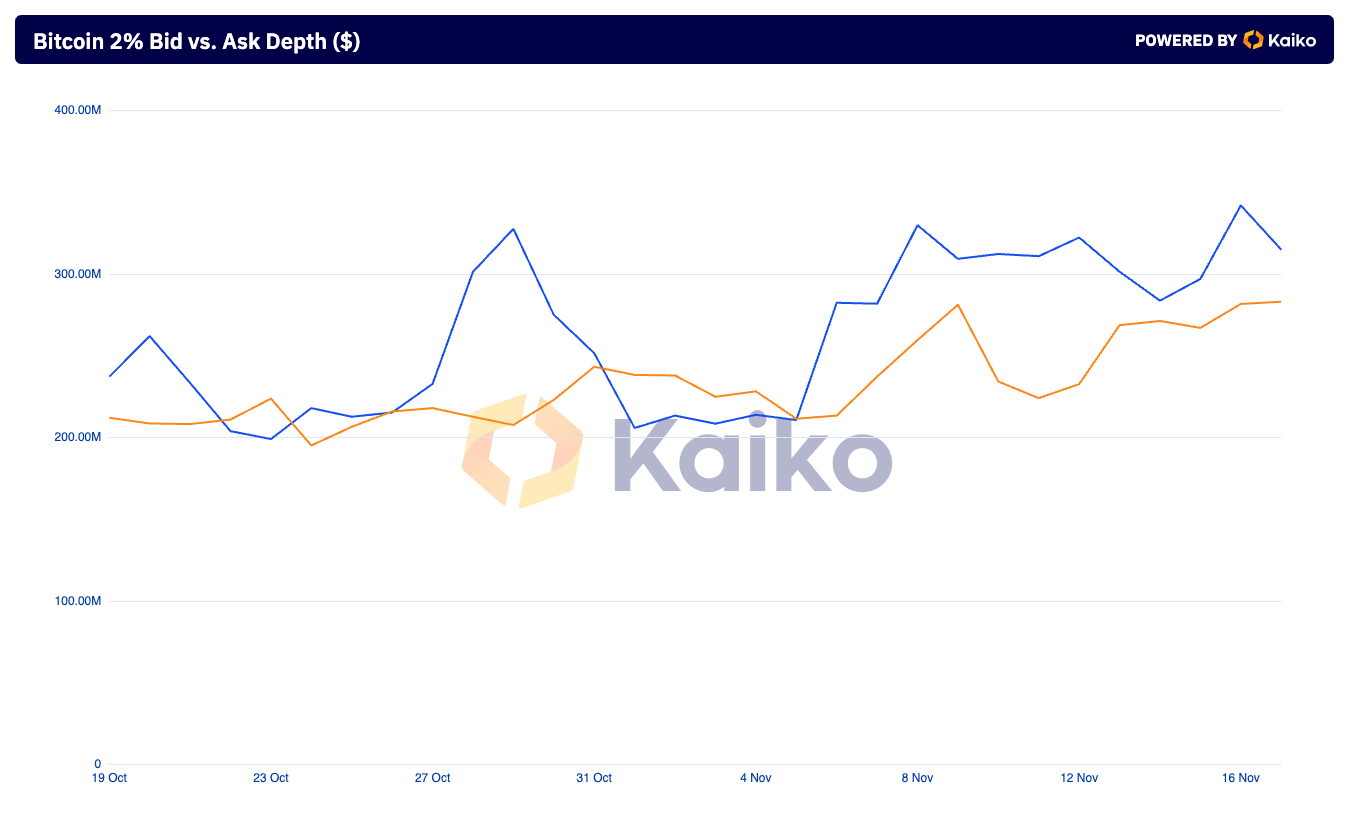

Bitcoin's combination 2% market depth, a measure of liquidity that mixes purchase and promote orders inside a slender 2% value vary across the market value, rose to a one-year excessive of $623.40 million as of Nov. 16. This represents a major enhance from $422 million as of November 5 – a major enhance in liquidity over a brief interval.

This means rising market confidence, as greater liquidity normally signifies that merchants and establishments are extra prepared to take part out there, offering a buffer towards value volatility.

This enhance in market depth main as much as and following the US presidential election is just not an remoted occasion, however a part of a broader shift in macroeconomic and political situations. The election of Donald Trump and his administration's introduced intention to assist Bitcoin and the crypto business via particular insurance policies catalyzed elevated market exercise.

This newfound political alignment with the crypto area probably signaled to institutional and retail buyers that the regulatory atmosphere might turn out to be considerably extra supportive, lowering perceived dangers and inspiring better participation.

