When analyzing the Bitcoin market, it’s simply as necessary to know the conduct of assorted market individuals as it’s to know the technical fundamentals of Bitcoin value actions. On-chain evaluation usually analyzes short-term and long-term holders as a result of their conduct is inherently completely different. Nevertheless, the maturity of Bitcoin permits us to tell apart between giant and small entities, as a whole lot of establishments have crammed the area and change into a dominant drive available in the market.

Giant entities are likely to make strategic strikes primarily based on long-term outlooks and thorough market evaluation. In distinction, small entities, sometimes retail buyers, are extra reactive and pushed by short-term hypothesis and sentiment.

The relative exercise of small and enormous topics is a wonderful metric for distinguishing the 2 cohorts. Whereas relying solely on this metric has its limitations—comparable to oversimplifying the advanced conduct of a various spectrum of buyers—it nonetheless provides a direct, binary test on market situations. The Glassnode metric differentiates between the median transaction volumes of small entities and the typical transaction volumes of huge entities to disclose tendencies that point out potential shifts available in the market.

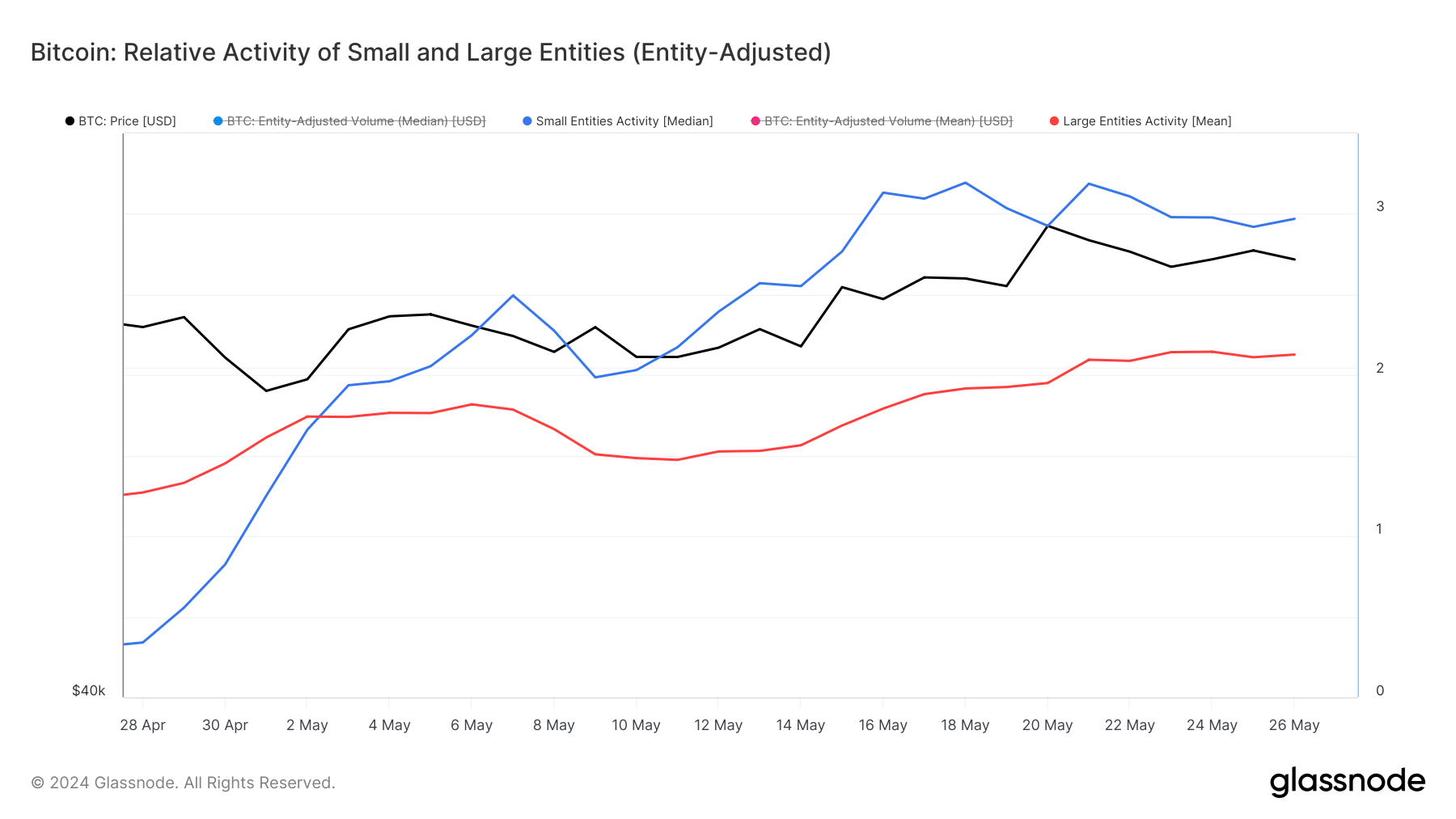

Since Might 3, the extent of exercise of small accounting entities, represented by medium transaction volumes, has constantly exceeded that of huge accounting entities.

