Bitcoin value trajectory in September appears to be like this at a essential secondand has the potential to develop in two very completely different instructions. After the closing of August on a bearish noticemain cryptocurrency continued present indicators of weak spot after the start of September. Within the early days of the month, Bitcoin has already entered bearish territory, a improvement that would sign an prolonged interval of capitulation for the remainder of the month. Nevertheless, taking into consideration that we’re speaking about BTC and we’re solely three days into September, we might see the crypto bounce again up someday in the course of the month.

Including to the hypothesis is a well known crypto analyst who goes by the moniker Titan of Crypto (@Washigorira) on social media and lately shared his ideas on the attainable final result of Bitcoin this month.

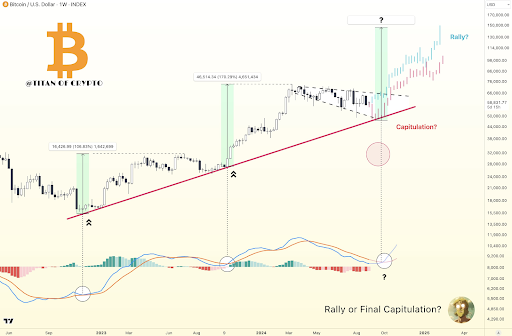

Bitcoin Trajectory in September

In keeping with his evaluationThere are two major situations that would play out for Bitcoin in September. The primary state of affairs envisages a rally that defies prevailing bearish expectations and surprises the market with an surprising improve. Nevertheless, the second state of affairs includes a last part of capitulation, the place Bitcoin might hit new lows earlier than making a major restoration within the final quarter of 2024.

This evaluation focuses on the Bitcoin/US Greenback (BTC/USD) chart noticed on a weekly timeframe. In keeping with @Washigorira's present chart setup, BTC has been following a value sample that carefully resembles a bullish increasing triangle since reaching its all-time excessive of $73,737 in March 2024. This specific sample is widely known for its bullish indicators. Regardless of the present short-term volatility, the long-term outlook for Bitcoin stays optimistic. Each situations famous by the analyst will in the end finish in a bull run for Bitcoin.

Within the first state of affairs, it’s Bitcoin anticipated to begin in September there was a major improve in costs. This surge could be sturdy sufficient to push the cryptocurrency above the higher trendline of the bullish increasing triangle that has served as sturdy resistance for months. If BTC efficiently breaks this resistance, the worth might probably obtain a full breakout, setting the stage for a brand new all-time excessive.

Associated: Crypto Analyst Predicts Shiba Inu Up 1,000% to $0.00014

As for the worth goal for this state of affairs, a full breakout will see BTC attain as excessive as $150,000 in Q1 2025. Curiously, this mirrors the upward rally it skilled in This autumn 2023, which in the end ended with the final all-time excessive in Q1 2024.

The second state of affairs represents a extra cautious outlookthe place Bitcoin continues to expertise the present capitulation part. This state of affairs assumes one other fall in Bitcoin in September, probably breaking decrease the $50,000 restrict. Such a decline might see BTC retest its August low of $49,800, a essential assist degree.

Nevertheless, this state of affairs doesn’t finish on a bearish notice. After this potential dip, Bitcoin is predicted to reverse its downtrend within the fourth quarter of 2024. This is able to then result in a bullish rally with a barely extra conservative value goal of $100,000.

On the time of writing, Bitcoin is buying and selling at $56,716.

Featured picture created by Dall.E, chart from Tradingview.com