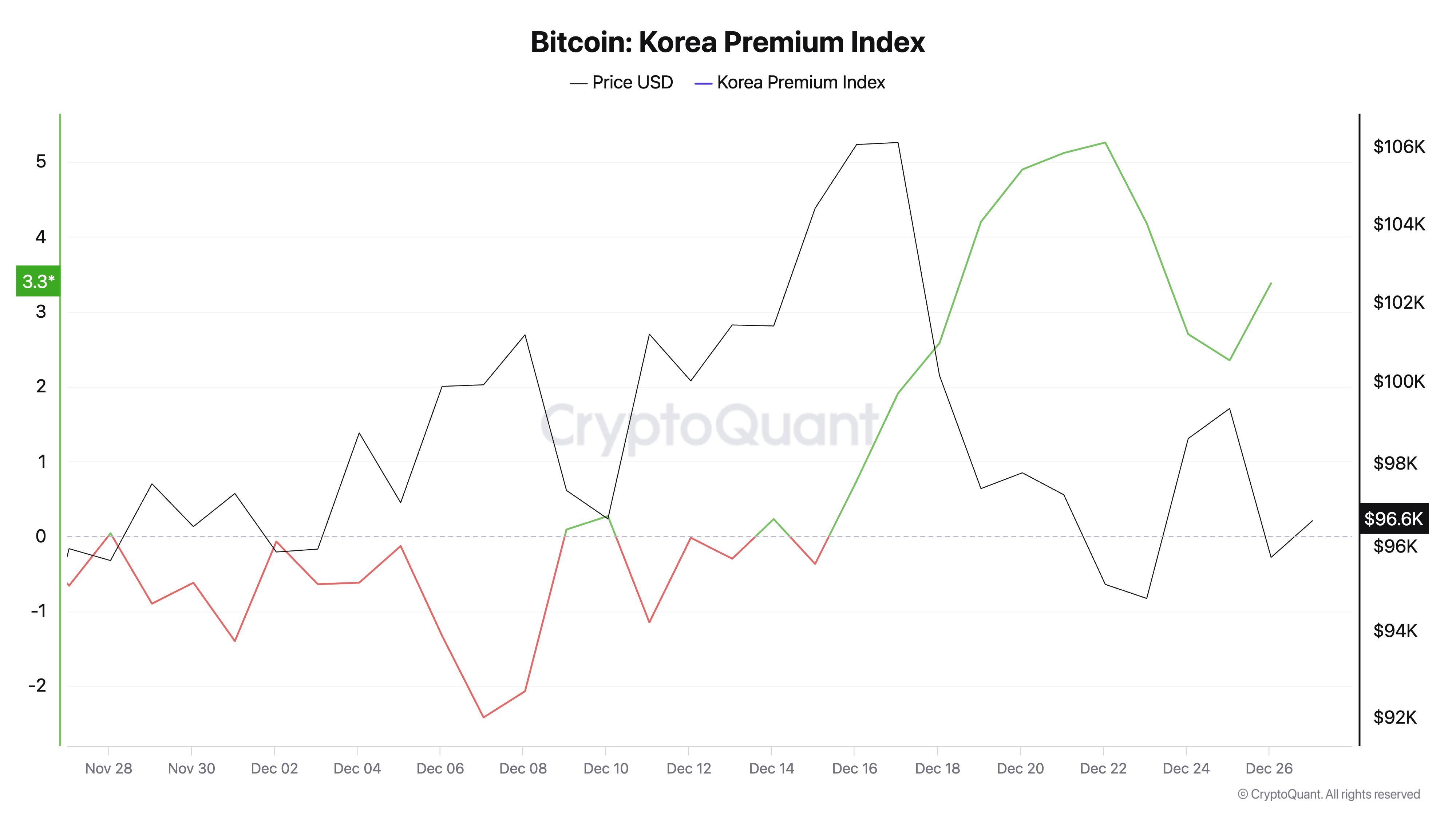

The Kimchi premium noticed a definitive restoration after Christmas, recovering to three.83% on December twenty seventh. Whereas that is nonetheless considerably decrease than the 5.26% recorded on December twenty second, it nonetheless represents a major distinction in bitcoin costs between South Korea and the world. markets.

The present restoration comes amid political and financial turmoil in South Korea, marked by the impeachment of incumbent President Han Duck-soo. The recall comes simply two weeks after parliament voted to question its president, Yoon Suk Yeol.

