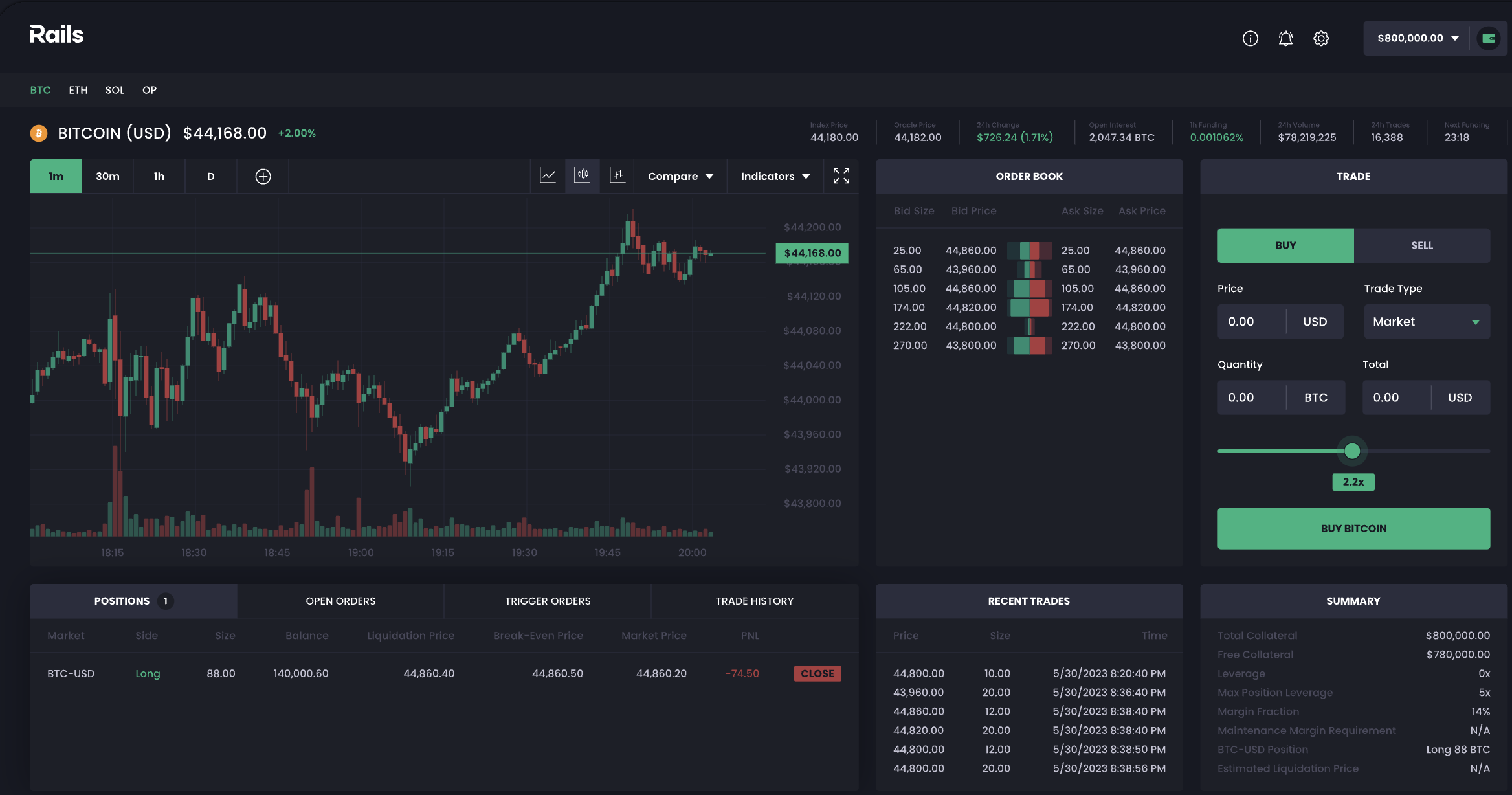

Rails, a decentralized crypto trade, has raised $6.2 million in an effort to fill the void left by the FTX crash in 2022, the startup’s co-founder and CEO Satraj Bambra solely advised fromcrypto. It’s at present within the early phases of launching an offshore service in choose crypto-friendly nations that don’t embody the US.

