MicroStrategy acquired roughly 18,300 bitcoins for $1.1 billion between August 6 and September 12 at a mean value of $60,408 per BTC, in response to a September 13 submitting with the US Securities and Trade Fee (SEC).

Coinflip information exhibits that the corporate's newest buy already has a paper lack of $2.2 million as a result of present volatility of the highest digital asset.

Financing

The agency mentioned the acquisition was funded by the sale of greater than 8 million shares of the corporate by a gross sales settlement with a number of monetary establishments, together with TD Securities, The Benchmark Firm, BTIG, Canaccord Genuity, Maxim Group and SG Americas Securities.

The capital raised from these gross sales was instantly used to broaden Bitcoin holdings.

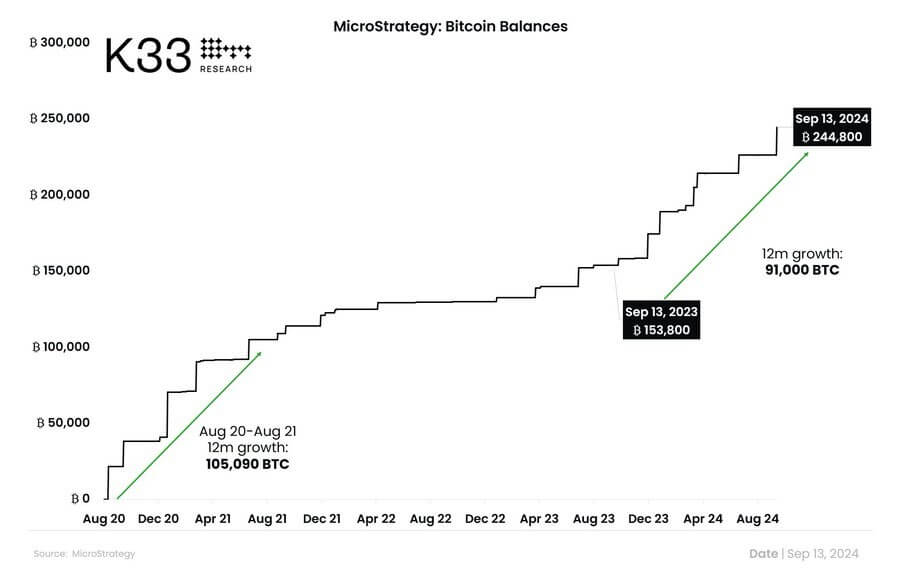

Notably, the corporate has aggressively pursued this funding technique over the previous 12 months to build up high digital property. K33 Analysis reported that the agency has bought round 91,000 BTC since September 2023 to this point.

Added:

“August 2020-21 is the one interval to function increased year-over-year development in MSTR's BTC publicity of 105,090 BTC.”

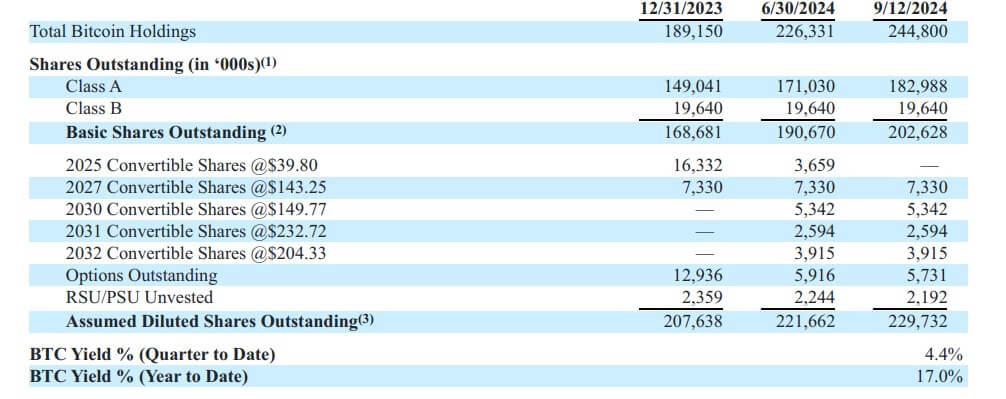

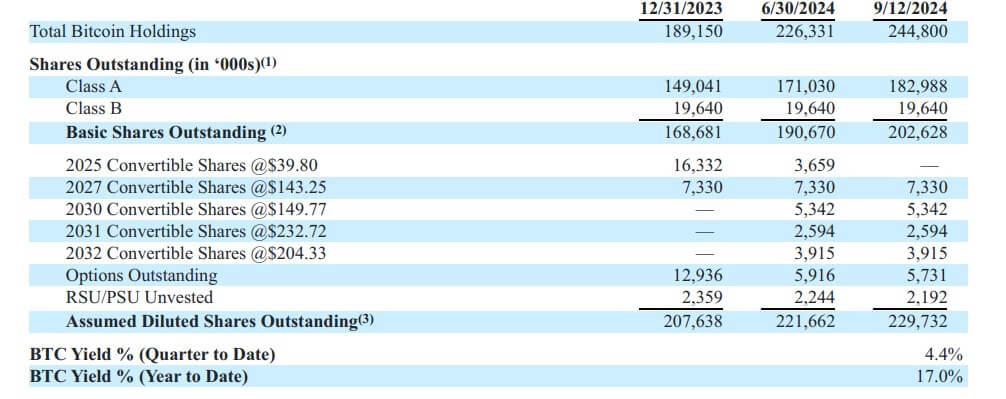

In the meantime, this newest acquisition brings MicroStrategy's whole bitcoin holdings to 244,800 BTC, price greater than $14 billion at present costs. The corporate's whole funding in Bitcoin is $9.45 billion with a mean buy value of $38,585 per Bitcoin.

Saylortracker information suggests the agency holds greater than $4 billion in unrealized earnings.

Bitcoin yield

MicroStrategy Govt Chairman Michael Saylor reported a 4.4% return for bitcoin for the quarter and a 17% year-to-date return on his holdings.

In line with the SEC submitting, this key efficiency indicator (KPI) helps assess a agency's technique for buying bitcoins. The BTC yield metric tracks the proportion change over time within the ratio of MicroStrategy's bitcoins held to diluted shares.

The corporate believes this measure can enhance investor understanding of its determination to finance bitcoin purchases by the issuance of extra shares or convertibles.

Regardless of information of the most recent purchase, MicroStrategy shares stay flat in premarket buying and selling. Nonetheless, it grew by 91% year-on-year.