The market reacted enthusiastically to the prospect of a pro-crypto administration, with merchants probably decoding the information as a inexperienced gentle for wider adoption and institutional inflows. This value enhance, mixed with a rise in combination market depth, means that market members have been buying and selling in response to the election outcomes and positioning themselves for a sustained uptrend. Expanded market depth displays this elevated publicity, as deeper liquidity permits bigger orders to be executed with minimal slippage – vital in a market present process speedy upward value actions.

The impression of the election may also be seen within the depth of provide versus demand. Whereas the imbalance favoring promote orders of $341.81 million versus $281.59 million in purchase orders suggests some profit-taking, you will need to be aware that this exercise didn’t set off a major value correction. As an alternative, the market successfully absorbed promoting strain, indicating robust purchaser demand at the same time as Bitcoin broke above $93,000.

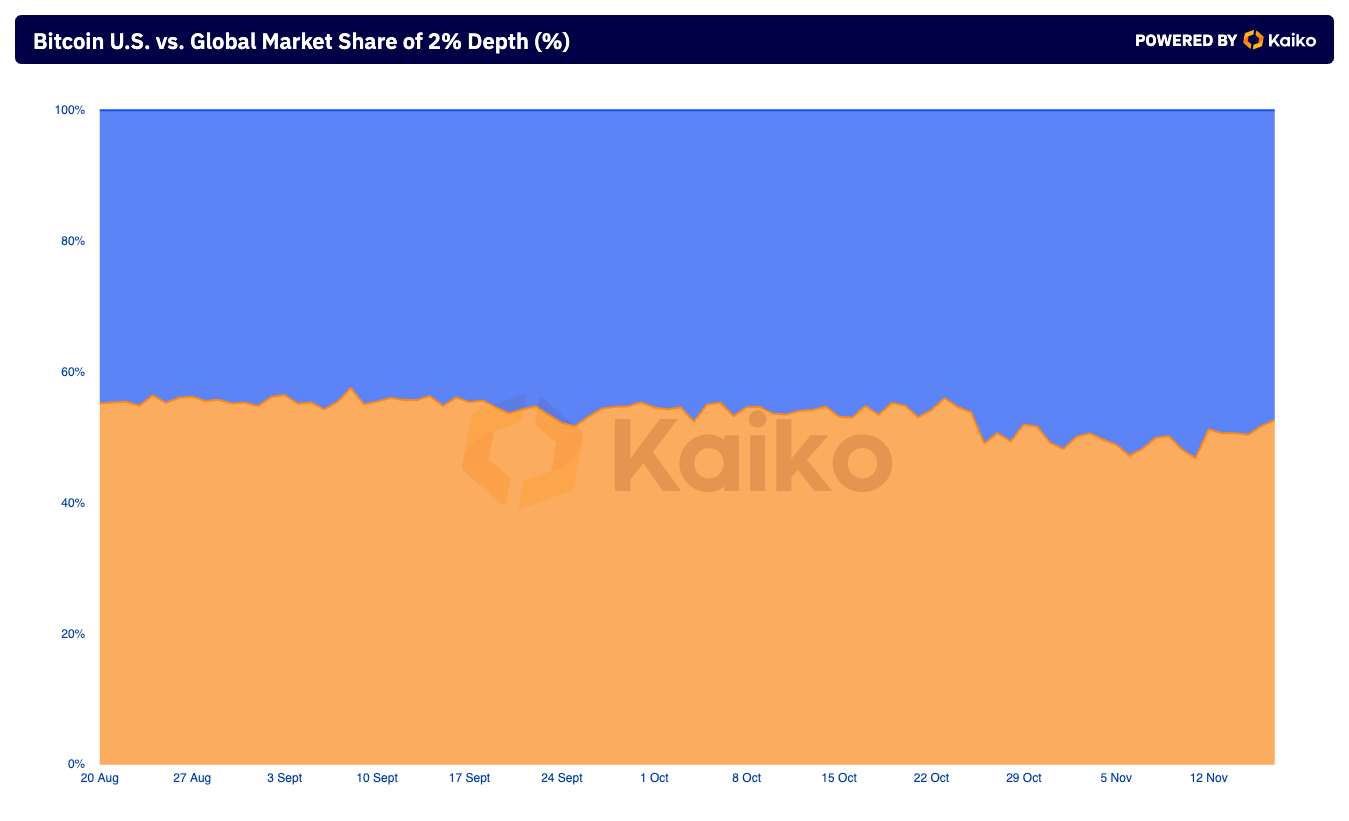

The US market's traditionally dominant share of worldwide market depth seems to have performed a major position in driving this enhance in liquidity. Though US market share fell barely after the election, the broader development via 2024 – when the US accounted for greater than 50% of worldwide depth – means that US establishments and merchants have been pivotal in shaping market exercise.

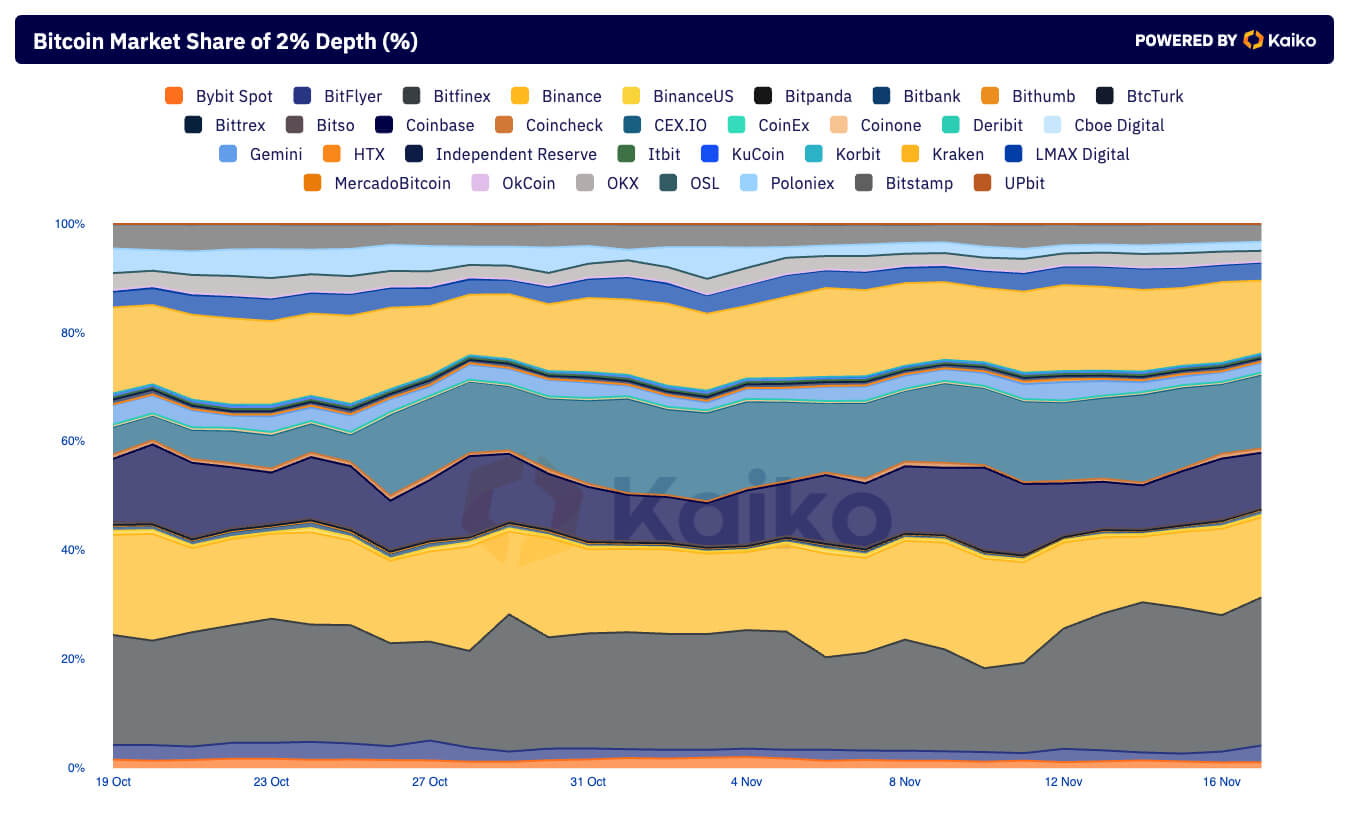

On the change degree, Bitfinex's rise as a frontrunner in international market depth could mirror its capability to draw liquidity amid these political and market modifications. The change's 27% share on November 16 coincides with bitcoin's post-election rally, suggesting that Bitfinex has efficiently captured a good portion of the elevated buying and selling exercise.

In distinction, Binance's declining share, which hovered between 10 and 15% in November, may be attributed to ongoing regulatory scrutiny, which can have deterred institutional gamers from utilizing its platform regardless of broader market optimism.

Put up-US Election Raises Bitcoin Liquidity to New Highs appeared first on fromcrypto.