Miners are the muse of the Bitcoin market. Their habits is among the finest indicators of market well being and can be utilized as a gauge for market sentiment.

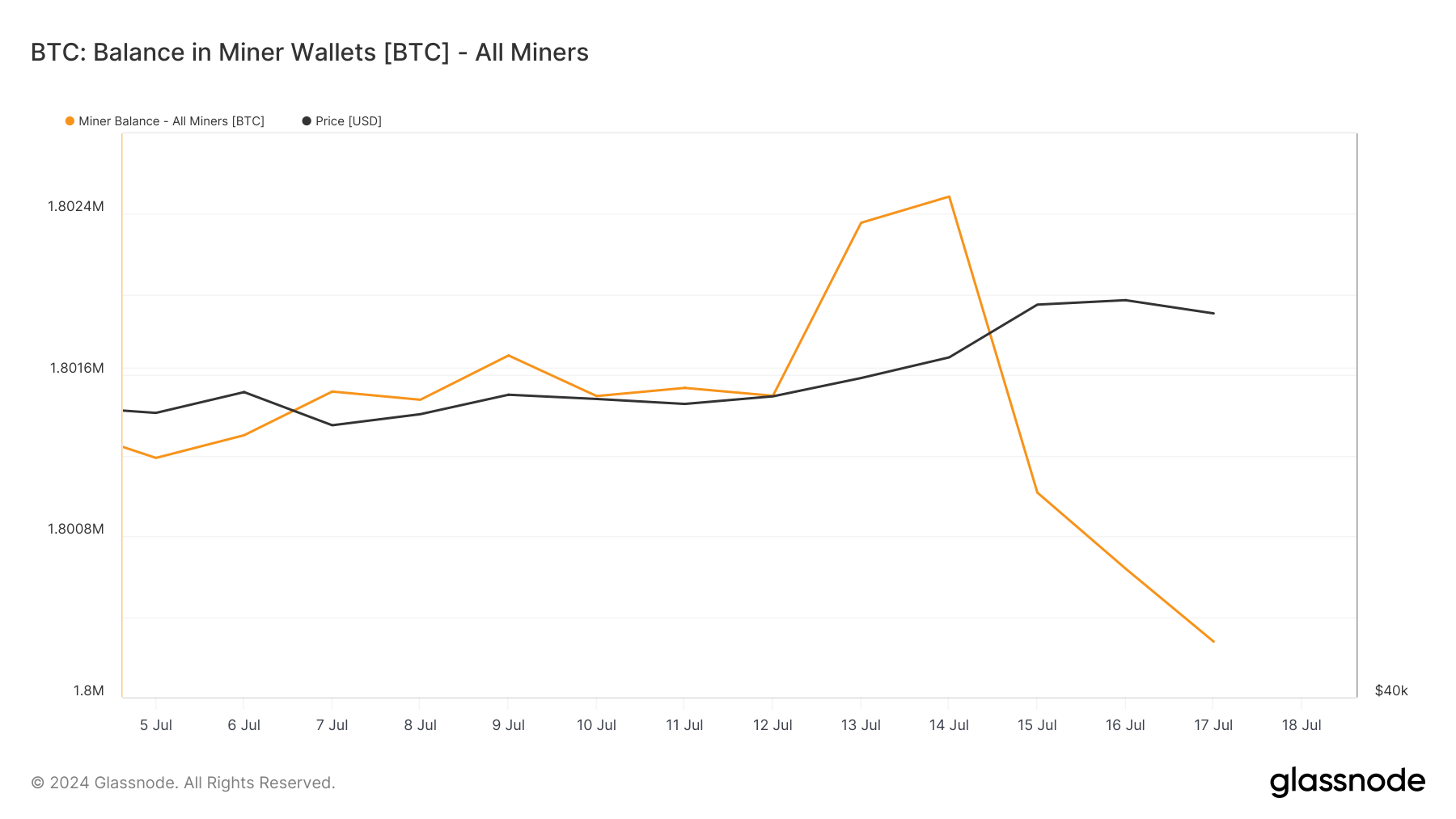

Miner balances mirror the entire quantity of BTC held by miners. They function one of many important indicators of promoting strain as they’re frequent sellers as a result of have to cowl working prices.

Nonetheless, miners are additionally competing to stay as worthwhile as doable, so that they often don’t promote or distribute their holdings if the worth of Bitcoin is simply too low. When miners maintain on to their BTC, it may be an indication of confidence in future value development. Conversely, when miners promote, it means they’re taking income whereas costs are excessive sufficient, or that they will anticipate the worth to drop.

