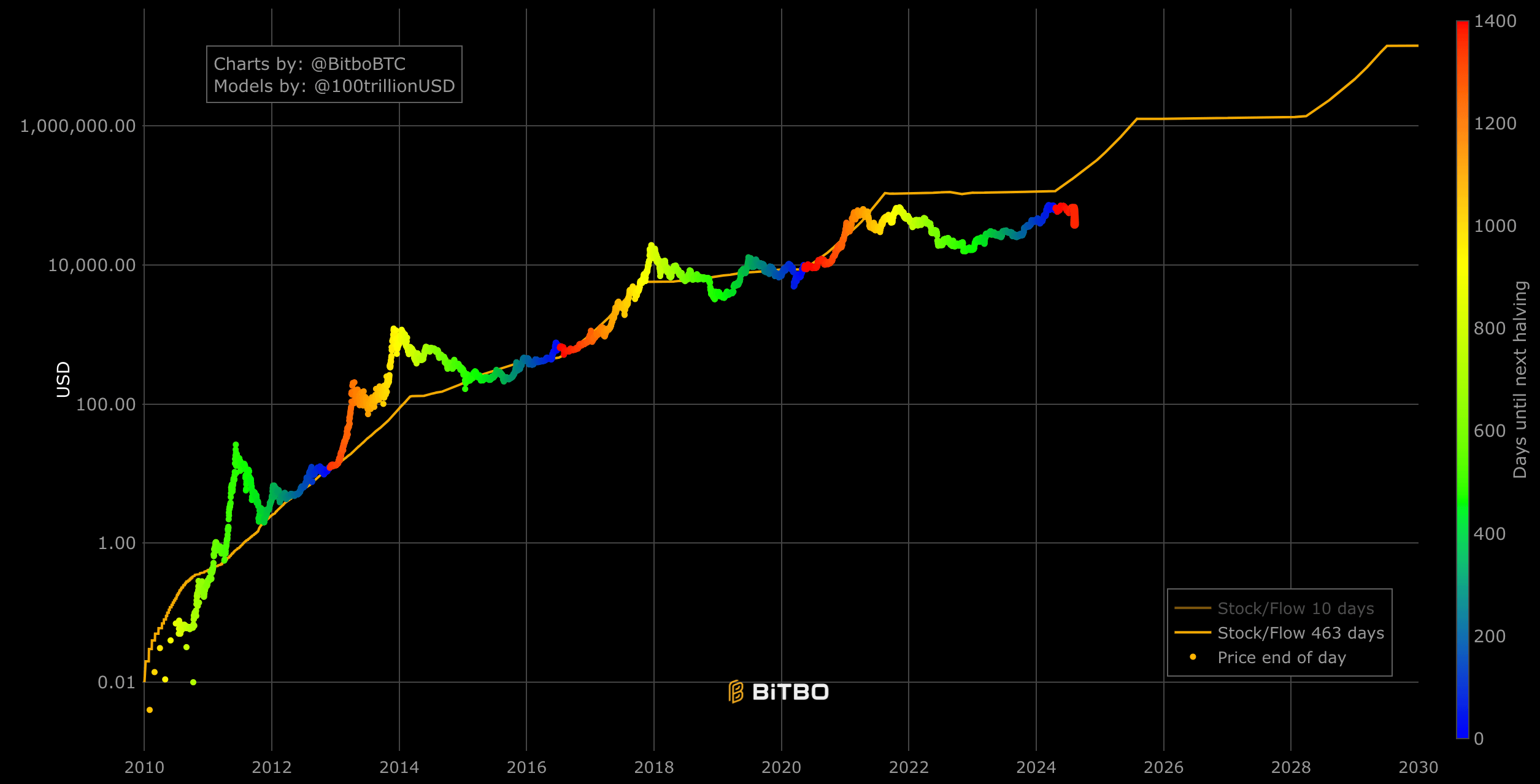

PlanB's Inventory-to-Circulation (S2F) mannequin, identified for predicting the value of Bitcoin primarily based on shortage, has confronted scrutiny as the worth of the digital asset has remained beneath the mannequin's expectations since 2021. The S2F mannequin, which correlates the rising shortage of Bitcoin as a consequence of a halving occasion with the value via valuation, they proposed a considerably increased worth than the precise market worth over the previous few years. Based on the most recent information, this distinction has reached roughly $130,000, elevating questions concerning the reliability of the mannequin within the face of unpredictable market circumstances. The mannequin presently predicts a worth round $180,000, whereas Bitcoin stays simply above $50,000.

