- Bitcoin rose 5.6% to hit a three-week excessive of $61.1K on Tuesday morning.

- Altcoins resembling Celestia, Immutable X, and Close to noticed double-digit share positive aspects.

- Cryptocurrency shares rose barely forward of an anticipated Fed fee lower announcement.

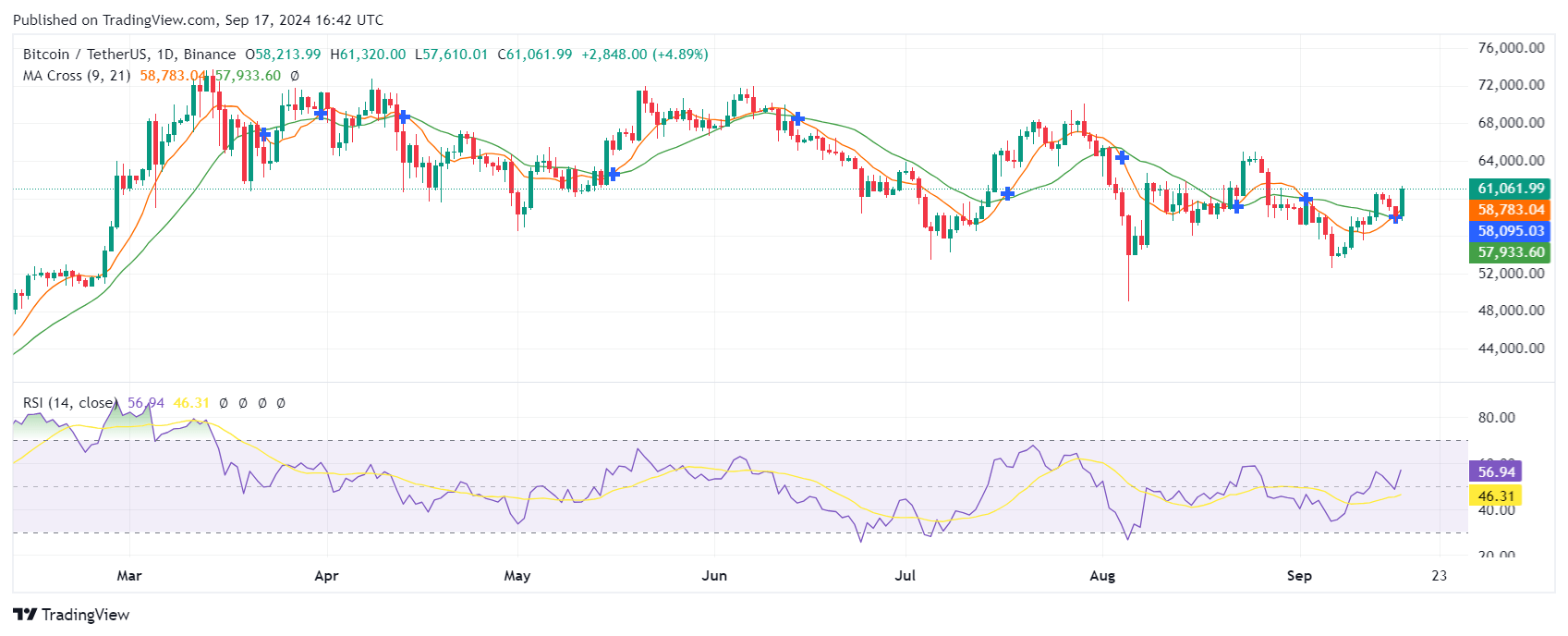

The value of Bitcoin rose to its highest stage in three weeks, sparking positive aspects within the cryptocurrency sector and associated shares. It soared 5.6% to $61.1,000 at 11:55 a.m. ET earlier than pulling again to round $61,000.

The surge marks a pointy turnaround from a quiet begin to the week, signaling renewed curiosity in digital property.

Altcoins and Bitcoin worth surge forward of Fed tapering

Along with Bitcoin, different main cryptocurrencies noticed vital positive aspects, with Ethereum (ETH) gaining 4.2% to $2.38k.

Notably, some altcoins have outperformed bigger tokens. For instance, Celestia (TIA) rose 15.7%, Immutable X (IMX) rose 14.8%, Close to Protocol (NEAR) rose 9%, Uniswap (UNI) rose 8.9%, and Sui (SUI) gained 8.1%.

The rally comes simply earlier than the Federal Reserve's extremely anticipated choice on rates of interest.

Market analysts usually anticipate the central financial institution to chop charges for the primary time in 4 years. With inflation largely beneath management and the labor market displaying indicators of cooling, many imagine the Fed will take a extra accommodative stance.

Decrease rates of interest are usually bullish for cryptocurrencies as decrease borrowing prices make conventional financial savings and funding automobiles much less engaging. Consequently, traders usually flip to riskier property resembling cryptocurrencies searching for increased returns.

Shares centered on cryptocurrencies are additionally surging

Crypto-focused shares additionally benefited from Bitcoin's rise, although their positive aspects have been usually extra modest in comparison with digital tokens.

MicroStrategy ( MSTR ), an organization recognized for holding giant bitcoin reserves, gained 0.6%.

Crypto trade platform Coinbase International ( COIN ) rose 3%, whereas crypto funding agency Galaxy Digital ( OTCPK ) gained 5.4%.

Within the cryptocurrency mining sector, Riot Platforms ( RIOT ) superior 2.4%, MARA Holdings ( MARA ) superior 1.9%, and HIVE Digital Applied sciences ( HIVE ) superior 4.3%. The largest leap was Bit Digital (BTBT) with a acquire of 13%, adopted by Hut 8 (HUT) with a 6.6% improve and CleanSpark (CLSK) with a 3.1% improve.

Because the broader inventory market additionally experiences shopping for stress forward of a key Federal Reserve choice, the crypto sector continues to journey a wave of optimism across the potential for decrease charges and elevated funding in digital property.