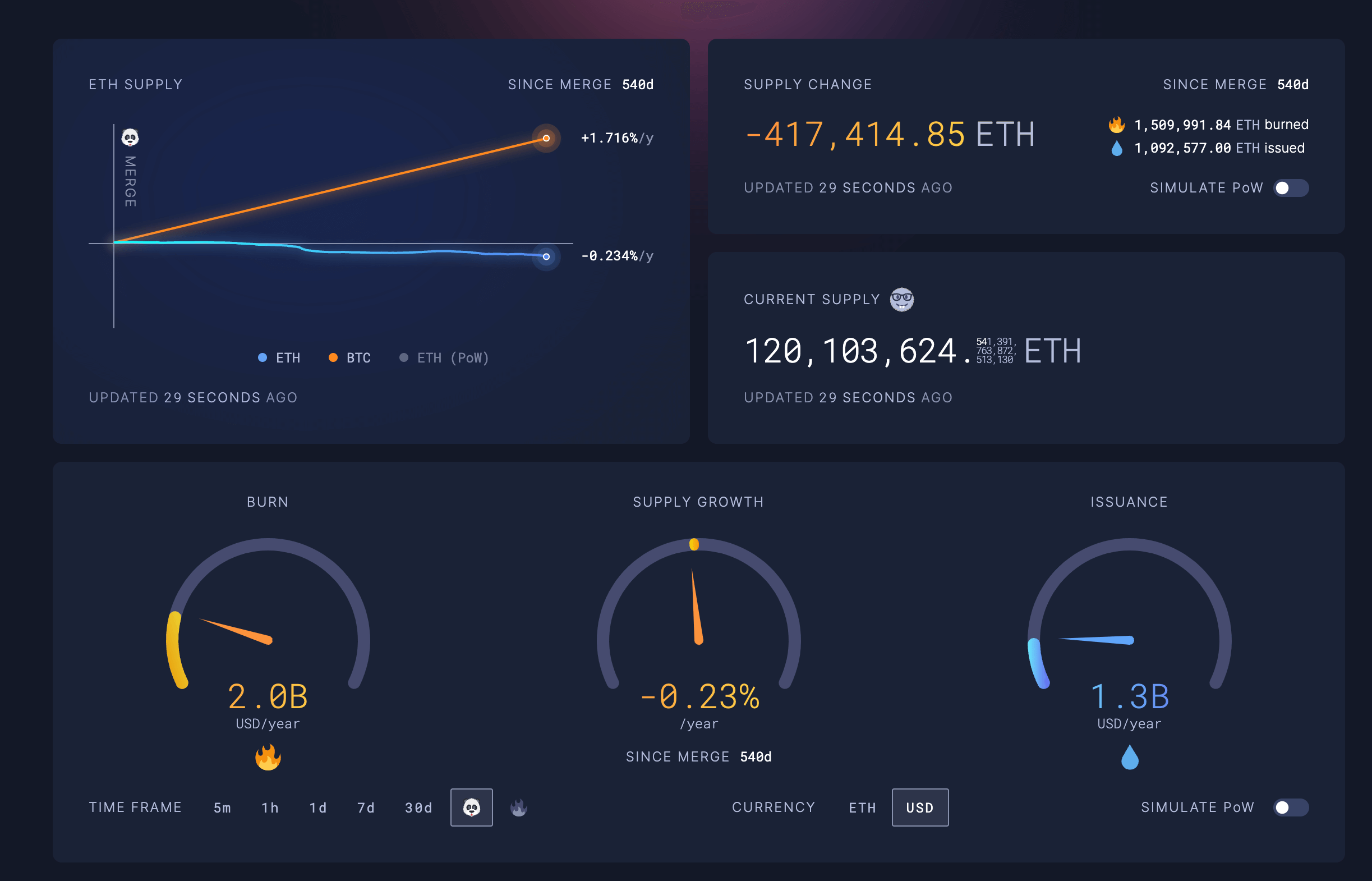

The Ethereum community has seen its provide lower by 417,413 ETH since switching to a Proof-of-Stake (PoS) consensus mechanism in September 2022, in accordance with knowledge from ultrasound.cash. Within the 540 days for the reason that merge, 1,509,991 ETH have been burned whereas the community has issued 1,092,578 new ETH, leading to a web lower.