The S2F mannequin works on the precept that because the stream of latest bitcoins decreases, the prevailing shares turn into extra helpful, thereby rising the value. Till 2021, this sample has traditionally been in step with vital worth actions, significantly round halving occasions. Nonetheless, the sustained divergence noticed since 2021 suggests a departure from this sample.

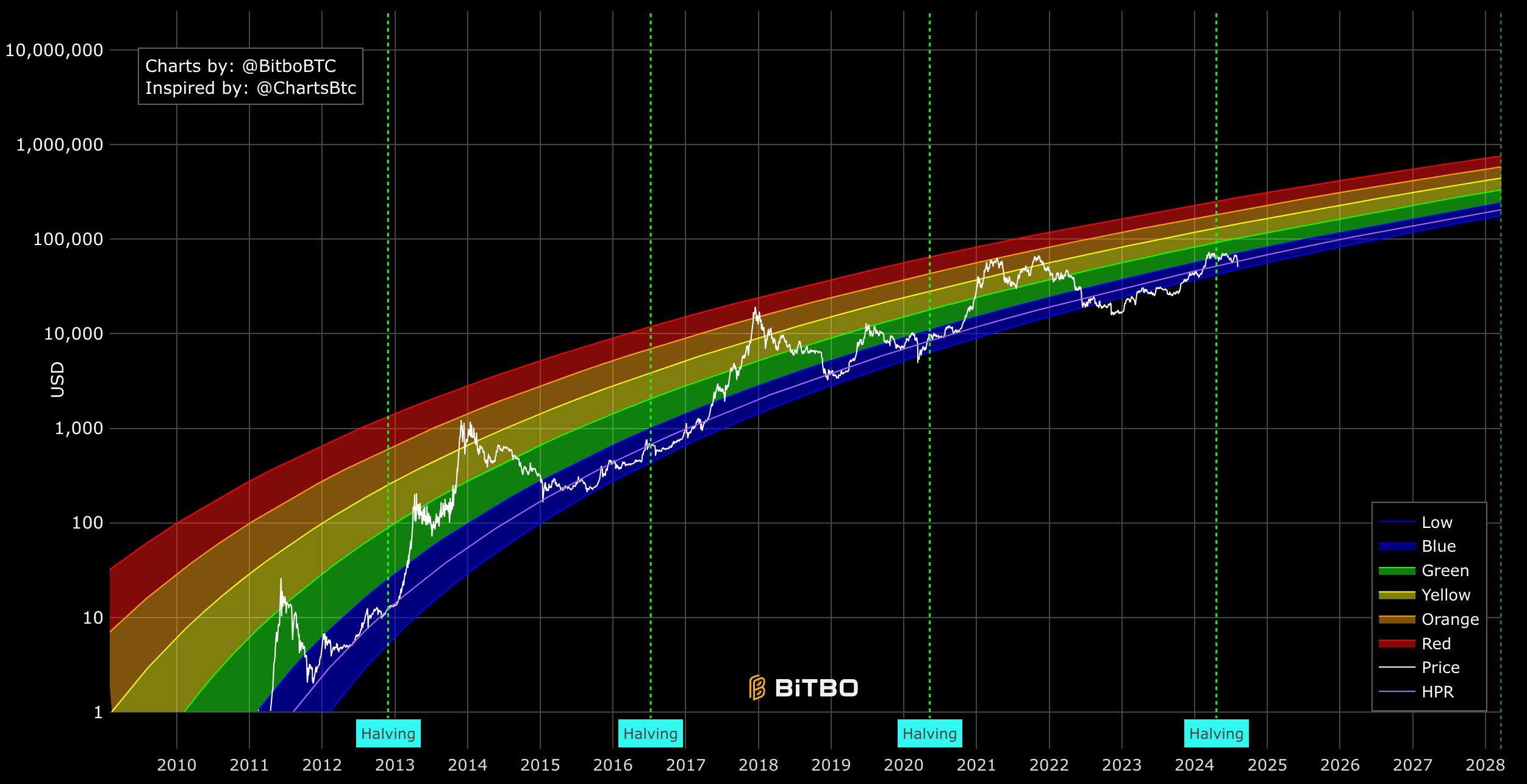

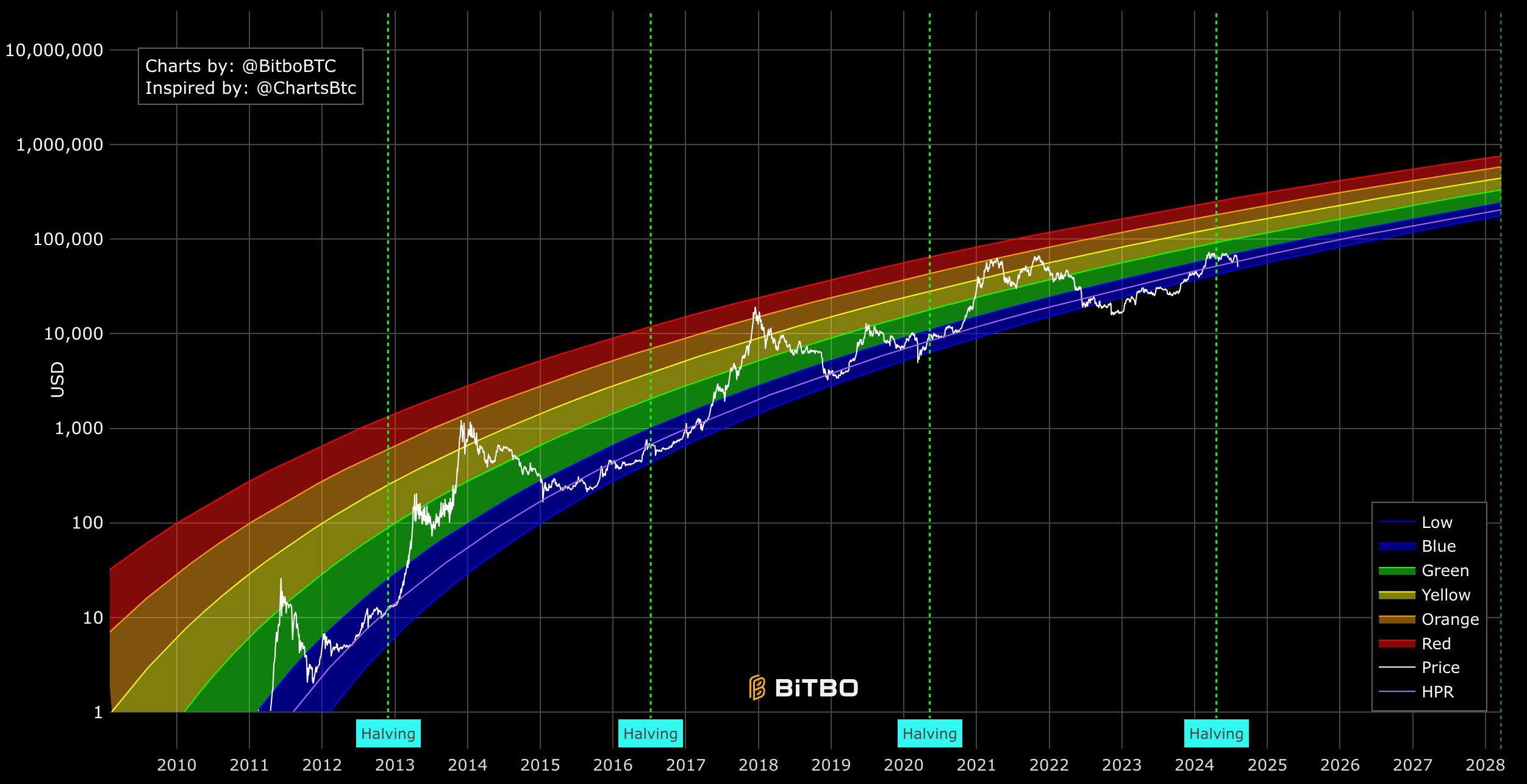

In contrast to the S2F mannequin, different analytical instruments such because the Rainbow Worth Chart and the Energy Legislation Mannequin present totally different views on the valuation of Bitcoin. The rainbow chart, which categorizes worth ranges by market sentiment bands from “Low” to “Excessive”, reveals Bitcoin primarily buying and selling in average bands from 2022. This implies a interval of secure development with out reaching speculative peaks that the S2F mannequin would possibly overestimate. Bitcoin is transferring in direction of the decrease boundary of the rainbow chart, which it broke throughout 2022 and 2023. At $50,000, Bitcoin is $220,000 beneath its higher boundary.

