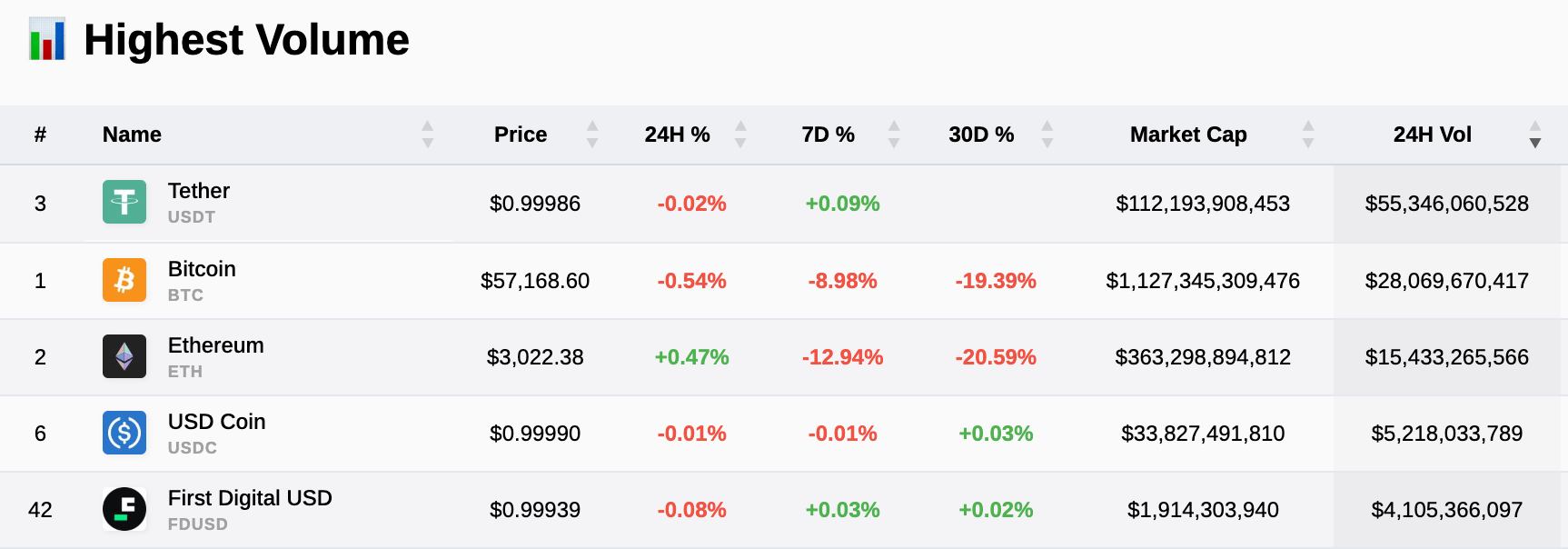

Tether USDT's 24-hour buying and selling quantity exceeds the mixed complete of the next 5 digital property, together with Bitcoin and Ethereum.

Serious about Tether's dominance in buying and selling quantity supplies perception into market liquidity. As fromcrypto knowledge signifies that Tether (USDT) maintains larger quantity than Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), Solana (SOL) and First Digital USD (FDUSD), indicating its vital presence available in the market. Particularly, Tether noticed a 24-hour quantity of over $55 billion, far surpassing Bitcoin's $28 billion and Ethereum's $15 billion.