The crypto neighborhood is following Rails because it seeks to bridge the hole in crypto exchanges by creating each a centralized and decentralized underlying expertise.

The spherical was led by Gradual Ventures with investments additionally from CMCC World, Round13 Capital and Quantstamp. The capital is being earmarked for hiring an engineering staff and increasing its licensing and regulatory technique to convey the trade “absolutely compliant,” Bambra mentioned.

Whereas FTX had quite a lot of issues, particularly the abuse of buyer deposits, Rails emphasizes the safety of its buyer deposits, in addition to the crypto derivatives or perpetual futures facet of buying and selling; one thing establishments have lacked because the demise of the Sam Bankman-Fried trade.

“There is a massive hole, particularly on the perpetual (future) facet with how establishments like to show themselves,” Bambra mentioned. He co-founded the corporate along with his spouse Megha Bambra and former Grindr COO Rick Marini. The husband-and-wife staff beforehand co-founded a startup, cryptocurrency pockets BlockEQ, which was offered to crypto buying and selling platform Coinsquare in 2018 for roughly CAD 12 million, or $8.8 million.

Bambra shared that he has heard from edge funds that they need to commerce cryptocurrencies however haven’t got a approach to do it; Rails hopes this shall be a gap. Its primary clientele shall be market makers on the availability facet and primarily institutional shoppers and excessive web value traders on the demand facet.

For context, perpetual futures contracts commerce relative to the spot value. So, for instance, individuals do not buy bitcoin itself, however purchase contracts that replicate the worth by one other asset, such because the USDC stablecoin. “It helps you play the course of the market in a a lot riskier approach, which is why we’re specializing in that,” Bambra mentioned.

And often, traders and customers alike belief banks, monetary establishments and exchanges to carry their funds, however Rails goes the self-managed route, which suggests the proprietor of the property has full management over them.

Rails has already raised north of $10 million in capital “in a personal method” earlier than it goes public in September or the fourth quarter of this 12 months, Bambra mentioned. In Could, it can open its trade to pick beta testing recipients to start out buying and selling and guarantee it really works correctly.

Thanks for the images: Rails (opens in a brand new window)

The startup’s trade isn’t accessible within the US, and Bambra mentioned it’s “nonetheless contemplating the place it is going to be” and could have a solution nearer to September. “The primary capital shall be from pleasant jurisdictions.” When requested which of them, he mentioned “there are no to share at this level.”

“We simply need individuals to make use of their cash, and that is why we’ve got decentralized custody,” Bambra mentioned. “It is a marriage between a central pc and decentralized administration.”

Central computing helps handle threat administration so commerce orders can have a dependable and well-managed surroundings that makes execution fast and swift, he added. Nonetheless, decentralized custody permits individuals to personal their funds, not the trade.

“All the pieces is targeted on the consumer expertise. With Rails, you log in and register, however we’ll be educating individuals on have funds on (crypto)wallets and withdraw them,” amongst different issues.

Bambra thinks there have to be an on-chain answer to unravel the FTX downside. He noticed this centralized Rails computing system as “actually, actually good” with FTX, however when it got here to decentralized exchanges like dYdX that exist right this moment, it wasn’t as strong, Bambra thinks.

However being a hybrid of decentralized and centralized is best than being absolutely on one facet or the opposite, he added. “It is tough and cumbersome for individuals who have not traded crypto but who need to. Individuals who commerce with them day in and day trip usually are not comfy placing the dimensions they used to place into decentralized exchanges.”

And customers will really feel a “centralized” expertise with out realizing that “all the things however your cash is decentralized,” Bambra mentioned. All executions shall be centralized, however the cash is held in good contracts, a self-executing motion on the blockchain that requires no intermediaries and shall be audited.

So the staff goals to bridge the hole between central computing and decentralized asset administration by cryptography and blockchain expertise to supply computerized visible details about what is definitely being executed on the trade and with funds.

After an anticipated public launch later this 12 months, Rails needs to deal with increasing its social options, leaderboard capabilities, and partnering with business gamers to broaden the product. “We’re very product-oriented,” Bambra mentioned. “We’re not an opportunistic startup.