Bitcoin's buying and selling hours have surpassed these of the trendy US fiat inventory market for the reason that Nixon Shock, however it will be untimely to say that it surpasses the whole historical past of US inventory buying and selling or fiat globally. Nearer examination reveals a extra nuanced image of market longevity and buying and selling exercise.

The crypto group has just lately been buzzing with statistics highlighting how Bitcoin has amassed extra buying and selling hours than the fiat inventory market following an evaluation by Cory Bates.

Bates identifies how bitcoin buying and selling has now outperformed the fiat inventory market, however you will need to word that this doesn’t characterize the whole historical past of the US inventory market. Nonetheless, it may be inferred that Bitcoin buying and selling predates fiat buying and selling within the US. Nonetheless, it isn’t globally older than fiat.

The earliest identified use of fiat foreign money was in China through the Music Dynasty (960-1279 CE). The federal government issued paper cash not backed by bodily commodities corresponding to gold or silver. This foreign money was initially supported by authorities credit score and have become extensively accepted for commerce and taxation.

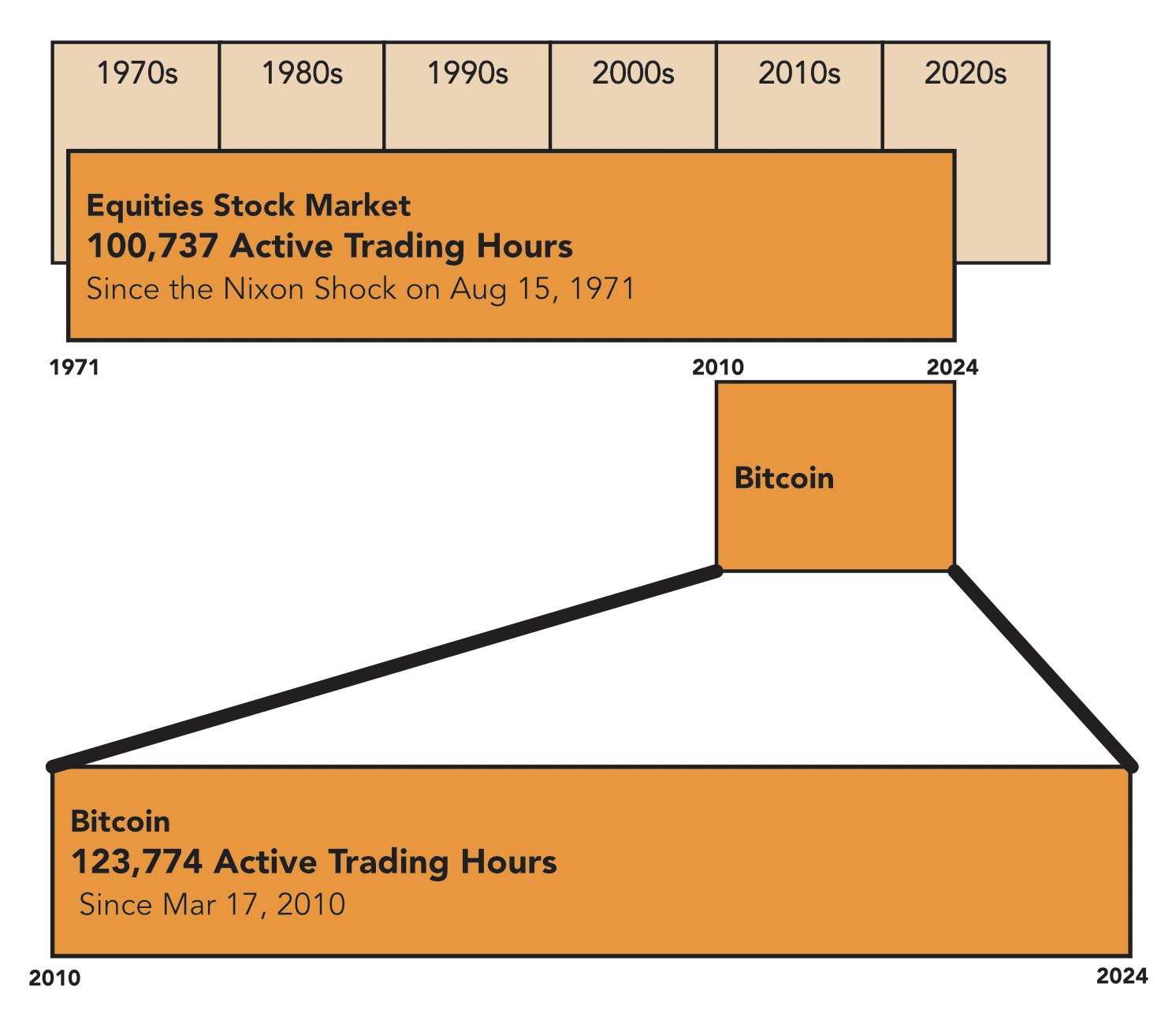

Bitcoin buying and selling hours vs US fiat inventory market

Launched in 2009, Bitcoin has amassed 123,774 energetic buying and selling hours since its first recorded commerce on March 17, 2010. This surpassed the 100,737 hours recorded by US inventory markets since August 15, 1971 – the date of the Nixon Shock, which marked a significant shift in world monetary programs via the removing of the gold customary.

Nonetheless, the historical past of the US inventory market goes again far past 1971. Based in 1792, the New York Inventory Change has a heritage spanning greater than two centuries. Once we think about all of this historical past, the image adjustments dramatically.

Calculations primarily based on the NYSE's inception date reveal roughly 380,509 energetic buying and selling hours by September 6, 2024. This quantity exceeds Bitcoin's present stability regardless of the digital asset's 24/7 buying and selling schedule.

Bitcoin's 24/7 availability provides it a major benefit in accumulating buying and selling hours. The normal inventory market operates on a extra restricted schedule, sometimes 6.5 hours a day, 5 days every week, excluding holidays.

Because of the steady buying and selling of Bitcoin, projections recommend that it’s going to take till round April 15, 2053 for the digital asset to truly exceed the entire buying and selling hours in the whole historical past of the US inventory market. This assumes that each markets will proceed to function based on their present schedules with out important disruptions.