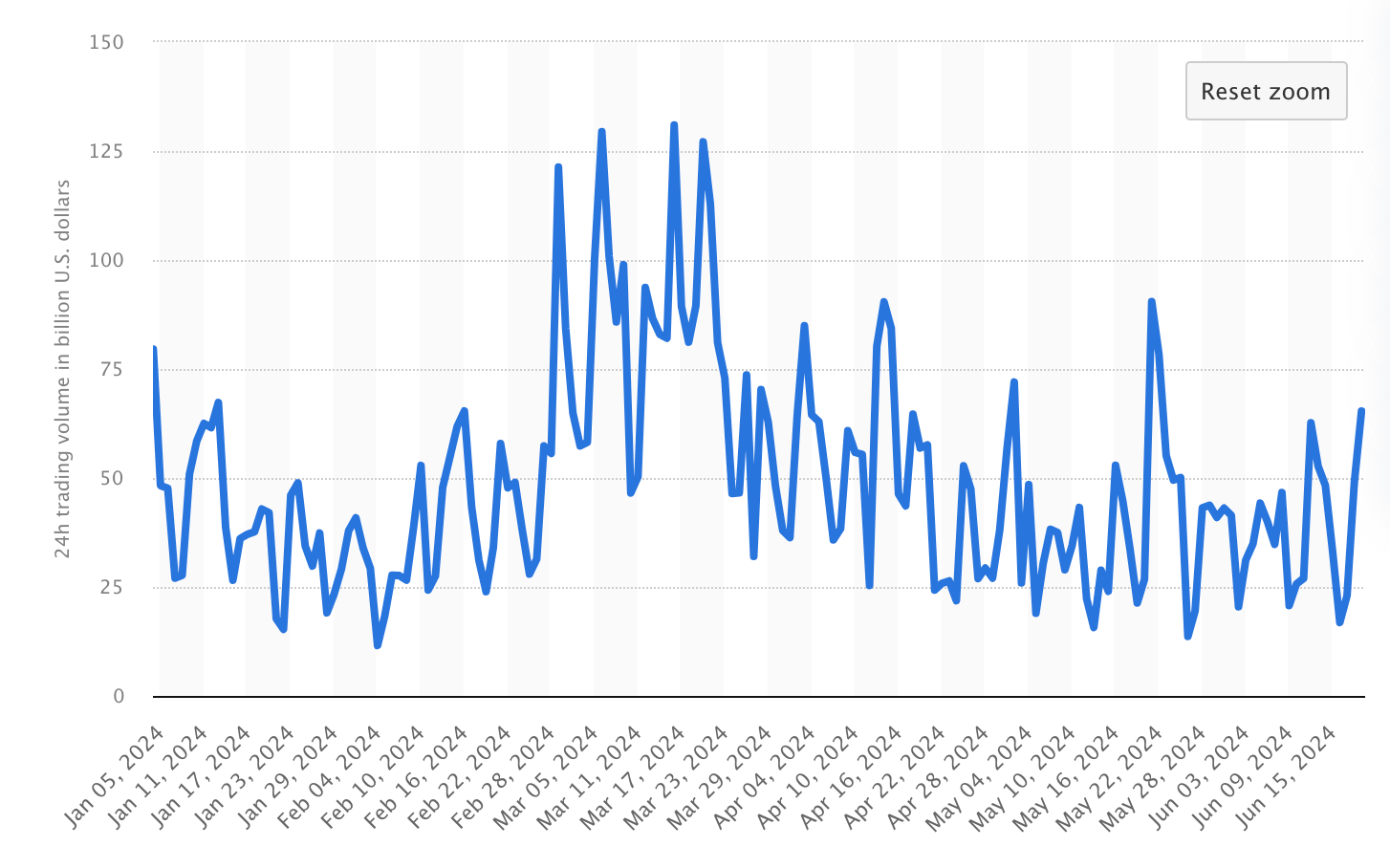

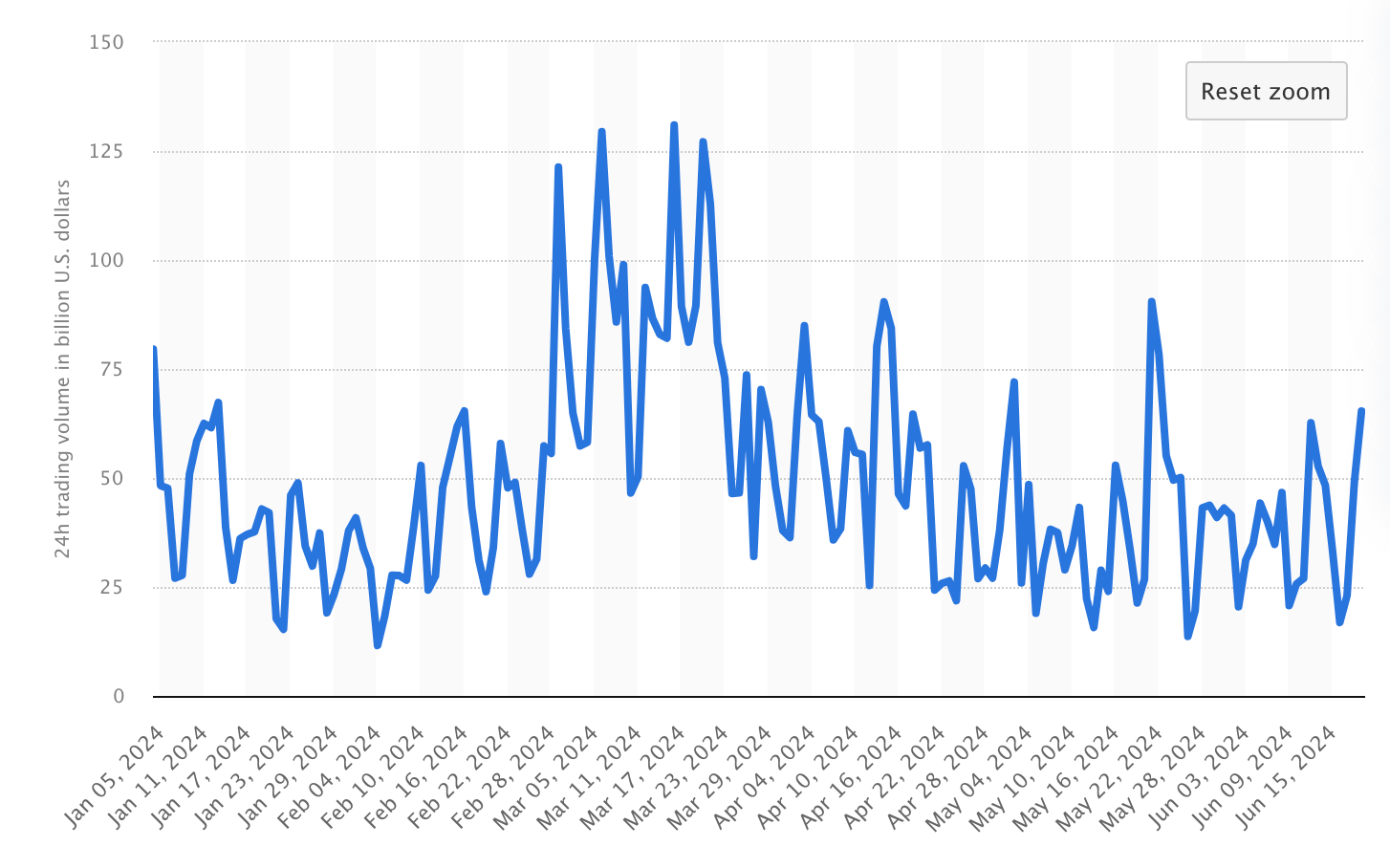

With a market cap of over $112 billion, buying and selling patterns additionally present that Tether's quantity has been persistently robust all through 2024, peaking at $130 billion on March 16. Tether's stability and frequent use in buying and selling pairs make it the popular selection for merchants trying to hedge towards volatility.

With a market cap of over $112 billion, buying and selling patterns additionally present that Tether's quantity has been persistently robust all through 2024, peaking at $130 billion on March 16. Tether's stability and frequent use in buying and selling pairs make it the popular selection for merchants trying to hedge towards volatility.

These quantity statistics mirror broader market tendencies as Tether supplies liquidity and stability. Tether often achieves each day commerce volumes in extra of $25 billion, reinforcing its standing as a key liquidity supplier within the crypto ecosystem.

