- The LUNA crash highlights the dangers related to algorithmic stablecoins.

- The altcoin plunged from $115 to $0, wiping $60 billion off its market worth.

- TerraUSD didn’t depend on the normal mannequin of getting bodily property as collateral.

A revered crypto researcher on X recalled the notorious occasions surrounding the LUNA crash a number of years in the past, which uncovered many cryptocurrency customers to important losses. The researcher launched his thread and described the incident because the LUNA crash that rocked the crypto world. He sees this as a basic case of the dangers related to algorithmic stablecoins.

Based on the researcher, LUNA instantly crashed from $115 to $0, wiping $60 billion off its market worth. One particular person misplaced practically $10 million, highlighting the extent of the potential dangers related to investing in cryptocurrencies.

Associated: Terraform Labs chapter listening to: Impression on LUNA, LUNC, USTC costs

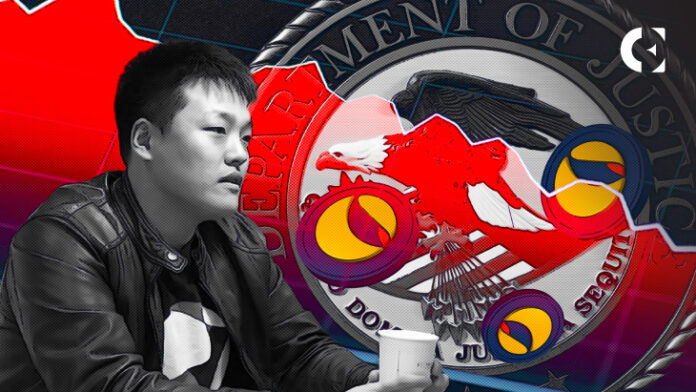

Recalling the LUNA scandal, the researcher described Terra, the infrastructure behind LUNA, as a blockchain protocol and cost platform designed for algorithmic stablecoins. Co-founded by Do Kwon and Daniel Shin, Terraform Labs was launched in 2018 and was recognized for UST, its Terra stablecoin, and the related reserve asset LUNA.

Terraform's revolutionary method has attracted a number of buyers. The stablecoin answer didn’t depend on the normal mannequin of getting bodily property as backup. As an alternative, UST maintained its worth utilizing advanced algorithms and market mechanisms. Over time, Anchor Protocol, a DeFi answer constructed on the Terra Blockchain, has develop into a cornerstone of the Terra ecosystem, providing as much as 20% annual return on UST deposits.

Associated: The Supreme Courtroom of Montenegro will assessment the choice to extradite Do Kwon

The Anchor answer turned enticing and attracted a major a part of UST. The protocol accounted for 75% of the stablecoin's provide, however raised issues about its long-term viability. The protocol realized these issues in Might 2022 after whales withdrew over $2 billion in US {dollars} and bought them in the marketplace. This triggered a de-fixation of the stablecoin, with the value falling to $0.91.

The de-pegging of UST led to large FUD within the Terra ecosystem, resulting in the sell-off of LUNA and the next removing of LUNA and UST by crypto exchanges. In mild of those obstacles, the Terra blockchain suspended its operations, triggering an ecosystem collapse that resulted in a lack of $60 billion and important authorized penalties for stakeholders, together with Voyager, Celsius, and Three Arrows Capital.

Different occasions following the collapse of TerraUSD included the arrest and imprisonment of Kwon throughout ongoing extradition proceedings between South Korea and america. The researcher underscores the influence of UST as a vital lesson for buyers concerning the dangers related to algorithmic stablecoins and the lure of excessive returns.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shall not be chargeable for any losses incurred because of using mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.

(@ardizor)

(@ardizor)