Bitcoin set a brand new all-time excessive and broke above $72,000, a major milestone for the market. Driving a wave of elevated institutional curiosity within the spot bitcoin ETF, it broke by way of the $68,000 ceiling set for November 2021 after a quick correction to $59,000 and seems poised for additional positive aspects this week.

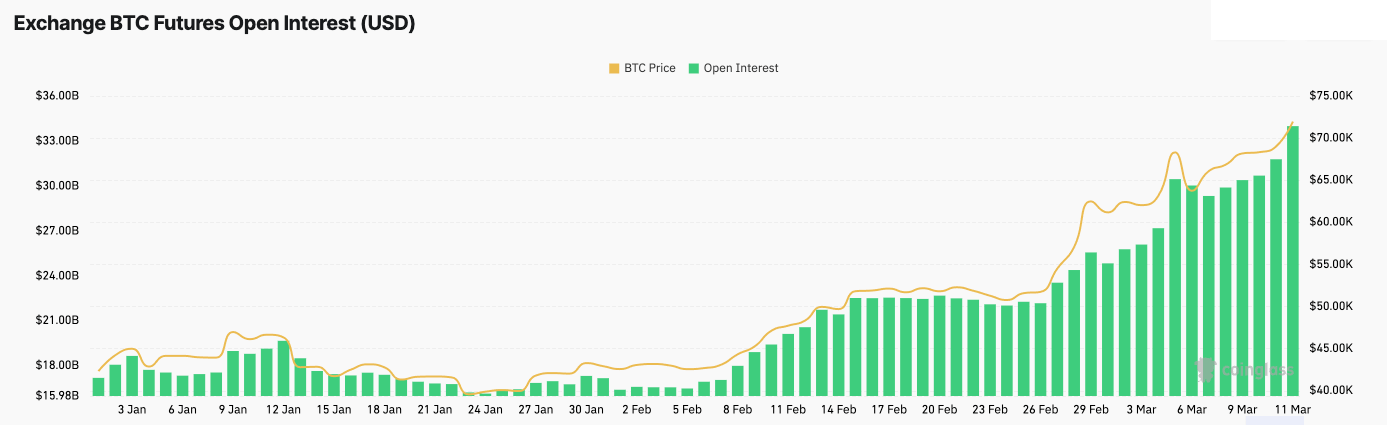

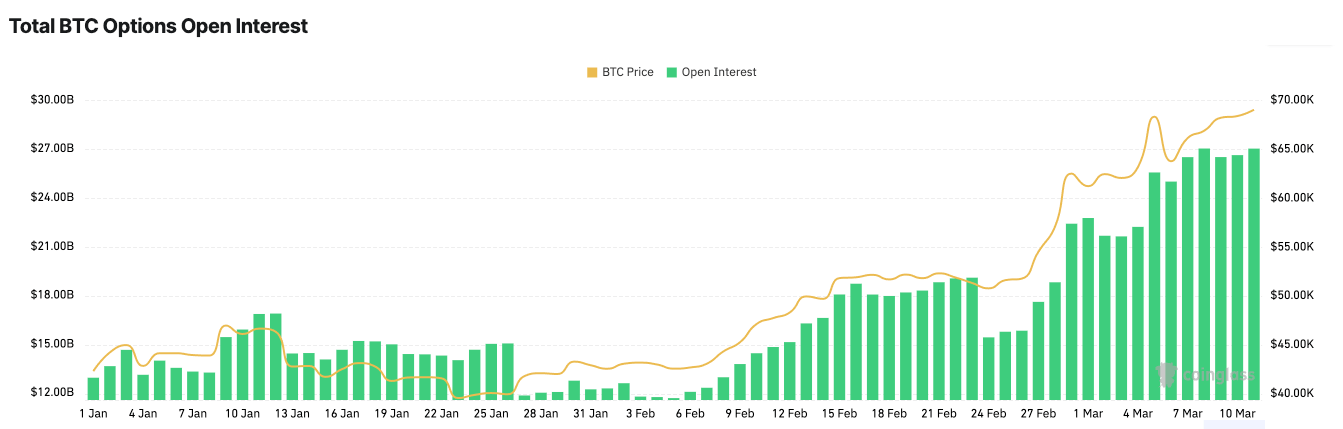

This week sees the potential for extra volatility within the derivatives market, which peaked when Bitcoin touched $71,400. Because the starting of the yr, Bitcoin futures and choices markets have seen unprecedented development, with open curiosity reaching new highs on March 11. Open curiosity evaluation is important to understanding market situations and merchants’ expectations. Whereas spikes in open curiosity all the time comply with value volatility, spike depth generally is a telltale signal of how leveraged the market is.

Futures open curiosity hit an all-time excessive of $33.48 billion within the morning hours of March 11 — almost double the $17.20 billion it posted on January 1.