Up to now week, miner balances have decreased by roughly 1,260 BTC. This discount continues a long-term development of lowering miner balances, which have been declining since October 2023. Present miner balances have reached ranges not seen since April 2019. And whereas the drop we've seen over the previous week isn't alarming, it does mirror a broader sample of miners step by step lowering their stake.

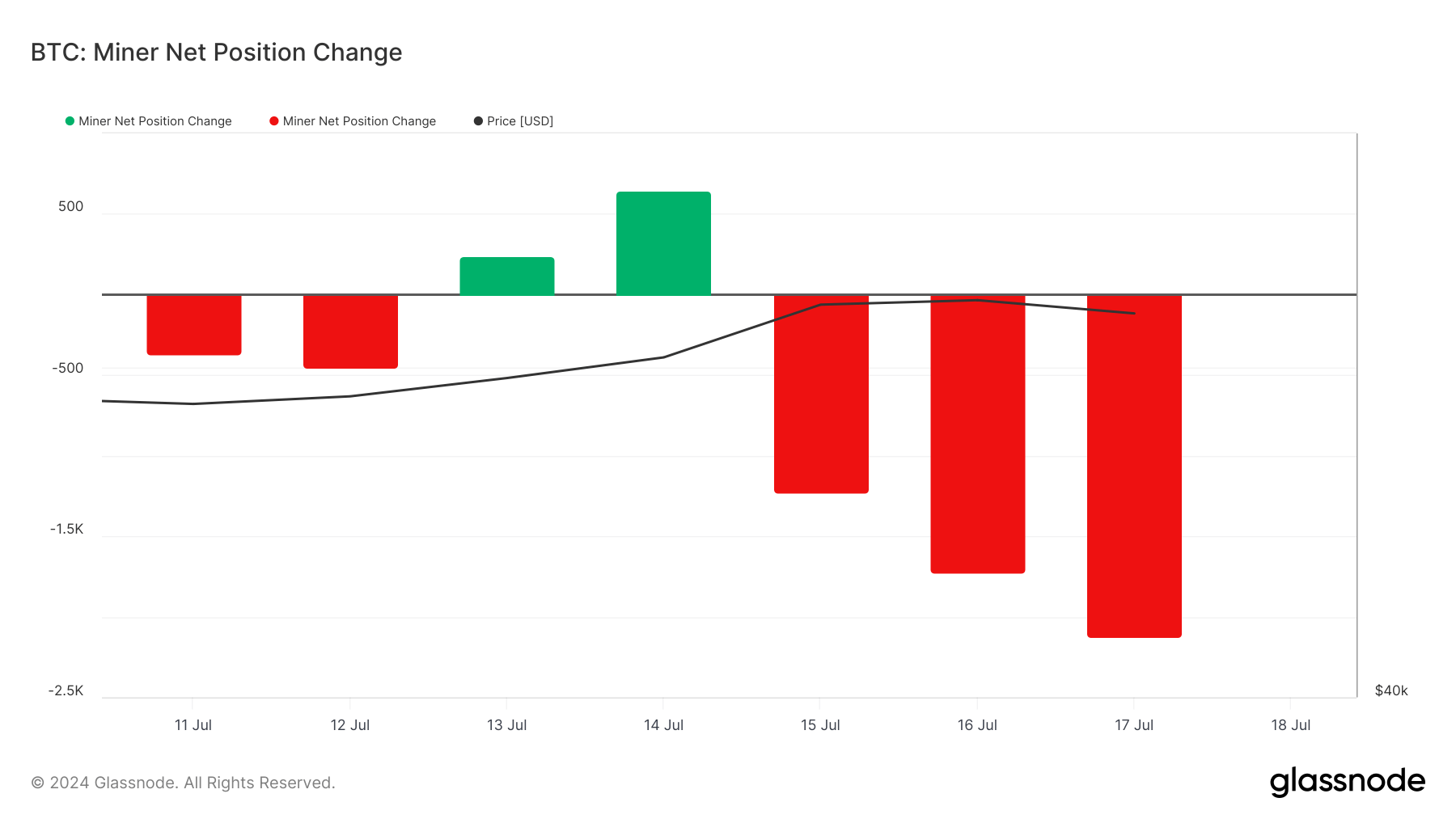

Wanting on the change in miners' web place, we see fluctuations over the previous week. After breaking the three-month development of web outflows on July thirteenth and July 14th, there have been web inflows of 241 BTC and 645 BTC respectively, indicating a short lived accumulation.

