Bitcoin's fall under $50,000 on August 5 marked the largest draw within the present cycle, leading to important revenue losses and liquidations. And whereas BTC has been exhibiting strong indicators of restoration since then, consolidating round $60,000, the market nonetheless stays cautious because it just lately broke under this psychological assist.

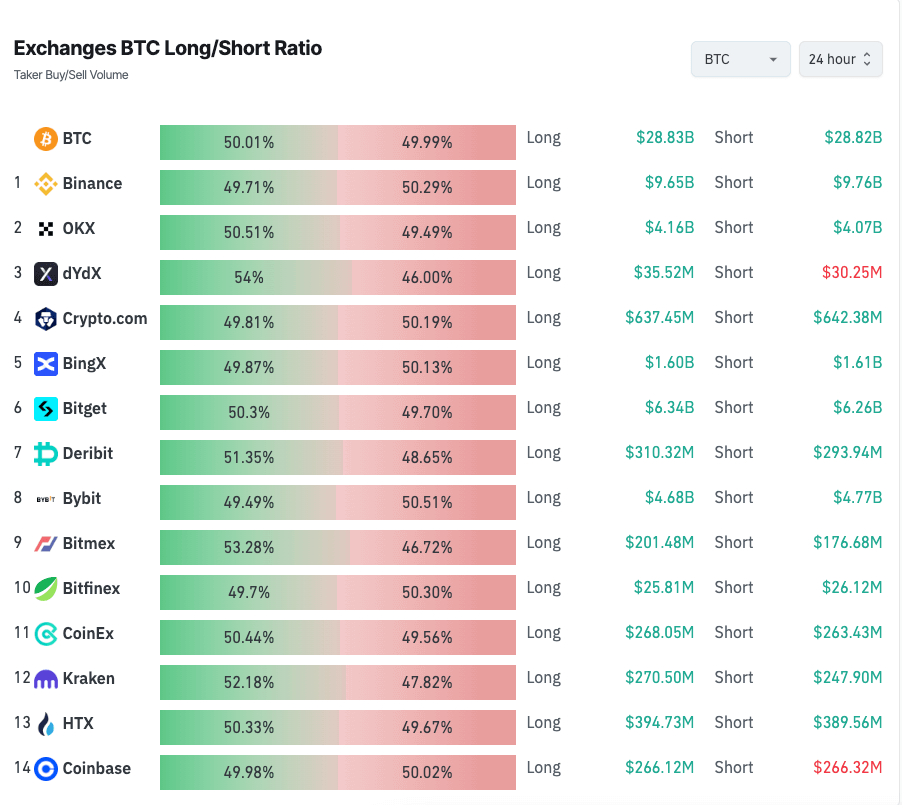

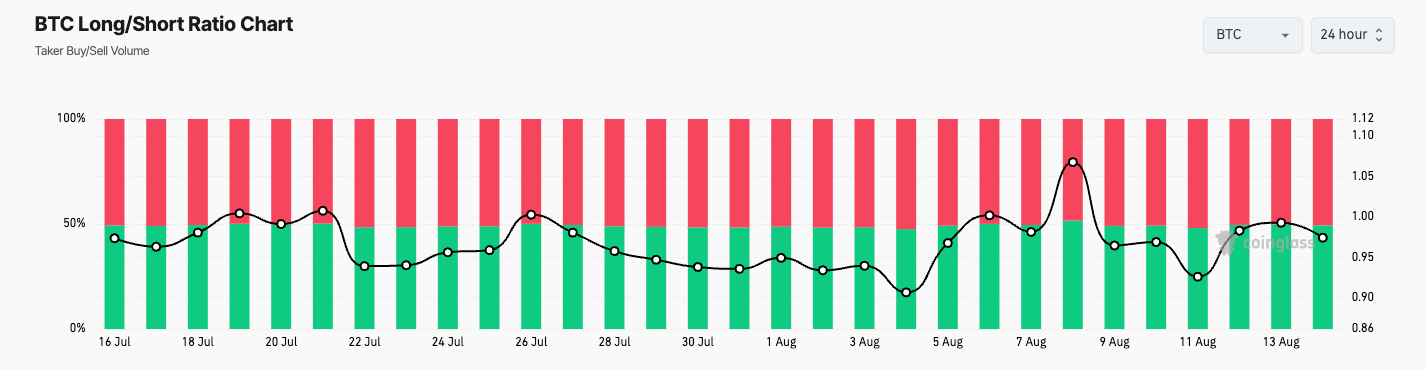

This prudence is greatest seen within the derivatives market, the place the lengthy/quick futures ratio settled round 1, with longs at 50.16% and shorts at 49.85%.

This practically even distribution exhibits a scarcity of clear directional bias amongst merchants. The present ratio represents a big shift from the bullish outlook seen earlier within the month, which peaked on August 8 at a ratio of 1.068.

