The Bitcoins market (BTC) has positively turned to 1.10% in line with CoinMarketcap information final week. Though there are nonetheless expectations of further value correction, the results of macroeconomic improvement, as proven in latest statements by US President Donald Trump, forged extra uncertainty concerning the future cryptocurrency trajectory.

Bitcoin bulls face a settlement for $ 98,000 – can they break by way of?

After the widespread correction of the market, Bitcoins have seen spontaneous market income within the final week and have reached the native peak of $ 95,000. At present, crypto asset is traded round $ 86,000 with a small trace of his future motion.

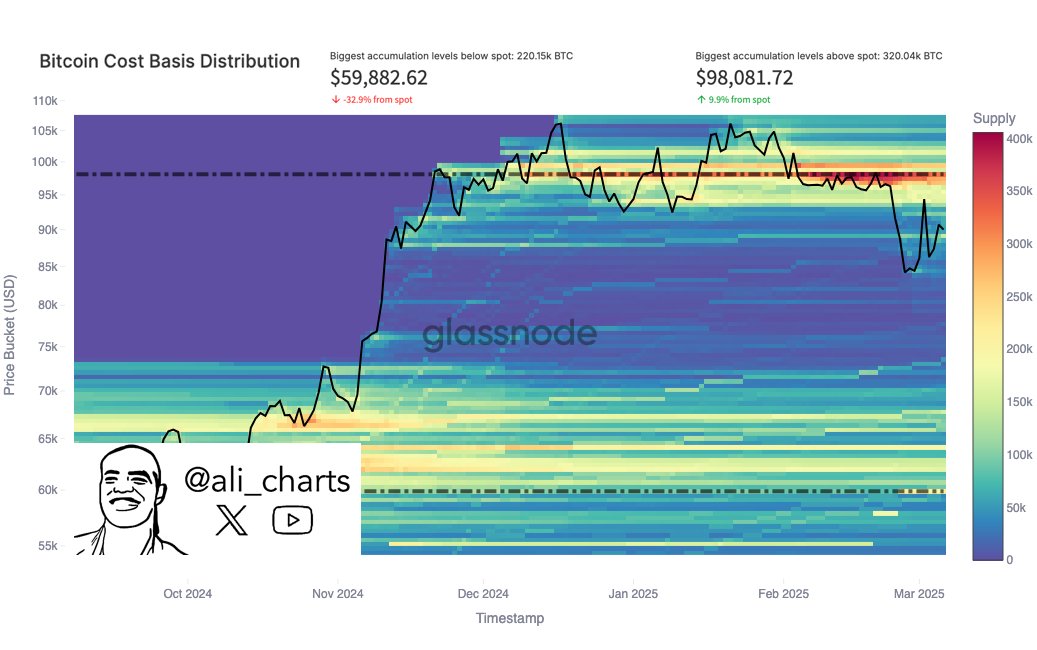

Based on Ali Martinez, the primary analyst of Ali Martinez, the Bitcoin value motion is presently caught between two key accumulation ranges primarily based on its price distribution (CBD) – allocation of Bitcoin's possession by the worth at which varied traders have obtained BTC. CBD helps to determine the primary stage of assist and resistance by displaying the place numerous bitcoins have been bought or offered.

Primarily based on CBD information, Ali Martinez explains to some other income, Bitcoin will face a key resistance to $ 981. This forecast stems from traders who beforehand obtained 320,040 BTC costs on this area and are more likely to promote after the worth to go away small or zero losses. Nonetheless, if bitcoin bulls can mount ample buying strain to interrupt this stage of resistance, it prepares a approach to return over $ 100,000 and probably a brand new historic most.

However, BTC ought to restore its pattern correction, Martinez emphasizes that one other vital stage of assist primarily based on accumulation information is $ 59,882, which was beforehand accrued by 220 150 BTC.

If bitcoins lower to those ranges of assist, it’s doubtless that it’ll expertise a robust reflection as a result of lengthy -term holders are more likely to get extra BTC to defend their positions. Curiously, this evaluation is consistent with different market information, which signifies that the BTC is more likely to bear one other correction. Nonetheless, it’s price noting that any decisive break beneath $ 59,882 would trigger an enormous quantity of panic gross sales.

BTC Value Outlook

On the time of writing, BTC is traded at $ 85,995 after a smaller decline in 1.98% on the final day. In the meantime, its each day buying and selling quantity decreased by 6.38%, indicating a lower in market curiosity. Within the center Constructive occasions such because the institution of American strategic bitcoin reserves, the BTC market stays in a considerably unstable state, as proven available in the market response to the occasions of final week.

The primary image from Morningstar, FROM TradingView Graph

Editorial course of For , it’s targeted on offering a totally explored, correct and neutral content material. We preserve strict supply requirements and every web page undergoes cautious overview of our crew of the perfect know-how specialists and seasoned editors. This course of ensures the integrity, relevance and worth of our content material for our readers.