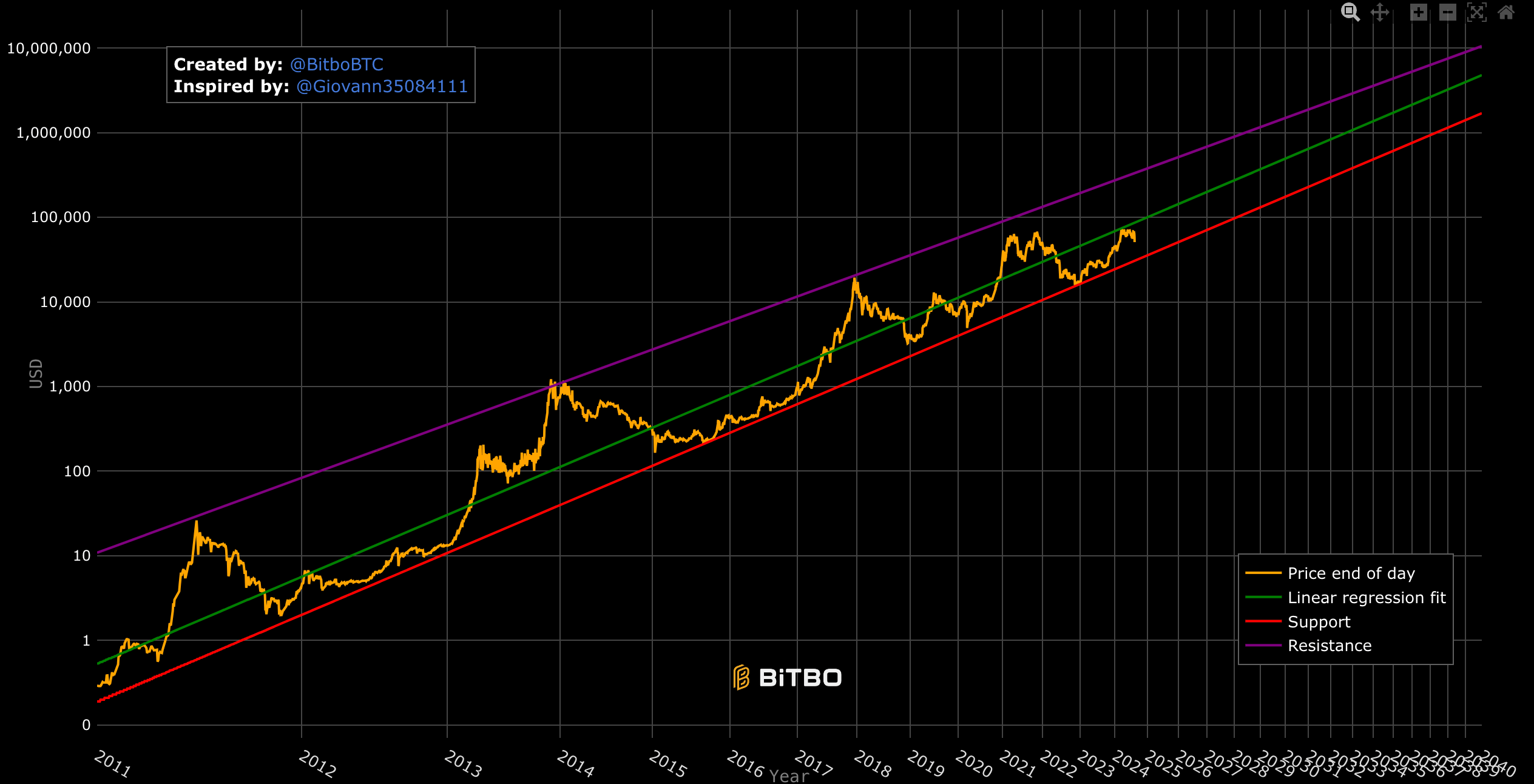

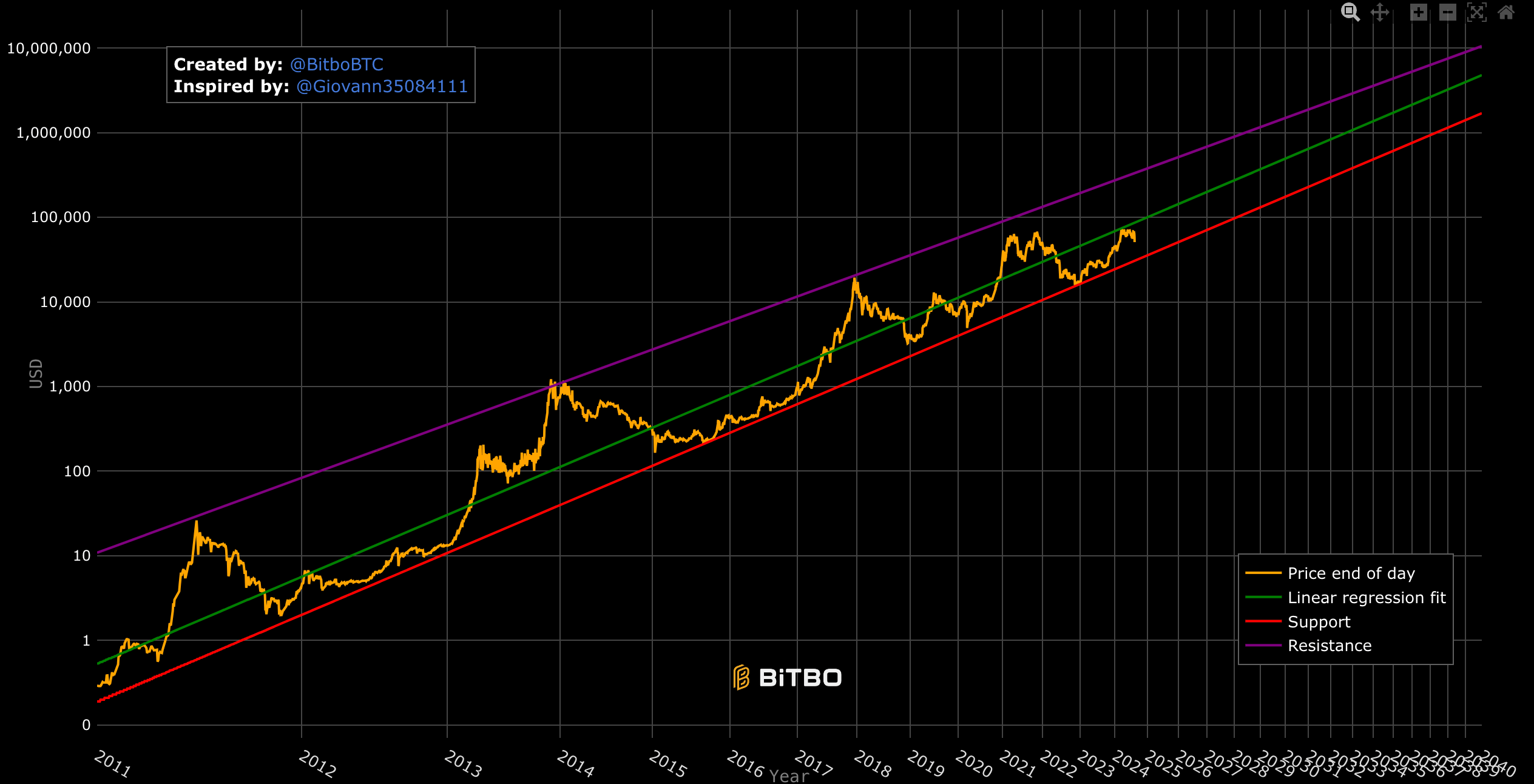

An influence mannequin is a statistical mannequin that describes relationships between portions the place one amount varies as an influence of one other. The Bitcoin Energy Legislation Mannequin refers back to the relationship between worth and time. It initiatives a long-term worth channel with outlined assist and resistance ranges. Bitcoin's latest worth actions have extra intently adhered to the projections of this mannequin, sustaining an upward trajectory inside the channel, however usually encountering higher-level resistance.

Based on the facility legislation mannequin, Bitcoin remains to be properly inside regular limits and solely $40,000 beneath the regression match or honest worth.

These discrepancies spotlight the complexity of predicting the value of Bitcoin. Whereas the S2F mannequin has been a well-liked framework for predicting market developments, its perceived shortcomings counsel that it could not absolutely account for the varied and dynamic components affecting bitcoin's worth. The deviation of as much as $130,000 from the mannequin forecast illustrates the necessity for a extra detailed understanding of market forces, together with the influence of investor sentiment, expertise developments and broader financial circumstances. Moreover, the facility legislation that additionally seems in nature and different man-made phenomena seems to be extra in step with Bitcoin, a forex instantly correlated with its vitality consumption.