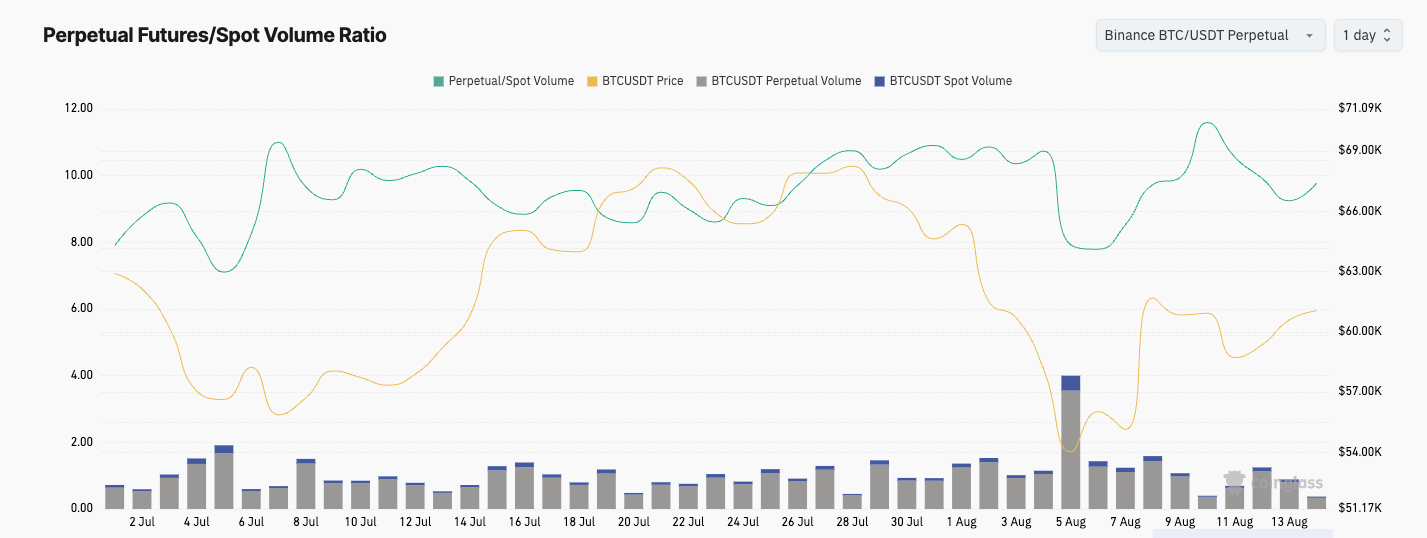

As perpetual futures grow to be the dominant instrument in Bitcoin derivatives buying and selling, this lack of directional bias can simply be sustained. On August 5, perpetual futures quantity reached $67.88 billion, practically eight occasions the spot market quantity of $8.58 billion. The ratio of perpetual futures to identify volumes hit its second-highest stage of the yr on August 10 at 11.60.

Such a excessive ratio of futures-to-spot volumes exhibits how necessary derivatives are in value discovery and liquidity. Excessive volumes, as we now have seen over the previous yr, are inclined to result in elevated volatility and quicker value actions. And with most of that quantity on Binance, the danger of volatility is even better.

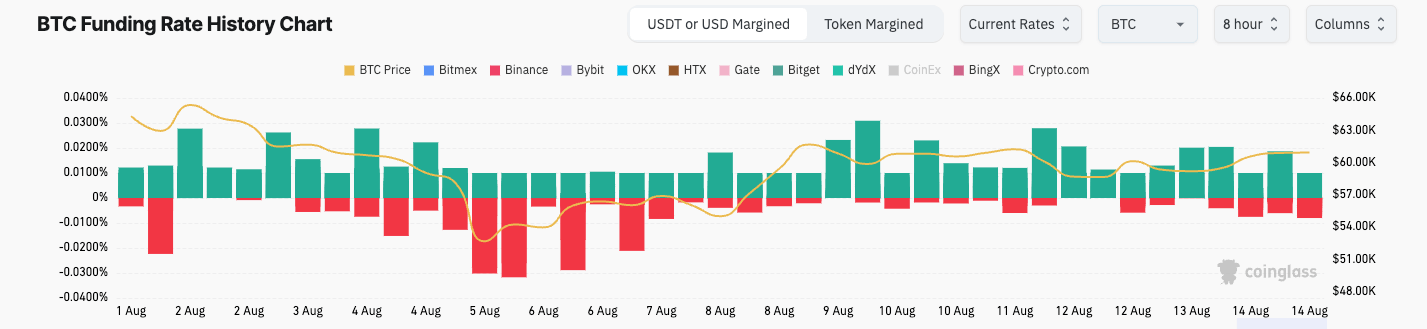

Perpetual futures funding charges have been constantly unfavorable since August 13, following a interval of primarily constructive charges earlier within the month. Vital quantity in Bitcoin perpetual futures signifies excessive leverage out there. Adverse funding charges within the perpetual futures market point out short-term bearish stress. Nevertheless, this might additionally set the stage for a possible quick squeeze if shopping for stress emerges from the following rally.

The gradual restoration we've seen in open curiosity additional confirms that the Bitcoin market is at the moment in a state of cautious restoration. Whereas the value has rebounded from its latest lows, derivatives information exhibits merchants are nonetheless unsure concerning the future course.

The dominance of perpetual futures and the balanced lengthy/quick ratio level to a market that would see important volatility within the close to time period as numerous extremely subtle merchants put together for the market to go both approach.

The put up Bitcoin Market Is Cautious As Longs and Shorts Are Night Out appeared first on fromcrypto.