Monitoring modifications in liquidity is simply as essential as monitoring modifications in bitcoininformation in a string. Any value motion, whether or not up or down, places important stress on liquidity. One method to analyze the modifications that value swings deliver to the market is to have a look at the depth of the market.

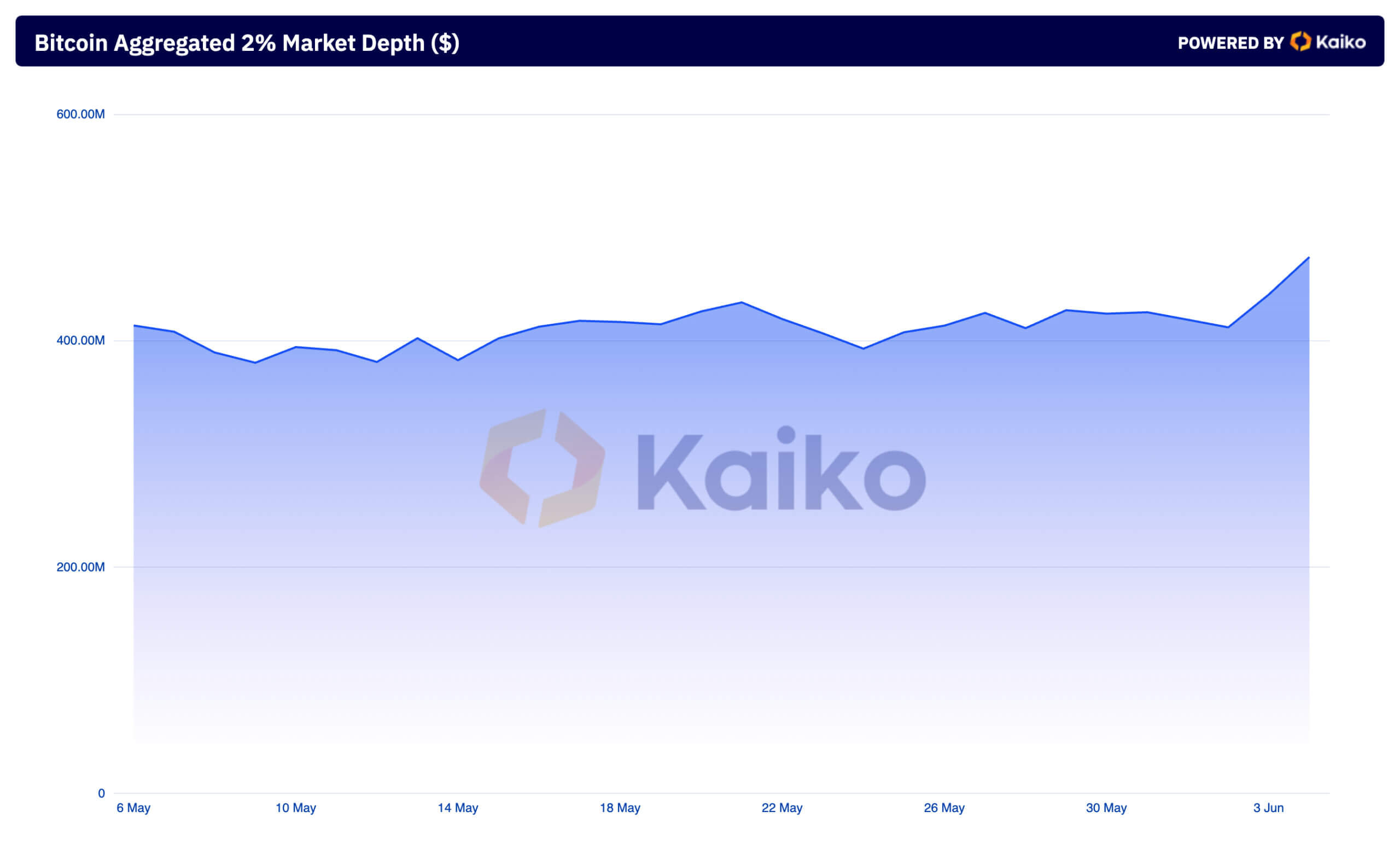

Mixture market depth of two% and provide depth of two% vs. depth of demand are glorious indicators of market liquidity and sentiment for Bitcoin. Mixture market depth represents the mixed worth of purchase and promote orders inside 2% of the present value. It offers an outline of how a lot BTC could be traded with out important value actions. As of June 2, combination market depth was $411.83 million on centralized exchanges monitored by Kaiko. The depth rose to $473.97 million on June 4, essentially the most in two months.