At press time, the market worth of delisted ETH was $1,653,797,635, representing an annual inflation fee of -0.23%.

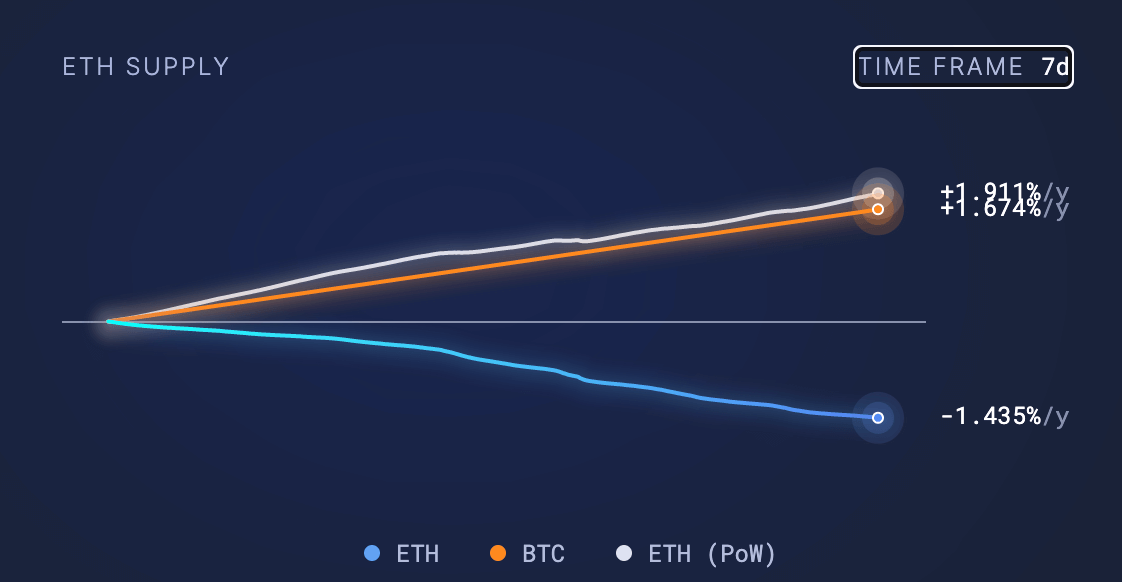

In distinction, Bitcoin provide elevated by 1.716% over the identical interval. This highlights the divergent financial insurance policies of the 2 largest cryptocurrencies as Bitcoin maintains a predictable emission schedule. On the identical time, the stability between staking rewards and burning transaction charges now determines the change in Ethereum provide.