Important web outflows adopted, lasting till July 17, when miners bought 2,126 BTC. The surge in gross sales lately correlates with a big enhance within the value of Bitcoin, which peaked at $65,172 on July 16 and fell barely to $64,120 the next day.

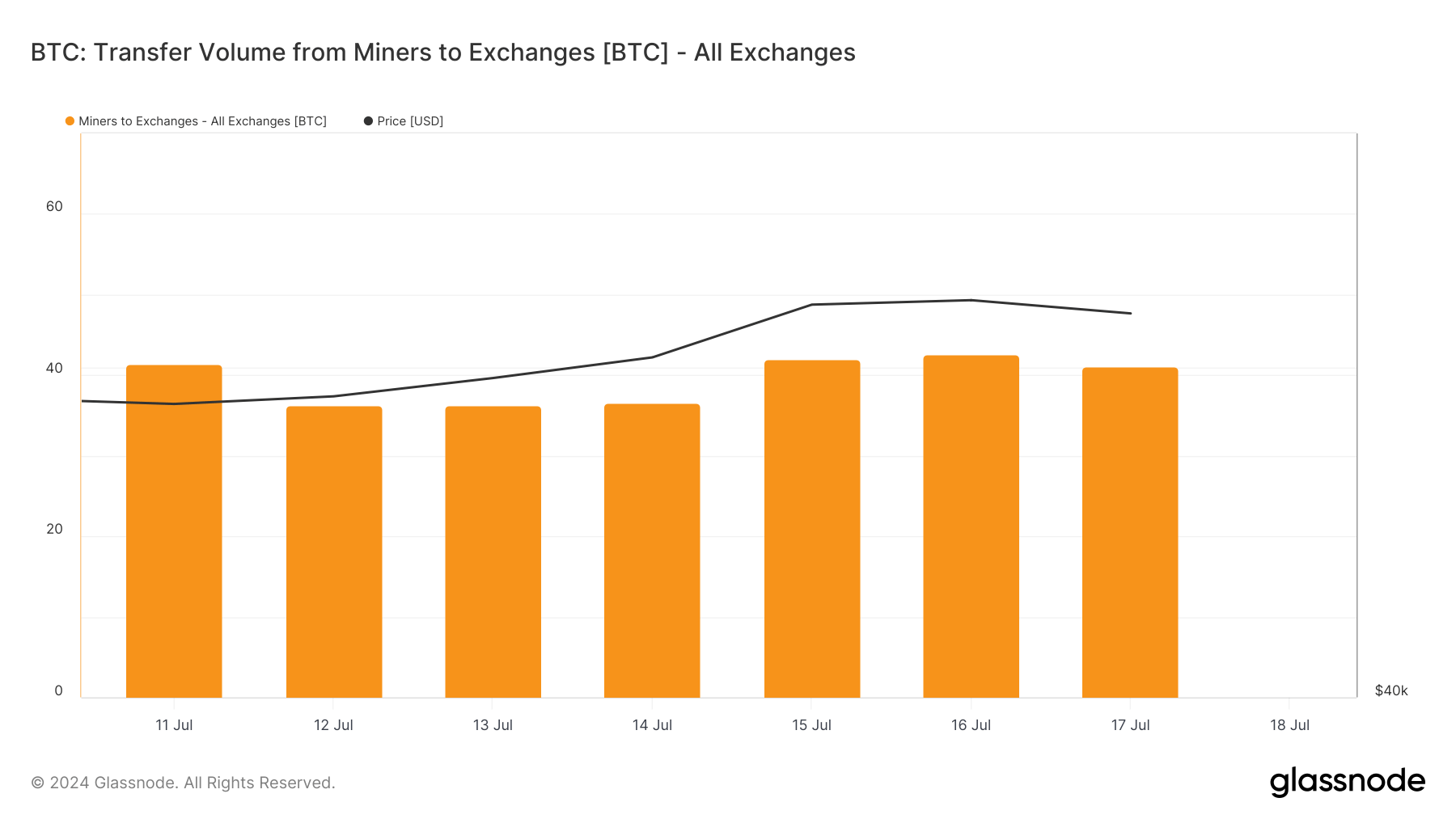

The quantity of transfers from miners to exchanges remained comparatively secure, starting from 36 BTC to 42 BTC per day. This stability means that miners should not considerably rising their direct gross sales to exchanges, at the same time as their total outflows are rising.

The best change switch quantity prior to now three months was 262 BTC on June 13, indicating that latest volumes are inside regular limits. The lower in miner balances, together with comparatively low transfers to exchanges, means that miners might be promoting their bitcoins by OTC (over-the-counter) transactions somewhat than on public exchanges.

