- Michael Saylor personally holds $1 billion in Bitcoin and owns 17,732 BTC.

- MicroStrategy holds 226,500 BTC price over $12 billion with a median price of $37,000.

- Saylor sees Bitcoin as a superb, secure asset and advocates continued funding.

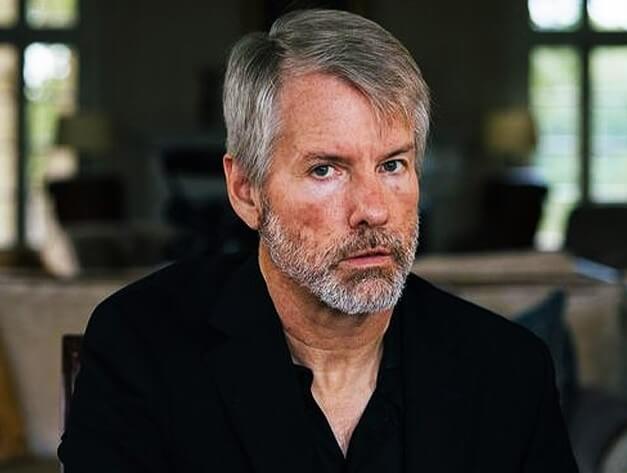

In a current interview with Bloomberg Tv, Michael Saylor, chairman of MicroStrategy, revealed that he owns roughly $1 billion price of bitcoins.

This makes him probably the most distinguished holders of BTC on this planet, becoming a member of the ranks of figures comparable to Binance founder Changpeng Zhao, the Winklevoss Twins and Satoshi Nakamoto.

Michael Saylor has not bought any of his BTC holdings

Saylor's assist for Bitcoin as an fairness funding asset is passionate and unwavering. In his dialogue with Bloomberg's Sonali Basak on August 7, Saylor confirmed that he owns a major private stack of bitcoins, which he first revealed 4 years in the past.

On the time, he reported possession of 17,732 BTC, a quantity that has solely grown since then.

Some requested how a lot #BTC I personal me personally #hodl 17,732 BTC I purchased for a median of $9,882. I knowledgeable MicroStrategy of those holdings earlier than the corporate determined to purchase #bitcoin for me.

— Michael Saylor⚡️ (@saylor) October 28, 2020

Regardless of Bitcoin's important appreciation through the years, Saylor hasn't bought any of his holdings and has saved buying extra cryptocurrency.

Seeing Bitcoin as Generational Wealth

For Saylor, bitcoin is greater than only a speculative funding. He describes it as a revolutionary monetary instrument that surpasses each bodily and conventional monetary capital.

Based on Saylor, bitcoin is an unmatched asset that gives wealth technology potential for people, households, firms and even nations. His dedication to Bitcoin is rooted in its perceived stability and safety, in addition to its means to retain worth over time.

In the course of the interview, Saylor emphasised his perception that “there’s by no means a nasty time to purchase bitcoin.” He likened bitcoin to a “cyber Manhattan” and steered that investing in it’s akin to buying prime actual property in essentially the most fascinating location.

This analogy highlights his perception that Bitcoin, as a uncommon and fascinating asset, will at all times have important worth, no matter market fluctuations.

MicroStrategy has amassed 226,500 BTC beneath Saylor's management

Saylor's funding philosophy extends past his private holdings to his management of MicroStrategy. Beneath his management, the corporate has amassed a considerable bitcoin reserve totaling 226,500 BTC price greater than $12 billion.

This large funding represents a major a part of the corporate's stability sheet. MicroStrategy's common price per bitcoin is roughly $37,000, and the corporate is about to conduct a ten:1 inventory cut up, which may additional have an effect on its monetary construction and inventory efficiency.

Along with discussing his private holdings, Saylor additionally addressed the broader implications of Bitcoin for company finance. He claims that bitcoin can “repair” company stability sheets by offering a secure and steady asset for long-term funding.

Saylor factors to Bitcoin's huge computing and electrical energy, which he claims is “nation-state-proof” and “nuclear-hardened.” He proudly notes that the Bitcoin community consumes extra electrical energy than america Navy, a testomony to its strong safety and resilience.

Nonetheless, Saylor's enthusiasm for Bitcoin isn’t restricted to its funding potential. He sees cryptocurrency as a revolutionary technological development with the flexibility to reshape monetary techniques globally.