A single Bitcoin miner independently solved a BTC block to obtain a reward of three.275 BTC, equal to roughly $200,000 USD.

On August 29, Con Kolivas, a software program engineer and ckpool solo mining fund supervisor, introduced on X {that a} miner had efficiently solved the 291st single block in Bitcoin historical past. He congratulated the miner and acknowledged:

“Congratulations to miner 36AisvWi1UiwLTeTZxLzindAkorqeUc3tT for fixing the 291st solo block on solo.ckpool.org! This stout 38PH miner would remedy a block on common as soon as each ~4 months.”

Blockchain knowledge confirms {that a} miner efficiently mined block quantity 858,978 on the Bitcoin blockchain, which included 2,391 transactions.

Considerations about centralization

This achievement comes at a time when there’s rising concern locally concerning the centralization of Bitcoin mining.

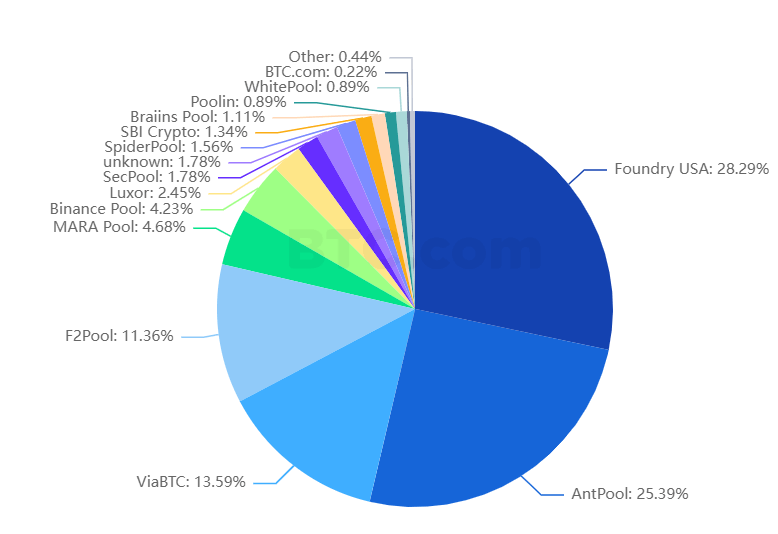

Knowledge from BTC.com reveals that 4 mining swimming pools – Foundry USA, AntPool, ViaBTC and F2Pool – have produced about 80% of Bitcoin blocks previously three days, elevating alarm amongst group members.

Foundry USA and AntPool alone accounted for greater than 50% of the blocks mined by these swimming pools.

This excessive degree of centralization has raised considerations about the way forward for Bitcoin. Jameson Lopp, co-founder of CasaHODL, weighed in on this concern and defined that the centralization of Bitcoin mining is a battle between economies of scale and the decentralized nature of power sources. However he stays optimistic that decentralization will finally win out.

The dangers had been notably exacerbated by the current halving, which halved block mining rewards. This discount drove many smaller miners out of the market, with publicly traded mining corporations dominating the trade.

Bitfinex warned that this focus of mining energy might result in potential censorship of transactions and elevated vulnerability to coordinated assaults or regulatory strain. The corporate acknowledged:

“This focus of mining energy amongst fewer entities might result in elevated centralization, which works in opposition to the ethos of Bitcoin. The dangers of centralization might imply potential censorship of transactions and elevated vulnerability to coordinated assaults or regulatory strain.”