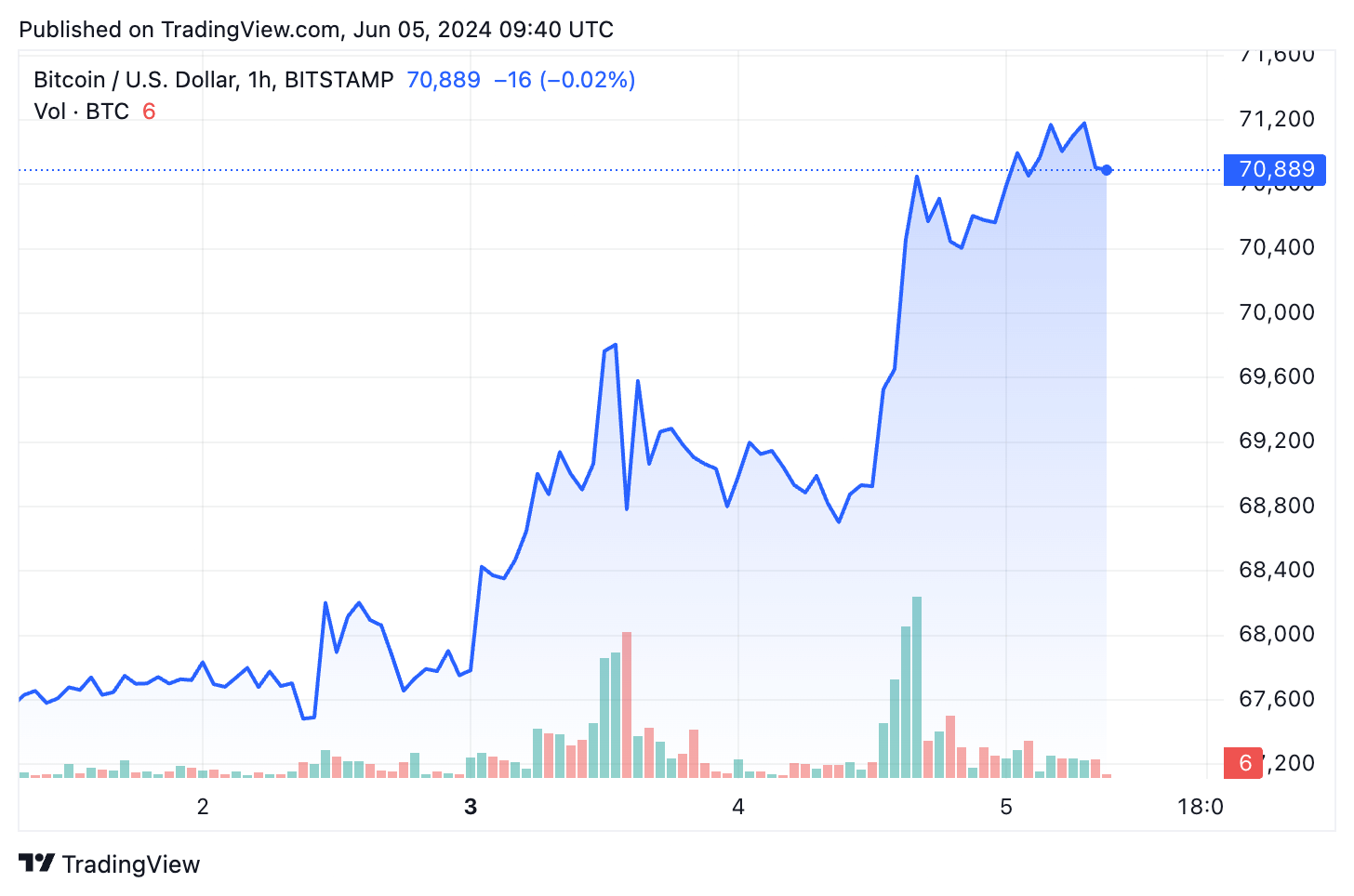

The rise in market depth adopted the rise within the value of Bitcoin from $67,750 to $70,600. Whereas it will not be a big share enhance, $70,000 is a very essential psychological milestone. This enhance turns into much more important once we contemplate the truth that BTC spent weeks within the $60,000 vary.

