The ETH/BTC ratio represents the relative power of Ethereum (ETH) to Bitcoin (BTC). Since these are the 2 largest cash by market cap and the 2 largest cryptoecosystems generally, it is sensible to check their relationship to higher perceive the market. Monitoring the ETH/BTC ratio is necessary as a result of it displays market sentiment in the direction of ETH relative to BTC. A rising ratio exhibits that ETH is outperforming BTC, indicating both elevated confidence in ETH or a decline within the worth of BTC.

Whereas long-term holders could not pay a lot consideration to this ratio, lively merchants use it to resolve their buying and selling positions to benefit from volatility. As well as, the ratio gives a measure of the relative power of ETH to BTC, serving to us perceive shifts in market dominance that might result in volatility.

This week began with a bang for ETH/BTC because the ratio noticed unimaginable volatility. The market was excited by hypothesis concerning the approval of spot Ethereum ETFs within the US. This expectation significantly influenced the costs of ETH and BTC and subsequently affected the ratio.

For many of the previous 30 days, the ratio has remained comparatively steady, round 0.0485 round April 24. On the time, each ETH and BTC noticed solely modest worth fluctuations with no important divergence to extend the ratio.

We noticed the primary important rise within the ratio round April 27, when it touched 0.0513. This correlated with a small improve within the worth of ETH, which rose from $3,140 to $3,250. This improve pushed the ratio up as BTC remained comparatively steady on the time. This improve continued till the top of April. Nonetheless, the constructive momentum was damaged in Could when the ratio decreased. It fell to 0.0451 on Could sixteenth when it began to get better and climbed to 0.0513 by Could twentieth. This gradual and regular rise was a near-vertical climb between Could 20 and Could 21, peaking round 0.0560.

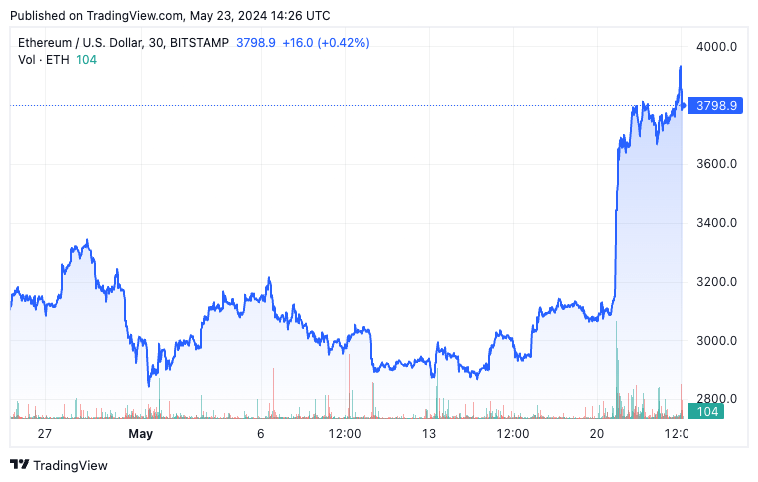

Whereas Bitcoin additionally noticed important worth motion throughout that point, reaching $71,400 on Could 20, ETH noticed a way more aggressive rally. It jumped to over $3,790 by Could 21, adjusted barely to $3,730 on Could 22, and reached as excessive as $3,948 on Could 23 earlier than any determination on the Ethereum ETF.

Such a pointy rise within the ratio comes as no shock as analysts have revised the chance of ETH ETF approval to 75% amid rumors of a possible favorable stance from the SEC. These rumors had been sufficient to gasoline hypothesis as merchants positioned themselves to capitalize on the anticipated inflows into ETH following the approval of the ETF.

The potential approval of an ETH ETF is a major step towards institutional adoption of Ethereum, just like the affect we've seen with Bitcoin ETFs. Nonetheless, as US regulators have struggled for years to resolve whether or not to designate ETH as a commodity or a safety, the approval of an ETH ETF would have much more important implications for the broader crypto market. This prospect fueled the rally in ETH, as seen within the narrowing low cost in Grayscale's Ethereum Belief and the elevated USDT coinage on Ethereum in anticipation of the ETF.

The publish Ethereum ETF Rumors Trigger Dramatic Rise in ETH/BTC Ratio appeared first on fromcrypto.