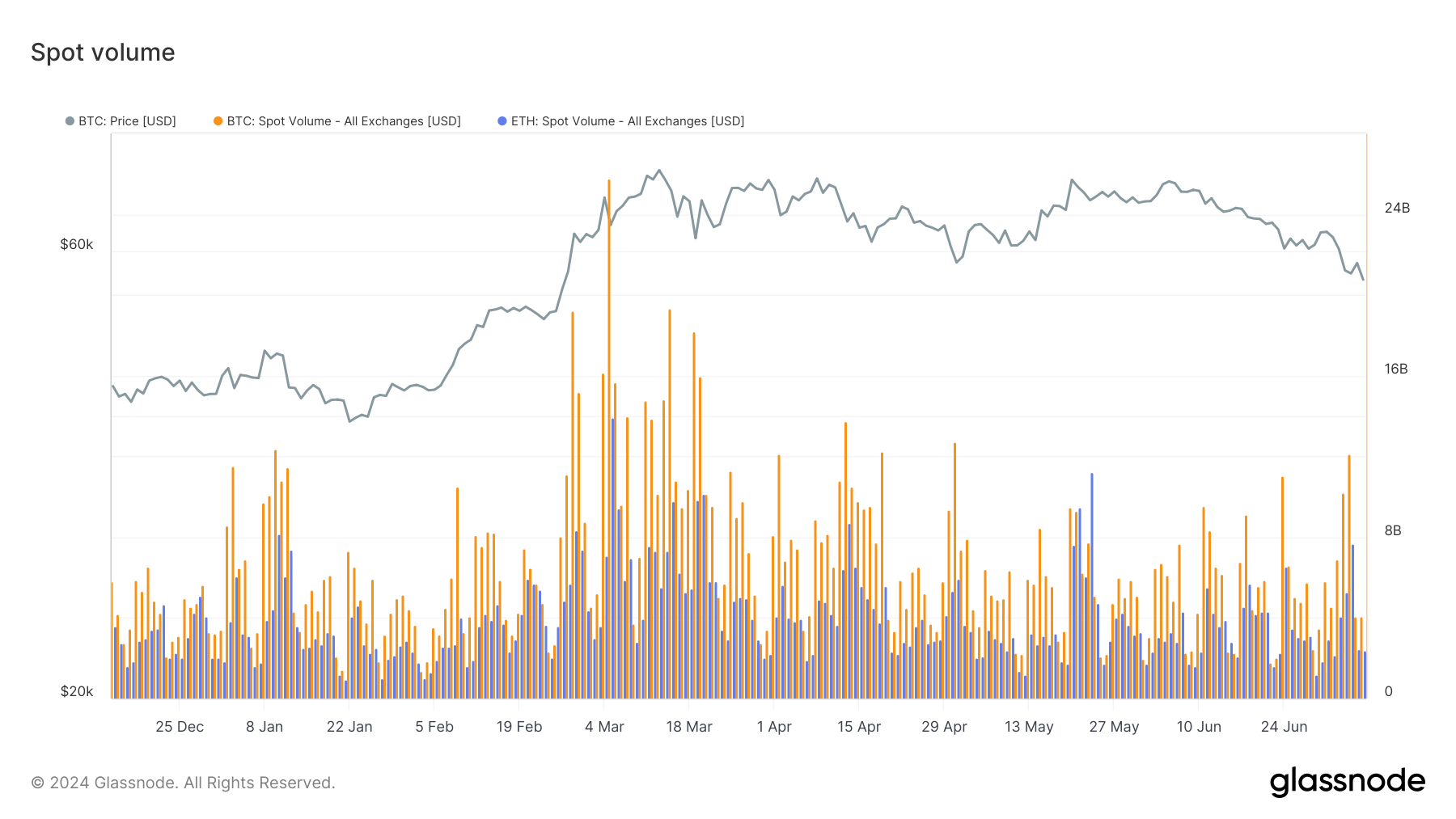

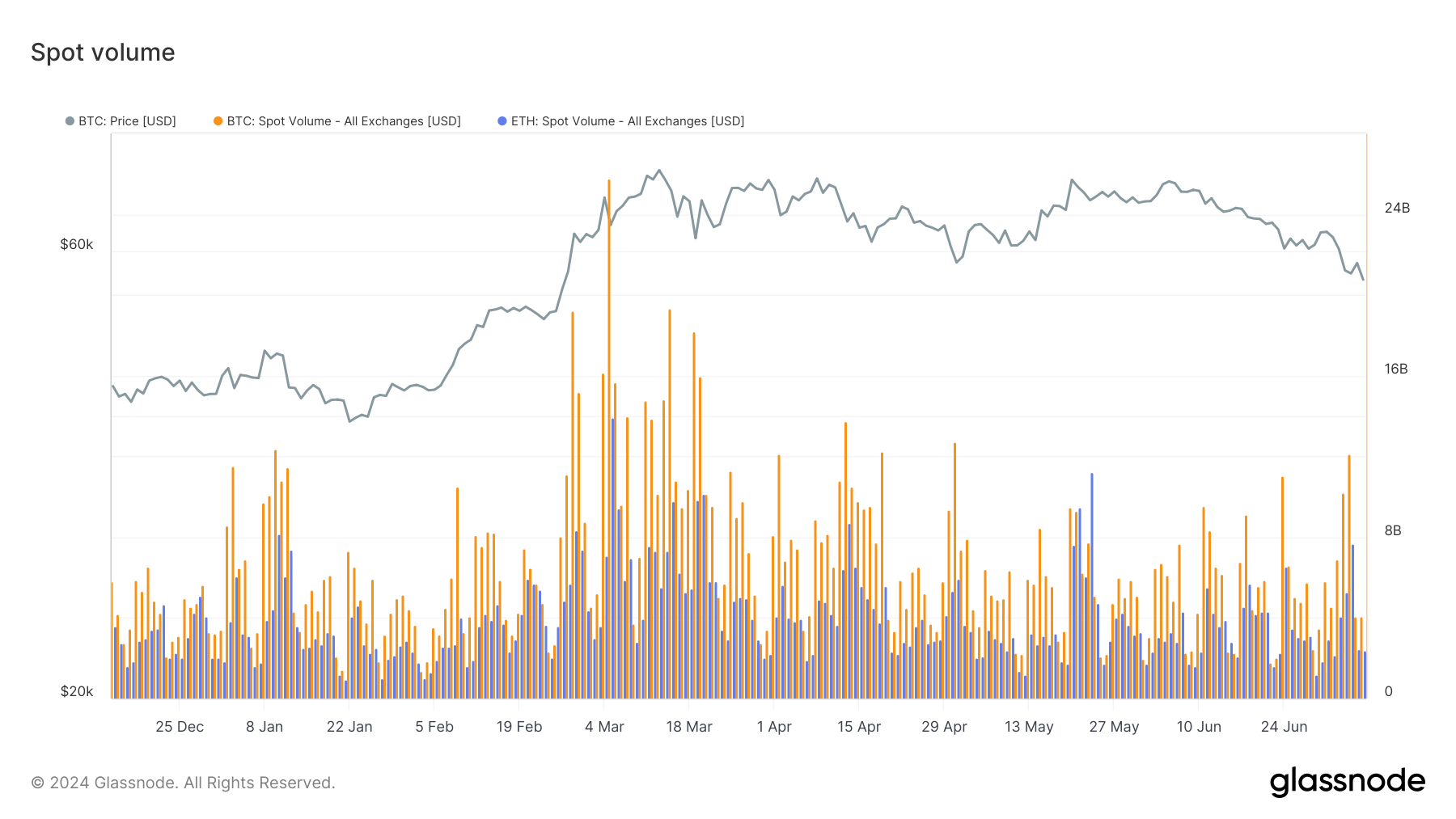

Based on Glassnode knowledge, throughout 2024, Bitcoin and Ethereum noticed round $4-8 billion per day, nicely beneath Tether's volumes.

Tether's excessive buying and selling quantity in comparison with different main digital property illustrates its integral function in each day buying and selling actions and the broader market technique utilized by merchants and establishments. This steady, high-volume buying and selling implies belief and reliance on the soundness and availability of Tether, making it important for the market to perform successfully.

Whereas Tether has confronted repeated challenges to its reserves and use in illicit actions prior to now, these volumes present its resilience in combating these claims. Tether CEO Paolo Ardoino lately advised fromcrypto that Tether is at present too hedged, with the agency's income being plowed again into reserves to bolster its stability.

Ardoino additional commented on how Senator Warren's discouraging of accounting companies from working with Tether hindered his capacity to make use of considered one of America's high 4 accountants for audits. The CEO claimed that Tether is consistently trying to rent one of many high firms, however has all however given up on that taking place anytime quickly, no matter their efforts to take action.