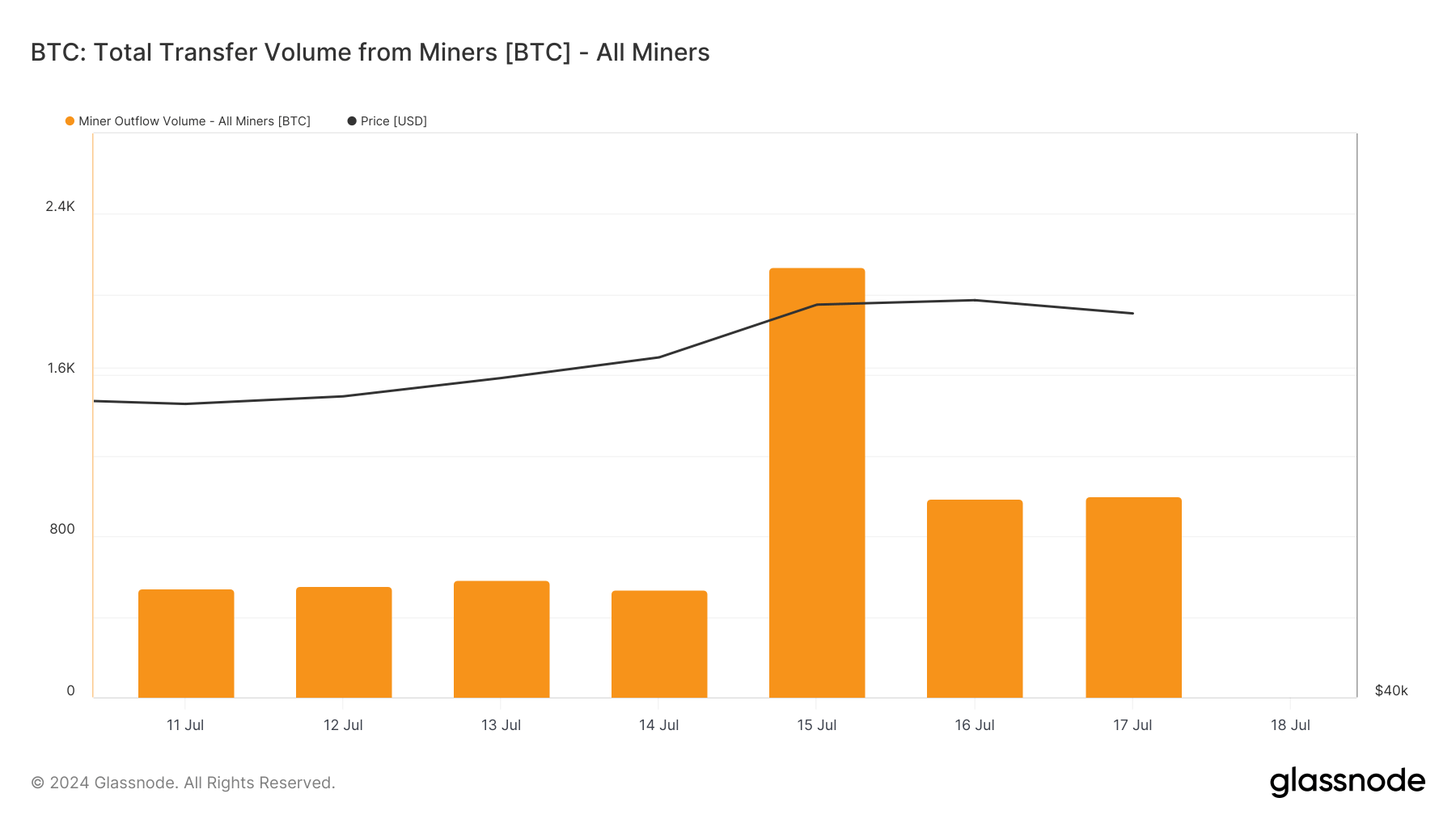

Switch volumes from miners present extra variability, with a big enhance on July 15 to 2,136.10 BTC, the second highest within the final 30 days. This enhance is in step with the surge in costs, exhibiting that miners have taken benefit of the upper costs to maneuver a big quantity of BTC. Outflows of 985.60 BTC on July 16 and 1,001.63 BTC on July 17 additional verify this development.

The info means that miners are lowering their complete holdings to maximise their returns throughout rising costs. This strategic promoting contributes to market liquidity and may have an effect on short-term value fluctuations.

The submit Miners Cut back Holdings Amid Rising Costs appeared first on fromcrypto.