Open curiosity in choices hit an all-time excessive on March 8 at $27.02 billion. A foothold above $27 billion seems to have been established, with open curiosity holding regular at $27.01 by way of March 11. This can be a important improve from the $12.93 billion in open curiosity at first of the yr.

The expansion in open curiosity exhibits a quickly rising curiosity in derivatives. Futures and choices present merchants with subtle methods that enable them to hedge their positions and speculate on value actions.

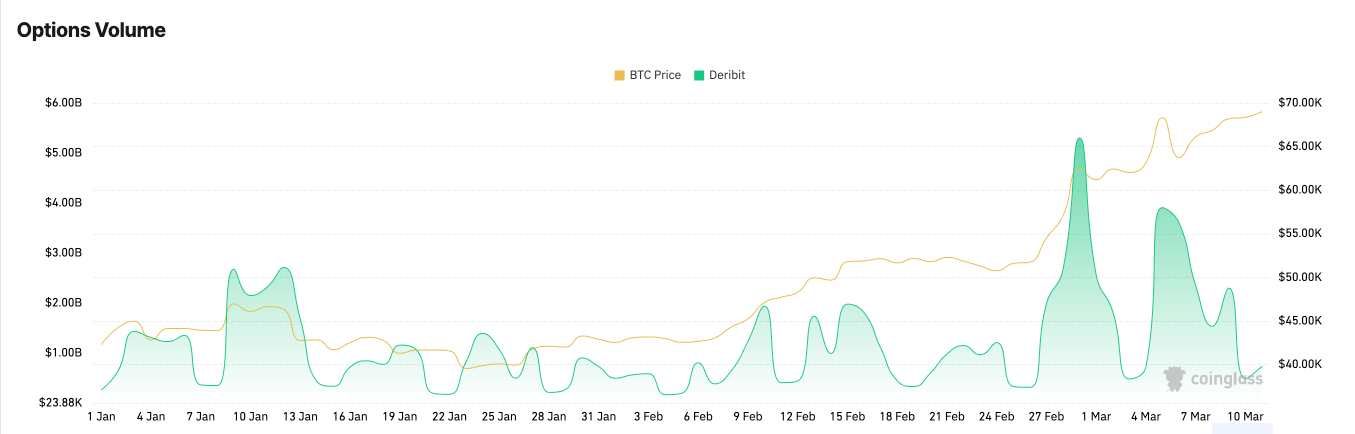

The dominance of name choices with open curiosity and quantity percentages constantly favoring calls over places (61.66% vs. 38.34% for open curiosity and 59.43% vs. 40.57% for quantity) exhibits an overwhelmingly bullish outlook amongst merchants. Because of this many of the market is speculating on additional value will increase.

Vital spikes in choices quantity on Deribit round key dates reveal the reactive nature of the derivatives market to Bitcoin value actions. Knowledge from CoinGlass confirmed important spikes in quantity on February 29 ($5.30 billion) and March 5 ($3.91 billion), correlating with intervals of intense value volatility.

Bitcoin breaking by way of vital resistance ranges performed a key position on this rise. Every resistance level crossed new ranges of market optimism and triggered elevated buying and selling exercise because the market adjusted its positions to benefit from bullish momentum or shield in opposition to a possible draw back.

The fast improve in curiosity in derivatives led to a convergence of open curiosity in futures and choices. Whereas OI futures and choices have but to achieve parity, the unfold between them is at present at an unprecedented low. Traditionally, open curiosity in futures has been considerably increased than in choices as a result of futures present a direct mechanism for hedging and hypothesis with out the complexity of possibility methods.

Nonetheless, Bitcoin’s efficiency this yr appears to have attracted many superior merchants who’re searching for extra versatile buying and selling methods than futures. Choices are thought of extra subtle buying and selling devices that enable merchants to hedge their positions, speculate on value actions with restricted draw back danger, and generate revenue by way of methods comparable to lined calls and protecting places. As traders grow to be extra educated and assured in utilizing choices, demand for these devices will increase, resulting in a rise in open curiosity.

Furthermore, present market situations – excessive volatility and document costs – make choices significantly enticing. Choices can present leverage just like futures, however with the additional benefit of predetermined purchaser danger. In a quickly appreciating market, choices enable traders to invest on continued development or hedge in opposition to a possible decline with out committing as a lot capital as is required for a futures place.

Balancing open curiosity in futures and choices additionally suggests the market is at a crossroads, with traders’ outlook divided. Whereas some might view the present value degree as sustainable and indicative of additional development, others might view it as extreme, requiring warning and utilizing danger administration choices.

The implications for future value actions are twofold. On the one hand, robust derivatives exercise factors to a wholesome market with excessive liquidity and complex contributors, probably supporting additional value development. However, a excessive diploma of leverage drastically will increase the dangers of market corrections – with derivatives value tens of billions on the road, even minor attracts have the potential to show into huge volatility.

The submit Open Curiosity Hits All-Time Excessive As Bitcoin Hits $72,000 appeared first on fromcrypto.