Low-income households in the USA are turning cryptocurrency positive aspects into homeownership alternatives, a Nov. 26 report from the Workplace of Monetary Analysis (OFR), the analysis arm of the U.S. Treasury Division, revealed.

Samuel Hughes, Francisco Ilabaca, Jacob Lockwood and Kevin Zhao carried out the research based mostly on tax information. It provides vital perception into how cryptocurrencies are shaping monetary conduct in economically weak communities.

Mortgage and automobile loans

The report famous a rise in “high-crypto” areas, outlined as zip codes the place greater than 6% of households reported holding cryptocurrencies on their tax returns. These areas have seen important will increase in mortgage and auto loans, coinciding with important positive aspects within the crypto market.

In these excessive cryptocurrency areas, low-income households noticed a rise in mortgage exercise between 2020 and 2024. The variety of customers with mortgages grew by greater than 250%, whereas common mortgage balances jumped from $172,000 in 2020 to $443,000 in 2024. A rise of greater than 150%.

These numbers recommend that the cryptocurrency windfall has enabled many households to safe bigger loans and enter the housing market.

The report said:

“Amongst low-income households, common mortgage debt balances and mortgage charges have elevated sharply in zip codes with excessive cryptocurrency publicity. This means that low-income households can use cryptocurrency earnings to take out new mortgages and take out bigger mortgages.

The report additionally sheds mild on automobile mortgage developments in these areas. Amongst low-income households, auto mortgage balances rose most importantly in high-cryptocurrency areas. Curiously, whereas delinquency charges elevated in low and medium crypto zip codes, they decreased in excessive crypto areas. This sample means that cryptocurrency earnings might assist some households handle their automobile mortgage funds extra effectively.

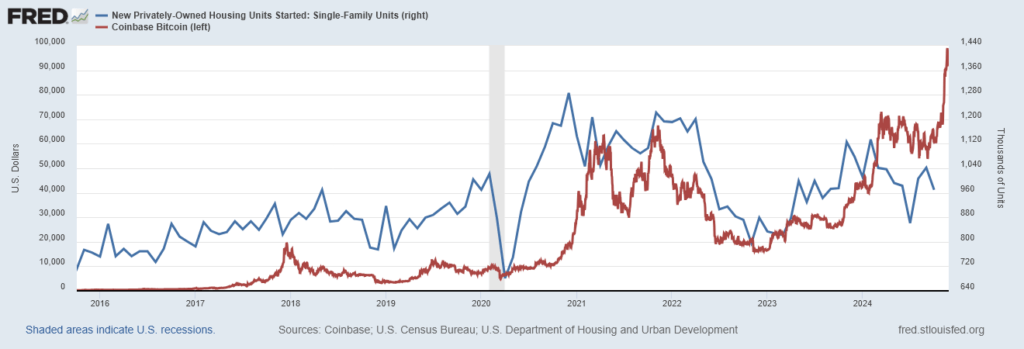

Because the banking disaster of 2008, which led to widespread defaults, single-family residence possession has by no means recovered. Nevertheless, since Bitcoin's inception in 2009, the numbers have continued to develop. Whereas correlation doesn’t recommend causation, it’s fascinating to notice that the 2021 bull run and subsequent 2022 bear market additionally noticed will increase and reduces in new single-family properties.

Dangers

Regardless of these constructive developments, researchers warn of potential dangers related to rising debt and leverage amongst low-income households with important cryptocurrency publicity.

Whereas delinquencies stay low general, financial downturns or a dip within the crypto market may result in monetary instability. Focus of publicity to systemically vital establishments may amplify these dangers.

The researchers concluded:

“An vital takeaway to observe going ahead is elevated debt balances and leverage amongst low-income households with publicity to cryptocurrencies. Rising misery on this group may trigger future monetary stress, significantly if publicity to some of these high-indebted, high-risk customers is concentrated in systemically vital establishments.”