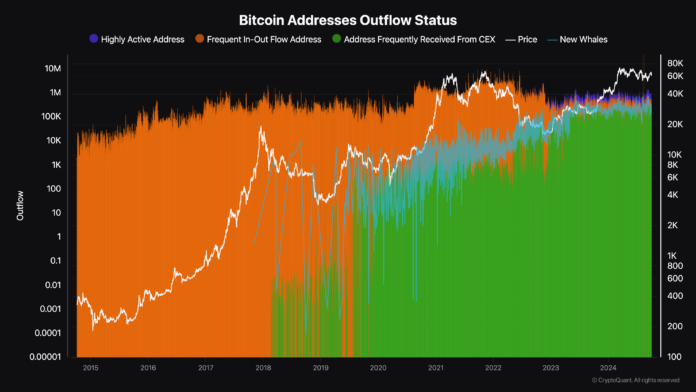

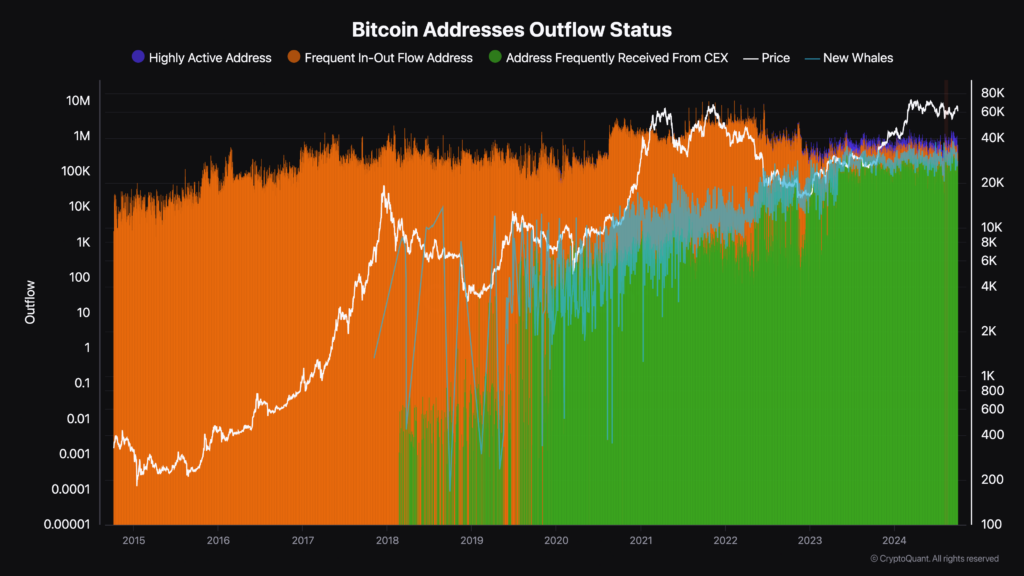

An evaluation of Bitcoin tackle outflow patterns suggests a correlation between sorts of tackle exercise and Bitcoin value actions from 2014 to 2024. Per CryptoQuant knowledge, shifts in outflow tendencies between completely different tackle classes replicate underlying market tendencies and participant conduct.

From 2014 to 2017, Bitcoin outflows had been dominated by frequent in-out addresses. This era coincided with low bitcoin costs in comparison with right now, suggesting that the excessive transaction exercise between these addresses didn’t considerably have an effect on market valuations. The predominance of frequent in-out flows displays a market primarily pushed by smaller transactions and particular person customers engaged in common transfers.

Round 2018, there was a big shift as addresses typically acquired from centralized exchanges started to develop quickly. This progress got here with a rise in bitcoins held or moved via trade addresses attributable to elevated buying and selling exercise and elevated consumer adoption of exchanges.

The timing is in line with an upward pattern in Bitcoin's value, suggesting a connection between inventory market exercise and market valuation. The prominence of exchange-related addresses could replicate buyers transferring belongings to exchanges in anticipation of market actions or elevated speculative buying and selling.

The variety of new whale addresses recognized by new or present giant Bitcoin holders elevated in early 2020. This enhance coincided with the elevated progress and volatility of Bitcoin, that means accumulation no matter value.

The inflow of latest whales throughout these intervals means that institutional buyers or excessive internet value people had been getting into the market, doubtlessly driving costs increased via substantial purchases.

