- Ripple CTO David Schwartz criticizes the classification of IMF industrial tokens as safety.

- Schwartz claims that Bitcoin must also be labeled as a tokens of advantages by IMF.

- The controversy on XRP classification comes in the midst of the continuing authorized battle Ripple with SEC.

The Chief Expertise Director of Ripple, David Schwartz, was strongly against claims that XRP needs to be labeled as security by the definition of tokens of the Worldwide Financial Fund (IMF).

The IMF just lately launched the seventh version of its Stability of Funds and Worldwide Funding Handbook (BPM7). This newest model is a vital replace that has been the primary revision since 2009 and, particularly, features a rising function in cryptocurrencies within the international economic system.

On this replace, nevertheless, the MMF try and categorize these digital property has induced controversy, particularly when it comes to XRP.

Associated: XRP will not be safety: Ripple celebrates orientation selections, warns towards overlap Sec

How does the IMF crypto like XRP?

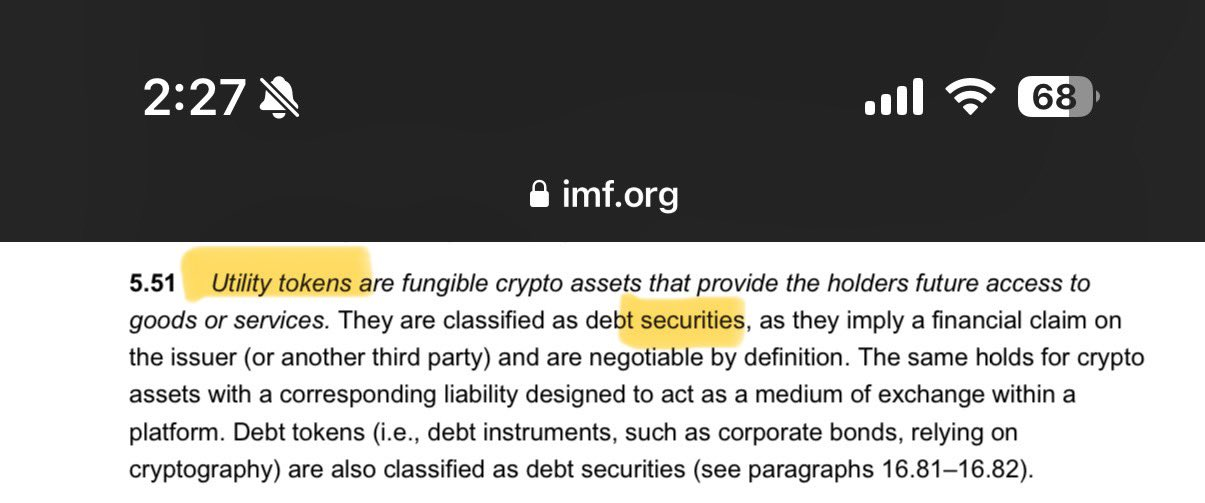

Inside this newly up to date framework, the IMF classifies crypto property by making a monetary declare or duty with the issuer. On this context, the IMF states that the tokens of advantages that embody many altcoins present future entry to items or providers, and will subsequently be labeled as “debt securities”.

This classification has induced some humorous to foretell that XRP can quickly be completely listed as safety.

Apparently, the IMF strategy to the categorization of utility tokens may doubtlessly classify not solely XRP but additionally different entrance cryptocurrencies similar to Ethereum and Solan, similar to “Debt Securities”.

Ripple's CTO disagrees with the classification of the IMF

Nevertheless, Ripple's CTO, David Schwartz, disagrees with this line of reasoning. He claimed that if XRP fits this definition, then different main cryptocurrencies similar to Bitcoin and Ethereum ought to fall into the identical class.

“Is that if XRP in response to MMF standards utilizing the token or safety, as it may be used for future transaction charges, bitcoin and ethereum must also be labeled in the identical method, “ Schwartz argued.

As well as, Ripple's CTO additionally identified that in his opinion no foremost token actually doesn’t match the definition of the IMF of the utility token. “I'm undecided what huge token, if in any respect, can be an instance“He stated.”

This debate on XRP classification comes at a decisive time. Ripple is approaching the tip of its ongoing authorized battle, the place the place of XRP was within the heart of the dispute.

Associated: Ripple's Sec Victory: The attraction has dropped, however Sec Silence leaves “formally?” Hanging query

In 2020, the US Securities and Inventory Trade Fee (SEC) filed an motion towards Ripple, with the sale of XRP violated securities legal guidelines.

In 2023, nevertheless, the district choose Analisa Torres determined that the sale of XRP of Ripple to most people didn’t qualify as a transaction with securities. Nevertheless, she discovered that direct gross sales of the corporate violated institutional traders rules for securities.

Renunciation of duty: The data on this article is just for data and academic functions. The article doesn’t signify monetary recommendation or recommendation of any form. Coin Version will not be liable for any losses as a consequence of using content material, services or products. It’s endorsed that the readers ought to proceed with warning earlier than taking any measures with the corporate.