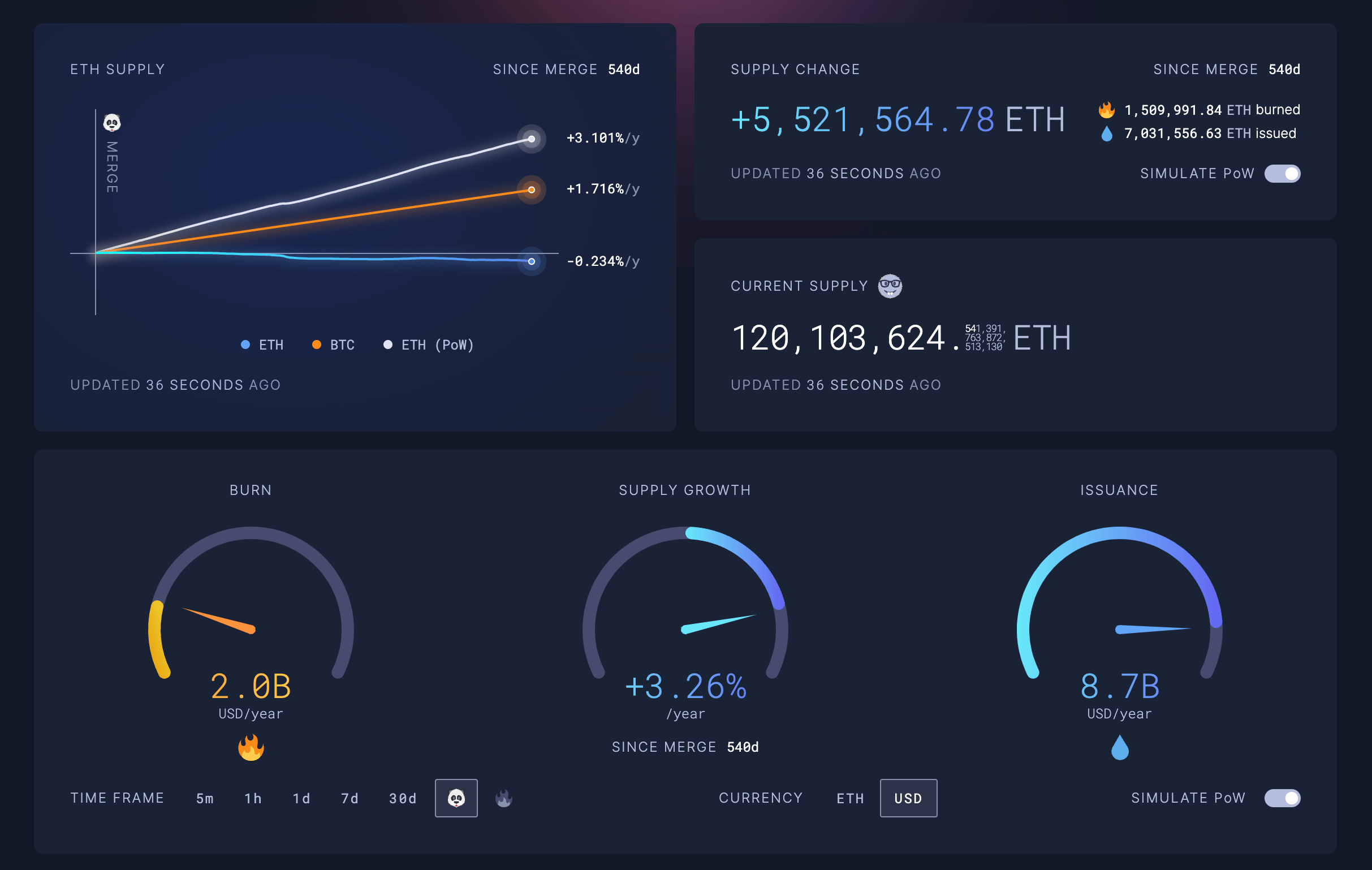

A Proof-of-Work (PoW) simulation on the ultrasound.cash dashboard exhibits that Ethereum’s provide would have elevated by greater than 5.5 million ETH throughout the identical interval if the community had not been transformed to PoS. In response to the PoW mannequin, the simulation means that 7,031,556 ETH could be issued with the identical burn fee of 1.5 million ETH, leading to a web improve of 5,521,564 ETH from The Merge. The worth of ETH issued on this simulation could be $21,865,393,440, representing a theoretical inflation fee of three.26%.

The stark distinction highlights the deflationary impression of Ethereum’s new consensus design in comparison with its earlier mining-based system. The transfer to PoS has significantly diminished the issuance of latest ETH, as validators staking ETH now safe the community as a substitute of PoW miners. This shift, mixed with the continuing burning mechanism launched in EIP-1559, has put downward strain on Ethereum’s provide.

In response to real-time knowledge, the overall circulating provide of Ethereum is at the moment 120,103,624 ETH. In the meantime, the PoW simulation estimates that the availability would attain 125,625,188 ETH if miners had been nonetheless powering the community in accordance with the outdated mannequin.