Bitcoin tackle exercise since 2021

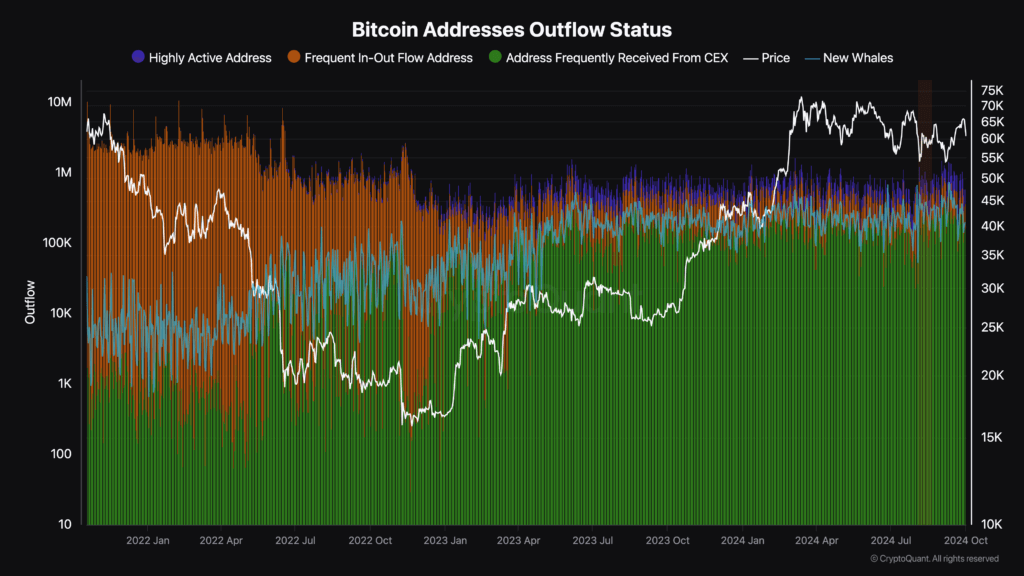

As the worth of Bitcoin declined all through 2022, frequent in-out addresses remained dominant. Nevertheless, their affect weakened after mid-2022, which coincided with a big enhance in addresses typically acquired from centralized exchanges. This shift means that extra bitcoins had been transferring or held by exchanges throughout the restoration interval, indicating elevated buying and selling exercise or investor relocation in response to market circumstances.

New whale exercise continued to extend throughout the second half of 2022 and into 2023, indicating continued shopping for by giant holders throughout low costs. This progress displays a strategic market repositioning throughout a interval of heightened market uncertainty. This exercise correlates with the bitcoin value bottoming in 2022, adopted by a restoration all through 2023 and into 2024.

A rise within the variety of new whales in periods of decrease costs signifies bullish sentiment in hopes of capitalizing on a future value restoration.

As of 2023, for the primary time in Bitcoin historical past, extremely lively addresses have gained floor. The event of buying and selling bots, excessive frequency buying and selling and Bitcoin meta layers is partly accountable. The expansion of most of these addresses exhibits the evolution of Bitcoin's use and distracts from theories that Bitcoin is changing into nothing greater than a retailer of worth. Bitcoin has main utility worldwide and is rising.

Persistent tendencies in Bitcoin addresses

The significance of exchange-related addresses throughout sure intervals displays adjustments in investor conduct, similar to strikes towards holding belongings on exchanges for liquidity or elevated buying and selling exercise in response to market fluctuations. Equally, the timing of whale exercise suggests that enormous holders are influencing market tendencies or strategically responding to cost actions.

The noticed patterns counsel that enormous holders play a big position in stabilizing the market or reversing the pattern. Their elevated exercise throughout value lows supplies market help and doubtlessly prevents additional declines. Conversely, intervals of decreased whale exercise might coincide with market uncertainty or phases of consolidation.

By monitoring the circulation of Bitcoin throughout completely different classes of addresses, we will determine rising tendencies or shifts in market sentiment. For instance, a rise in stock-related addresses could sign elevated buying and selling exercise or anticipation of market actions, whereas elevated whale exercise might point out confidence amongst giant buyers in future value appreciation.

The correlation between tackle exercise and value motion highlights the transparency of Bitcoin itself. Publicly obtainable on-chain knowledge allows complete evaluation of market conduct and provides perception not usually obtainable in conventional monetary markets. This transparency permits contributors to make extra knowledgeable selections primarily based on observable patterns within the community's transactional exercise.

Lastly, evaluation of Bitcoin tackle outflow patterns over the previous decade reveals vital correlations with market cycles and value actions. Evolving tendencies amongst completely different tackle classes replicate adjustments in market construction, participant conduct and broader adoption tendencies.

The publish Ten Years of Bitcoin Tackle Knowledge Reveals Investor Conduct and Market Shifts appeared first on fromcrypto.