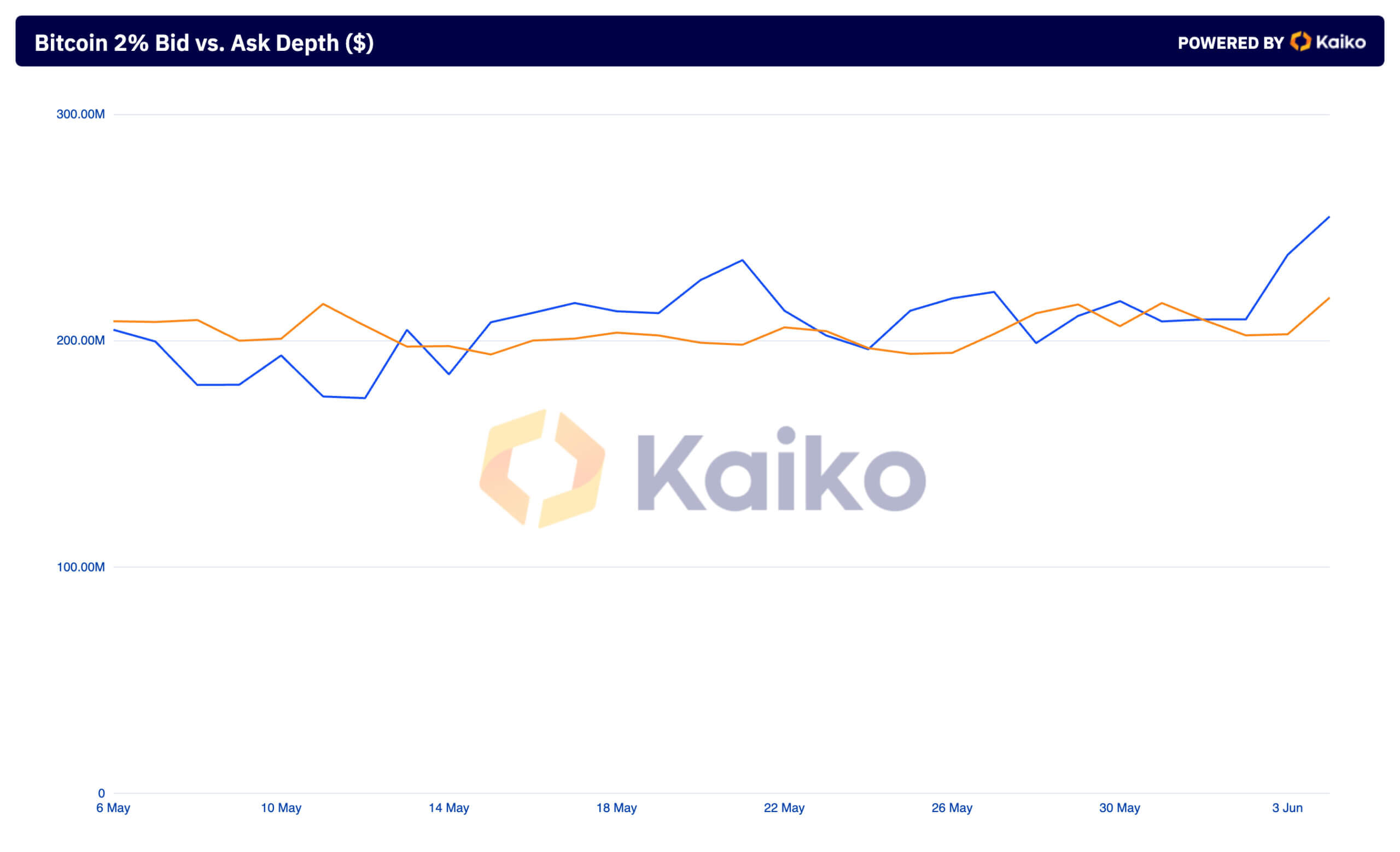

Depth of Provide Vs. the demand exhibits the worth of purchase and promote orders throughout the similar 2%. This unfold has additionally seen a big enhance previously few days. On June 2, there have been $202.40 million in bids and $209.44 million in asks. This coincides with the earlier one fromcrypto evaluationwhich discovered that the market is nearly evenly cut up between shopping for and promoting.

By June 4, bids had elevated to $219.06 million and bids had surged to $254.91 million, ensuing within the largest bid-ask unfold since early April. This enhance in each market depth and provide vs. depth of demand signifies elevated market exercise.

A rise in combination market depth means that the market can deal with bigger trades with much less affect on value. This can be a clear signal of extra liquidity available in the market. This greater liquidity signifies that merchants could make substantial transactions with out inflicting important value fluctuations, which contributes to general market stability. The present enhance within the depth of provide and demand displays elevated exercise and confidence amongst merchants. Extra purchase and promote orders inside 2% signifies that merchants are extra actively taking part available in the market.

A higher enhance within the depth of demand in comparison with the depth of provide signifies that sellers are setting greater costs and anticipate costs to proceed to rise. This sentiment is supported by a considerable enhance within the depth of provide, indicating robust demand for Bitcoin at greater value ranges. As extra patrons enter the market prepared to purchase at these elevated costs, market momentum will increase. Elevated liquidity together with greater bid and ask values paint an image of a strong buying and selling atmosphere the place giant trades could be executed with minimal value affect.

A good portion of this exercise resulted from spot Bitcoin ETFs. Reversed information confirmed that spot bitcoin ETFs noticed $886.6 million in inflows on June 4, the second greatest day of inflows since launch. fromcrypto reported that it was the most important influx in a day with no US ETF outflows, together with GBTC. A wider bid-ask unfold signifies that sellers are anticipating continued value progress and setting greater costs accordingly. Elevated liquidity helps value stability and makes the market extra enticing to institutional traders and enormous merchants. Rising institutional curiosity, evidenced by a rise in ETF inflows, is solidifying demand for Bitcoin, including to the potential for sustained value progress within the coming months.

The put up Market Depth Reveals Bitcoin's Basic Power at $70,000 appeared first on fromcrypto.