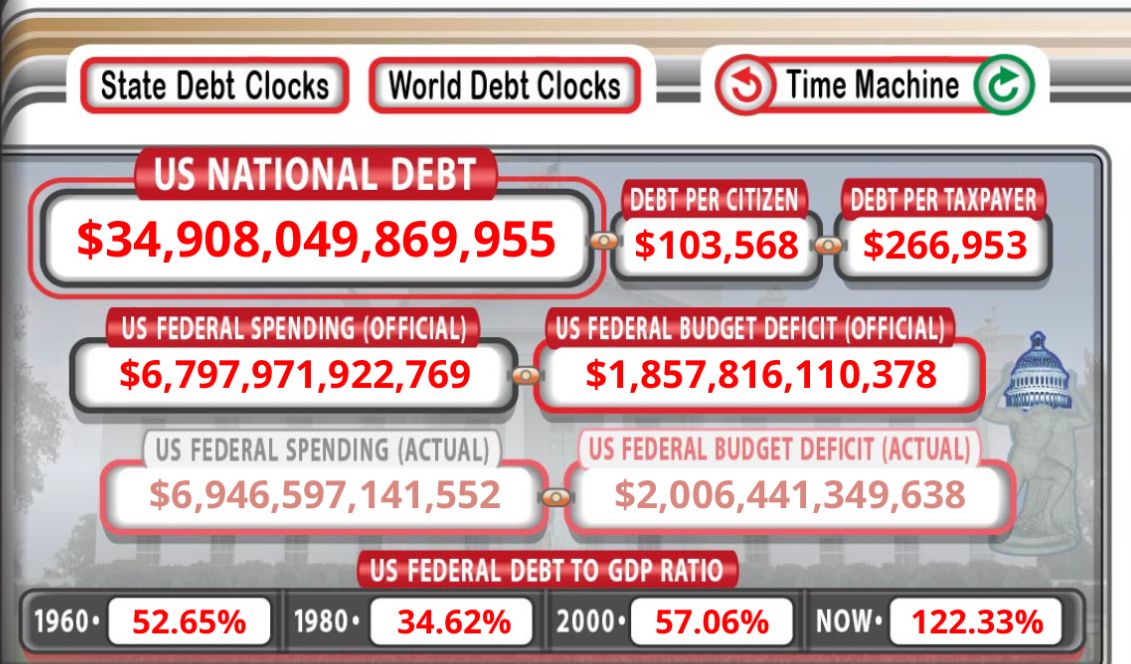

The U.S. federal debt-to-GDP ratio, which has escalated from 52.65% in 1960 to 122.33% in the present day, additional illustrates the unsustainable nature of the nation's fiscal coverage. The probability of a pointy financial downturn turns into extra pronounced when debt grows unchecked.

The nationwide debt of america has now reached $34.9 trillion. The debt per citizen is $103,568, whereas the debt per taxpayer has risen to $266,953. The US federal finances deficit can be vital, the official determine is $1.8 trillion, and the precise deficit exceeds $2 trillion.

Responding to Gayed, Erik Voorhees, founding father of ShapeShift and a outstanding voice in cryptocurrency, emphasised the gravity of the state of affairs. Voorhees argues that rising debt, no matter presidential administrations, poses an inevitable financial risk. He predicts that the unrelenting development of the nationwide debt will culminate in a catastrophic collapse of the bond market, resulting in a widespread monetary meltdown.

Voorhees additionally means that the present political panorama represented by leaders like Trump and Biden can not reasonable this trajectory. The projected annual debt enhance of greater than $1 trillion underneath any believable situation illustrates a dire monetary outlook. This unsustainable debt development, Voorhees argues, is a extra substantial risk to democracy than any single political determine.

The results of such an financial collapse are profound. Voorhees envisions a situation the place society might navigate this turmoil with dignity and precept and doubtlessly thrive. Nevertheless, this might deviate considerably from the twentieth century concept of giant nation-states. He argues that bitcoin or comparable decentralized belongings are key to this transformation. By means of its personal financial sport concept, Bitcoin might stop the financial devaluation that facilitates the expansion of huge nation-states.

Bitcoin's place as a extra everlasting asset than fiat foreign money, which has but to be absolutely realized, may very well be key on this shift. Voorhees believes that as a result of bitcoin is seen as a extra steady retailer of worth throughout generations, it might probably restrict the enlargement of huge nation-states by limiting their means to inflate their currencies.

Ought to Republicans win in November, Voorhees says Trump and Vance probably received't materially scale back the debt, however they might present an surroundings the place cryptocurrencies can thrive. By doing so, they’d enable cryptocurrencies to deepen their roots within the cultural and financial surroundings, doubtlessly making them resilient sufficient to face up to anticipated monetary shocks.

“One of the best factor Trump/Vance can do throughout their administration, since they can’t (and won’t) materially scale back the debt state of affairs, is to create 4 years of a tolerant house through which cryptocurrencies can thrive, with out persecution.”

Voorhees' perspective displays a broader sentiment within the crypto neighborhood, which sees decentralized digital belongings as a possible hedge towards the financial instability of huge sovereign debt. The crypto business's means to supply an alternative choice to conventional fiat techniques could also be essential in assembly future monetary challenges.