- The Uniswap Basis has introduced a delay within the vote on updating the protocol charge mechanism.

- UNI worth reacted decrease, falling 9% to hit a low of $10.17.

The Uniswap Basis has postponed a governance vote on a proposal to activate a brand new protocol charge mechanism. This proposal would provoke a charge change for Uniswap that may reward UNI token holders who stake and delegate their tokens.

Because the market reacted to the information, UNI fell practically 9% to hit a low of $10.17 on main exchanges.

Uniswap postpones key improve vote

Uniswap introduced the charge change proposal final week with on-chain deployment and voting scheduled for right this moment, Friday. Nonetheless, this is not going to occur as deliberate now in response to the brand new replace.

In an replace right this moment, the Uniswap Basis mentioned the delay was associated to a difficulty raised by a stakeholder after the proposal. This required “additional care” from the muse.

“Because of the non-changing nature and sensitivity of our proposed improve, we’ve got made the tough determination to delay publishing this ballot. This was sudden and we apologize for the delay. We are going to maintain the neighborhood knowledgeable of any main adjustments and can replace you all as soon as we’re extra sure about future timeframes” Uniswap Basis famous through their official X account.

UNI worth

The UNI token traded as excessive as $11.04 on Friday earlier than the token plunged.

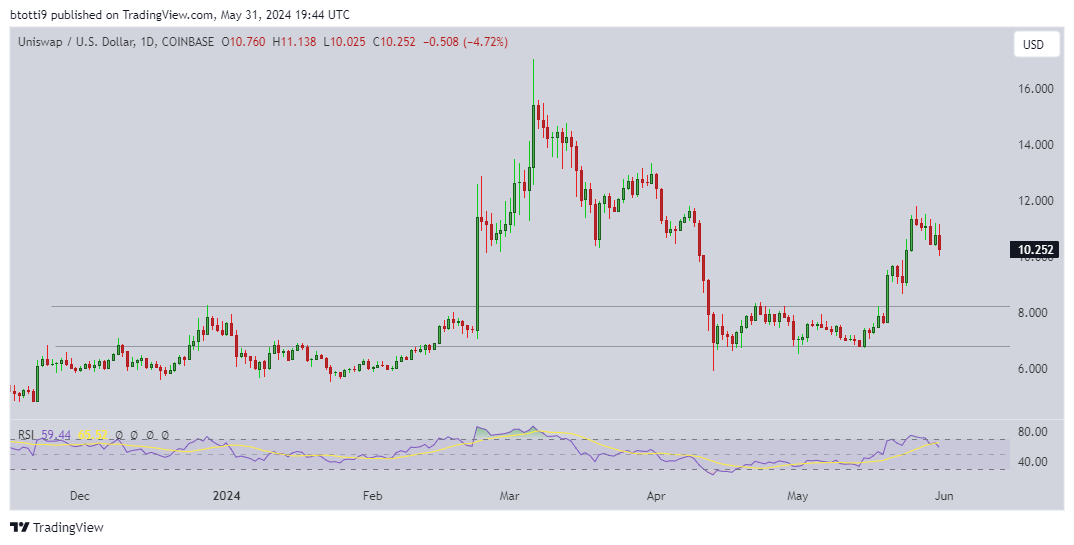

The value of UNI moved decrease because it hit a excessive of $11.79 on Might 26. The RSI on the every day chart means that the bears might nonetheless goal costs across the $10 degree.

With Unswap at the moment buying and selling round $10.26, a break under the psychological degree might push it to assist close to $8.00.

As seen within the chart above, UNI worth fluctuated between $6.80-$8.22 for a number of days earlier than the Might 20 breakout.