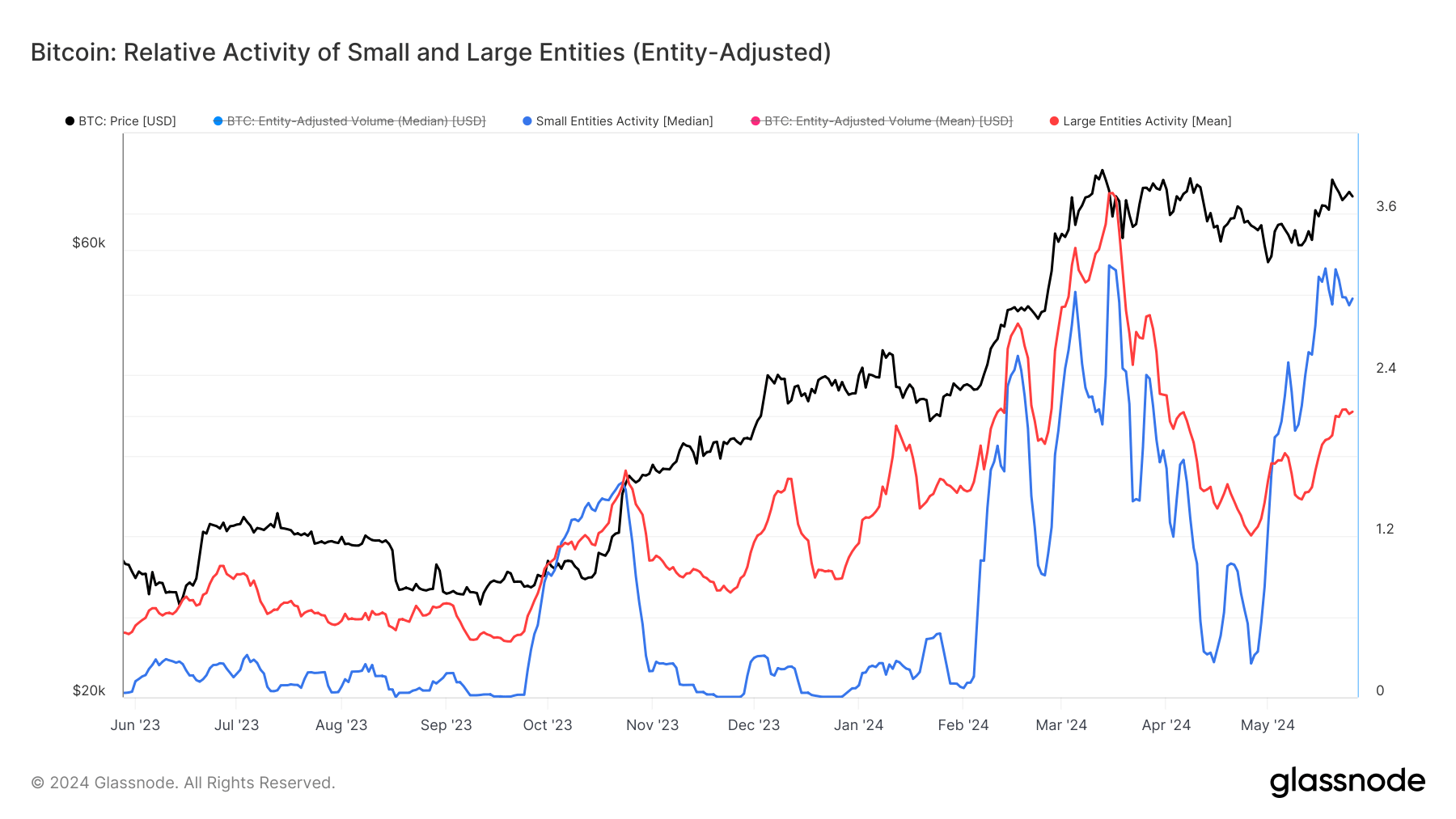

The unevenness in transaction volumes, the place the typical transaction dimension (imply) is bigger than the everyday transaction dimension (median), signifies that many small transactions happen ceaselessly. This sample is typical of the Bitcoin markets and exhibits a powerful involvement of retail buyers who typically make smaller trades. When the exercise of small entities is increased than the exercise of huge entities, it often signifies that the market is pushed by the joy and hypothesis of small buyers, which frequently happens in the beginning of a bull market. Alternatively, if this exercise decreases, it might point out that retail curiosity is waning and the market could stabilize or consolidate.

On Might 18, the typical transaction quantity of small entities reached a peak exercise ratio of three.194, whereas the typical transaction quantity of huge entities was 1.916. This divergence signifies a a lot bigger base of smaller transactions, indicating elevated demand and speculative exercise amongst retail buyers.

The continued improve in small-cap exercise, particularly throughout vital value swings such because the $71,400 peak on Might 20, exhibits appreciable retail enthusiasm. Retail demand like this could usually improve market volatility as smaller buyers react to market adjustments extra rapidly than giant institutional gamers. Glassnode information for Might 26 additional confirms this development, with smalls sustaining a excessive exercise ratio of two.969 in comparison with larges' 2.127, regardless of the worth correction to $68,500.

Provided that that is the primary time that small-cap exercise has outpaced large-cap exercise since October 2023, it's secure to say that the market is turning into more and more bullish.

The elevated exercise amongst small entities suggests sturdy grassroots assist for Bitcoin's value actions, which might maintain upward momentum within the brief to medium time period. A decline in exercise by majors throughout this time could be a pink flag, as markets pushed totally by retail hypothesis are extremely unstable and liable to volatility.

Nevertheless, there may be additionally a gentle improve within the exercise of huge entities. The inflow of huge buyers into the area, pushed largely by the recognition and availability of spot bitcoin ETFs within the US, retains exercise constantly excessive. The truth that small entities had a better stage of exercise previously month exhibits that a lot of the volatility got here from retail, whereas underlying development was pushed by establishments.

The publish Retail Exercise Dominates Bitcoin, Overshadows Institutional Strikes appeared first on fromcrypto.