Nonetheless, it’s essential to notice that buying and selling hours alone don’t absolutely seize market depth, liquidity or general financial influence. The U.S. inventory market stays a cornerstone of world finance, with a depth and breadth of listed corporations and buying and selling quantity unmatched by Bitcoin.

Whereas Bitcoin has made outstanding strides in its brief existence, the sheer weight of the century-long historical past of the US inventory market stays a formidable benchmark.

Full fiat cash buying and selling historical past

Bitcoin's journey, as quick as it’s, nonetheless has many years to go earlier than it might actually declare to have outlasted the cumulative buying and selling hours of the well-known US inventory markets. Additional, contemplating the declare that it has additionally outperformed fiat, international alternate markets have been accessible 24 hours a day on weekdays since 1971.

Estimating complete buying and selling hours for fiat foreign money globally presents a singular problem as a result of gradual historic adoption of fiat programs. Whereas fiat foreign money has been utilized in some type since historic China, trendy enterprise hours didn’t turn into constant till the twentieth century, particularly after the transition from the gold customary to the Nixon Shock of 1971.

Earlier than 1971, world enterprise hours had been localized, irregular, and assorted between areas. Though fiat programs turned extra frequent, there was no single world buying and selling market and exchanges operated with restricted hours of operation. Nonetheless, after 1971, the creation of the international alternate (foreign exchange) market turned a extra dependable benchmark for calculating buying and selling hours.

Trendy foreign currency trading right this moment operates roughly 120 hours every week (24 hours a day, 5 days every week). Utilizing this as a baseline, it may be estimated that since 1971, there have been roughly 6,240 hours of fiat buying and selling per yr. Over the 53 years from 1971 to 2024, that will be roughly 330,720 buying and selling hours for fiat in trendy world markets.

Briefly, whereas Bitcoin outperformed the post-1971 US fiat inventory market by way of buying and selling hours, the cumulative buying and selling hours of world fiat buying and selling for the reason that inception of organized world foreign exchange markets is considerably greater.

Thus, Bitcoin has not surpassed the entire world buying and selling hours of fiat currencies – neither by way of trendy foreign currency trading nor contemplating the deep historical past of fiat cash globally. Nonetheless, until main foreign exchange markets are open on weekends as nicely, Bitcoin might theoretically ultimately catch up. Nonetheless, some brokers permit restricted weekend buying and selling for the preferred foreign exchange pairs.