After such a historic run over the previous two years, it was solely a matter of time earlier than Bitcoin bear market projections took over cryptocurrency discussions. A number of students and specialists have shared after they suppose the digital asset market will peak within the cycle and sure witness a reversal.

Whereas the group continues to be pretty optimistic concerning the potential of varied cryptocurrencies, a market shifting in the wrong way won’t be a shock. A preferred cryptocurrency dealer echoed an identical sentiment on the social media platform and offered attainable timing for the arrival of a bear market in cryptocurrencies.

Why a bear market might begin in April

In a Jan. 25 publish on Platform X, outstanding crypto analyst Ali Martinez shared his “unpopular opinion” on the present Bitcoin bull cycle and its potential finish. Based on the skilled, the bear market might begin in about three months.

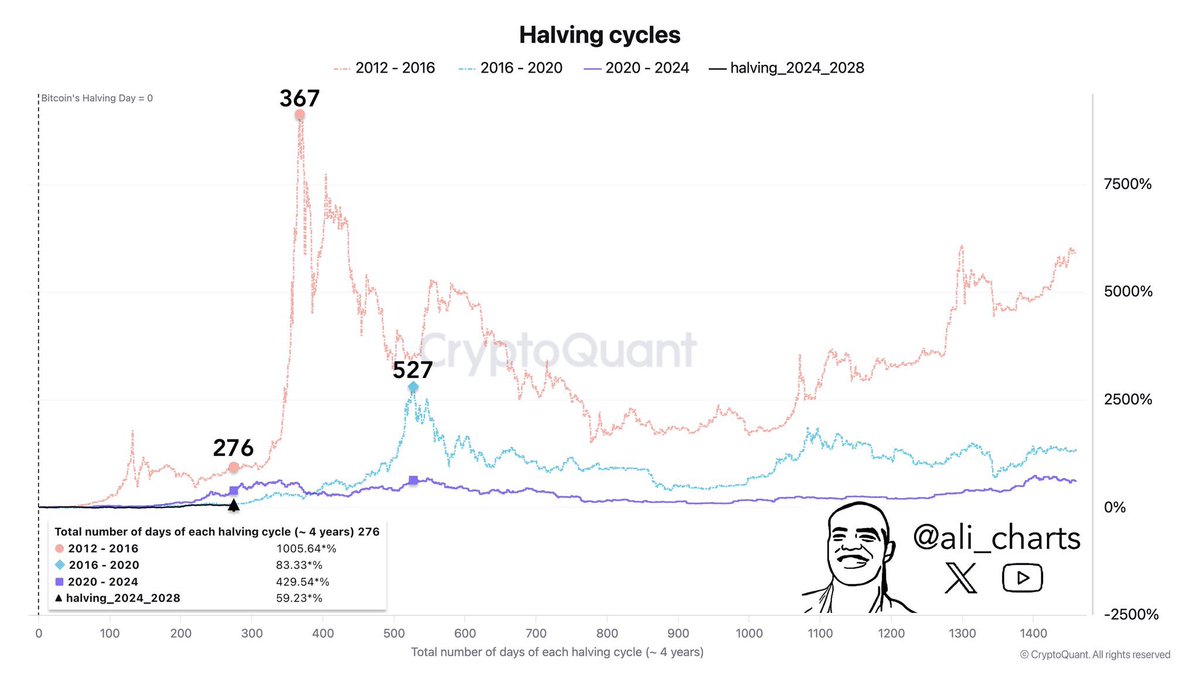

The rationale behind this projection is Bitcoin's historic worth efficiency over varied half-range cycles. The bitcoin halving, an occasion that happens roughly each 4 years, narrows the provision of bitcoin by halving the mining reward.

As seen in 2024 – the final 12 months of the halving, the halving occasion has traditionally been a harbinger of considerable worth progress. Nevertheless, post-halving rallies are normally adopted by important profit-taking, resulting in market consolidation and a bear market.

Supply: Ali_charts/X

Traditionally, roughly 276 days after the halving occasion has confirmed pivotal within the trajectory of the Bitcoin market. Particularly, the value of Bitcoin noticed a big worth improve after crossing the 276-day milestone within the 2012-2016 halving cycle.

Nevertheless, the BTC market witnessed a change in sentiment and a pointy market decline 367 days after the halving – 91 days after the 276-day milestone. If this historic sample holds, buyers might see the beginning of a bear market someday in late April.

On the time of writing, the value of BTC sits just under the $105,000 mark, reflecting no important motion over the previous day.

Retail curiosity on the rise?

Whereas historic worth information is an efficient option to analyze the trajectory of a cycle, on-chain information is one other technique that sheds mild on cyclical worth actions. One such piece of information is retail curiosity in Bitcoin, which measures retail investor demand for the main cryptocurrency.

Associated Studying: MicroStrategy Could Face Tax Bother Over $19B Of Unrealized Bitcoin Earnings: Report

Demand from small buyers normally typically correlates with the section of peak euphoria. “Taking a look at previous cycles, the final two massive jumps in “easy methods to purchase cryptocurrency” searches occurred when BTC was round $65,000 in Could 2021 and $69,000 in November 2021 – proper on the prime of the market,” Martinez mentioned in a separate publish on X.

Supply: Ali_charts/X

As proven within the graph above, the “curiosity over time” indicator seems to extend once more in 2025. This could possibly be a sign of an approaching prime within the crypto market.

The worth of Bitcoin on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView