- The technique suspended the purchases of bitcoins between March 31 and 6 April 2025.

- Bitcoin fell under $ 80,000 after Trump introduced new US enterprise tariffs.

- The present bitcoin holding of the technique prices 528 185 BTC.

Michaela Saylor, a method, stopped her bits of bitcoins for the primary time in a latest reminiscence, which meant a shift from common buy.

This improvement comes in the course of a pointy restore in the marketplace market, which has fallen in response to the brand new 10% of US President Donald Trump's tariff to nearly all international items.

The technique bitcoin accumulation pause, which was confirmed in 10-Q by the US Securities and Inventory Change Fee (SEC) on April 7, coincided with the wool of the investor's warning after Trump additionally threatened to double the tariffs of Chinese language imports to 50%.

Technique holds 528 185 BTC

In line with the SEC technique, the purchases of bitcoins didn’t perform Bitcoins between March 31 and April 6.

The corporate nonetheless holds 528 185 BTC, accrued since 2020, when it first accepted the Technique of the Treasury geared toward Bitcoins below the management of Saylor.

Whereas the corporate didn’t promote any of its shares throughout this latest pause, it seen unrealized losses within the first quarter of 2025.

This sharp lower in worth displays a decline in bitcoins under $ 80,000, a reversal from the income that appeared after the re -election of Trump.

The doc didn’t make clear whether or not the pause was momentary or a part of a wider strategic shift, however confused that market circumstances and geopolitical uncertainty influenced the acquisition exercise.

Trump warns 50% of Chinese language tariffs

A pause when shopping for bitcoins technique was not an remoted determination.

It coincided with the instability of the market -induced market coverage, which precipitated disruption to conventional monetary markets and the alternate of digital property.

April 7 President revealed on X, previously Twitter, he mentioned: “The consequence might be sturdy, brave and affected person and dimension might be.”

Nevertheless, traders' sentiment deteriorated sharply after Trump escalated the threats of accelerating tariffs to Chinese language imports from 34% to 50% until Beijing had remedied its retribution.

This added additional strain on the worldwide worth of property, which led to capital outflows and falling in dangerous property, together with cryptocurrencies.

Unrealized technique losses elevate issues in regards to the BTC money register mannequin

Unsalized losses of $ 5.91 billion have highlighted the potential dangers of the corporate treasury centered on bitcoins.

Though the technique has lengthy been defending bitcoins as a storage of worth, latest occasions have dominated debates on volatility exposition.

Unmissible losses of the corporate within the first quarter illustrate how geopolitical developments – for instance, adjustments in US enterprise coverage – can straight have an effect on the steadiness sheets related to crypto asset.

Whereas the technique didn’t touch upon its future acquisition plans when submitting SECs, the absence of latest purchases within the interval of elevated market uncertainty suggests a extra cautious angle within the quick time period.

Ackman requires reversing the customs tariff

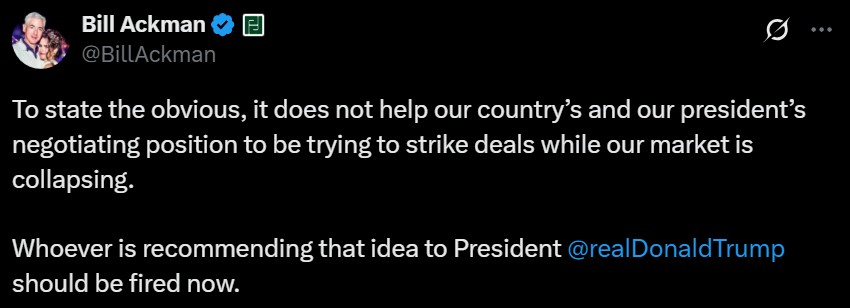

Invoice Invoice Ackman, who beforehand expressed assist for Trump, criticized new tariffs and their impression on market stability.

April 7 Ackman revealed on X that politicians undermine the American negotiations of the lever impact and needs to be instantly reversed.

His feedback mirror rising issues about traders on the broader penalties of enterprise coverage on market markets, particularly with shares and crypto property fall below present strain.

The technique determination to droop the acquisition of bitcoins contributes to this narrative, suggesting that some corporations are actually re -evaluating the aggressive methods of aggressive crypt accumulation in the course of macroeconomic heads.

Whether or not this pause will flip into a protracted -term shift in coverage could rely on how bitcoin costs reply to the creating world financial surroundings and different political improvement.

The put up of technique will hit the Bitcoins button after a lack of 5.9 B appeared for the primary time at fromcrypto.