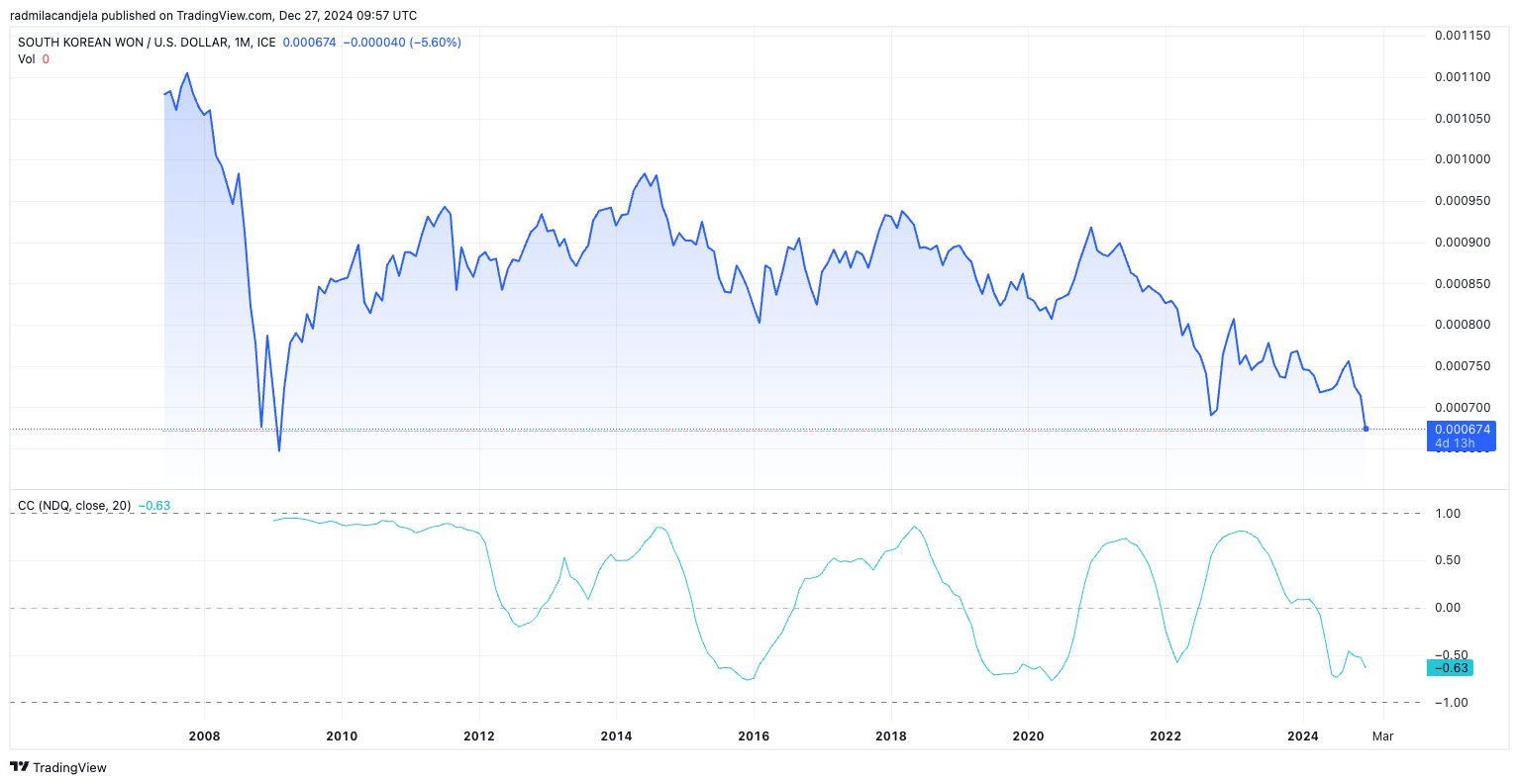

The continuing political disaster has raised fears of financial instability, which has fueled elevated demand for Bitcoin. As native traders sought refuge in bitcoins, elevated demand drove home costs above world averages. The continued devaluation of the Korean received, which hit its lowest stage towards the greenback since February 2009, additional supported the rise within the premium.

The kimchi premium was notably risky within the second half of 2024. There was a major decline in late November and early December, with the premium turning damaging. A number of components led to this decline, the primary one being political instability within the nation. On December 3, President Yoon Suk Yeol declared that he was imposing martial regulation, citing the necessity to defend the nation from political opposition. Shortly after, Yoon and officers from his authorities have been arrested and charged with sedition, whereas Yoon faces an impeachment trial.

The political unrest has led to fears of tighter regulation by South Korean authorities. The stricter measures on crypto exchanges are geared toward curbing speculative buying and selling, which is weakening native demand for bitcoin. As well as, world arbitrage exercise performed a task in narrowing the premium. As worldwide merchants took benefit of the worth hole, the circulation of bitcoins into South Korea elevated, balancing provide and demand. Market sentiment additionally modified throughout this era as South Korean merchants pulled again from speculative exercise as world bitcoin costs consolidated.

Regardless of these adjustments, the received continued to weaken towards the greenback. For the reason that devaluation didn’t instantly set off a rise within the kimchi premium, it’s protected to say that native market situations on the time have been extra influenced by regulatory and political components.

In mid-December, there was a pointy restoration within the kimchi premium. This restoration has come towards a backdrop of higher political instability, with the nation's incumbent president additionally going through impeachment. However this time, fears of financial turmoil and potential capital controls have led traders to show to bitcoin as a hedge, boosting native demand.

Speculative habits that usually accompanies intervals of uncertainty has additionally intensified, additional boosting bitcoin costs in South Korea relative to world markets. In the meantime, the received's continued depreciation has added to bitcoin's attraction as a retailer of worth, contributing to the premium's upward trajectory. The mixture of those components created the proper storm that led to the renewal of the premium.

The influence of the kimchi premium will not be restricted to South Korea. When the premium is excessive, it creates arbitrage alternatives for merchants to maneuver bitcoins to South Korea, growing cross-border capital flows. This arbitrage exercise typically results in short-term volatility as markets alter. As well as, the excessive premium could distort world bitcoin worth alerts, as South Korea typically accounts for a major share of buying and selling quantity. Rising premiums additionally have a tendency to draw regulatory scrutiny as authorities intention to curb speculative buying and selling and defend retail traders from potential dangers.

On the plus facet, the premium has traditionally confirmed bitcoin's position as a hedge towards financial and political instability. The kimchi premium is historically a barometer of South Korean market sentiment and macroeconomic situations. Throughout speculative booms reminiscent of late 2017 and early 2021, premiums reached double digits, pushed by frenzied retail demand. In distinction, intervals of damaging premium reminiscent of mid-2024 mirrored tighter regulation and diminished speculative curiosity. The latest upswing displays these historic patterns however is rooted in distinctive circumstances, together with a political disaster and important foreign money devaluation.

The put up Kimchi premium recovers as KRWUSD sinks to 15-year low appeared first on fromcrypto.