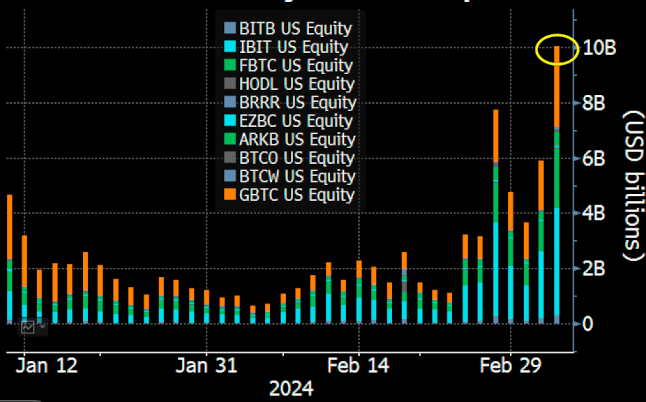

Spot bitcoin ETFs continued their document efficiency this week, posting over $10 billion in quantity on March 5 – probably the most since their launch in January.

The earlier document was set on February 28, when ETFs recorded a collective buying and selling quantity of roughly $7.7 billion.

IBIT, FBTC preserve lead

Three spot bitcoin ETFs accounted for a lot of the whole quantity. Buying and selling closed with web inflows of $109.86 million throughout all ETFs.

BlackRock’s iShares Bitcoin Belief (IBIT) was liable for roughly $4 billion in quantity on March 5, whereas Constancy Smart Origin Bitcoin Belief (FBTC) accounted for roughly $2 billion. Grayscale’s Bitcoin Belief (GBTC) has seen $3 billion in each day quantity.

Bloomberg ETF analyst Eric Balchunas wrote on X:

“These are banana numbers for ETFs lower than 2 months previous.

Earlier within the day, Balchunas he predicted it spot bitcoin ETFs would possible surpass their earlier document as whole quantity reached $6 billion round 19:53 UTC.

Particular person ETFs are breaking data

Balchunas famous that IBIT, FBTC, BITB and ARKB noticed document each day volumes.

He additionally noticed distinctive efficiency amongst a number of non-spot ETFs that enable for strategic investments. BetaPro Inverse Bitcoin ETF (BITI), ProShares Bitcoin Technique ETF (BITO) and 2x Bitcoin Technique ETF (BITX) all noticed document volumes.

A number of Bitcoin ETFs have been among the many most energetic ETFs general. Knowledge from Barchart indicated that IBIT and BITO got here out on high, outperforming the S&P 500 ETF Belief ( SPY ) and the Nasdaq QQQ Invesco ETF ( QQQ ). GBTC and FBTC additionally ranked within the high ten ETFs by quantity.

New child 9’s outstanding efficiency has been a essential driver of Bitcoin’s latest value rally as demand outstrips provide. The flagship cryptocurrency hit a brand new all-time excessive forward of the halving for the primary time in its historical past.

All volumes coincide with Bitcoin (BTC) costs reaching new highs. BTC briefly touched $69,324 on March 5, surpassing its November 2021 all-time excessive of $69,044, earlier than a brutal value correction.