The discount in provide since The Merge is according to the Ethereum group’s imaginative and prescient to make ETH a deflationary asset over time, deviating from Bitcoin’s mounted inflationary schedule. Proponents imagine {that a} mixture of staking rewards and burning charges will proceed to offset new issuance, which can result in intervals of web adverse provide change.

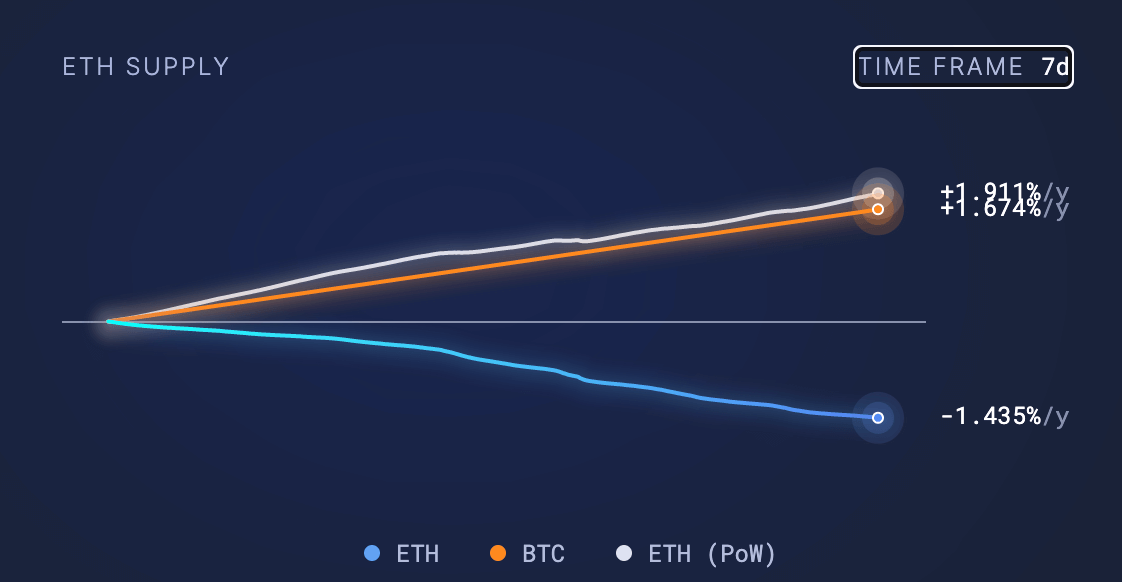

Over the previous seven days, rising ETH community charges have facilitated a rise in deflationary conduct as they rose to -1.435%. Moreover, even underneath PoW, its inflation fee would drop to 1.911% as a result of spike in community exercise and its correlation with the burn mechanics.

Nevertheless, critics argue that the transfer to PoS has centralized management of the community within the fingers of main entities and exchanges. Some warn that the focus of ETH staked might undermine Ethereum’s decentralization and safety ensures, not like Bitcoin’s extra distributed mining community.

As Ethereum continues to evolve underneath its new PoS regime and Bitcoin maintains its established PoW mannequin, observers shall be watching intently to see how their respective provide dynamics and safety trade-offs evolve. With Bitcoin’s issuance roughly at half as a result of upcoming halving, its inflation fee will drop to 0.8%, which is inside 1% of Ethereum. Nevertheless, Bitcoin has a set provide and can ultimately have zero inflation. Ethereum’s inflation fee is tied to community exercise and the quantity burned via community transactions.

Nonetheless, the deflationary pattern in ETH over the previous 540 days affords an early have a look at the potential way forward for the 2 largest cryptocurrencies forward of The Merge’s first bitcoin halve. The long-term sustainability and implications for each networks stays to be seen, with Bitcoin at the moment thriving with a market cap of $1.3 trillion and Ethereum subsequent at $478 billion.