It's election season in america, and Bitcoin and the broader cryptocurrency business have by no means been extra concerned within the political panorama. From former President Donald Trump's brazenly pleasant stance to Vice President Kamala Harris' comparatively reserved stance, there was fairly a little bit of drama within the interaction between the crypto market and United States politics.

There have been quite a few discussions in regards to the final result of the election and its potential impression on the crypto panorama. QCP Capital, a distinguished buying and selling agency, is among the many newest to weigh in on the survey outcomes and impression on cryptocurrencies, significantly Bitcoin.

QCP thinks the worth of Bitcoin will drop after the election consequence – right here's why

In a Nov. 2 report, QCP Capital revealed that it expects the U.S. election to be one other sell-the-news occasion whatever the final result. Just like the Bitcoin convention in Nashville, the buying and selling agency expects many buyers to shut their BTC positions after the election on Tuesday, November 5.

In accordance with QCP, there’s a sustained degree of short-term implied volatility above 72 vol for each Bitcoin and Ethereum within the upcoming election. Because the identify suggests, short-term implied volatility tracks the market's expectations about worth actions within the close to future.

With this metric as much as 72 volumes in the meanwhile, there’s a sense that buyers predict large worth swings within the Bitcoin and Ethereum markets after the election. The rise in places distorts that almost all merchants anticipate downward worth actions.

QCP emphasised that the rise in put skews signifies that merchants are taking “draw back safety” in anticipation of a market correction. Finally, this coincides with a sell-the-news projection reflecting the fallout from the Bitcoin convention in Nashville.

After practically reaching its all-time excessive within the earlier week, BTC has seen a major drop beneath $70,000. On the time of writing, the main cryptocurrency is hovering round $68,150, reflecting a 2.2% decline over the previous 24 hours.

Binance Merchants Go Lengthy on BTC Futures

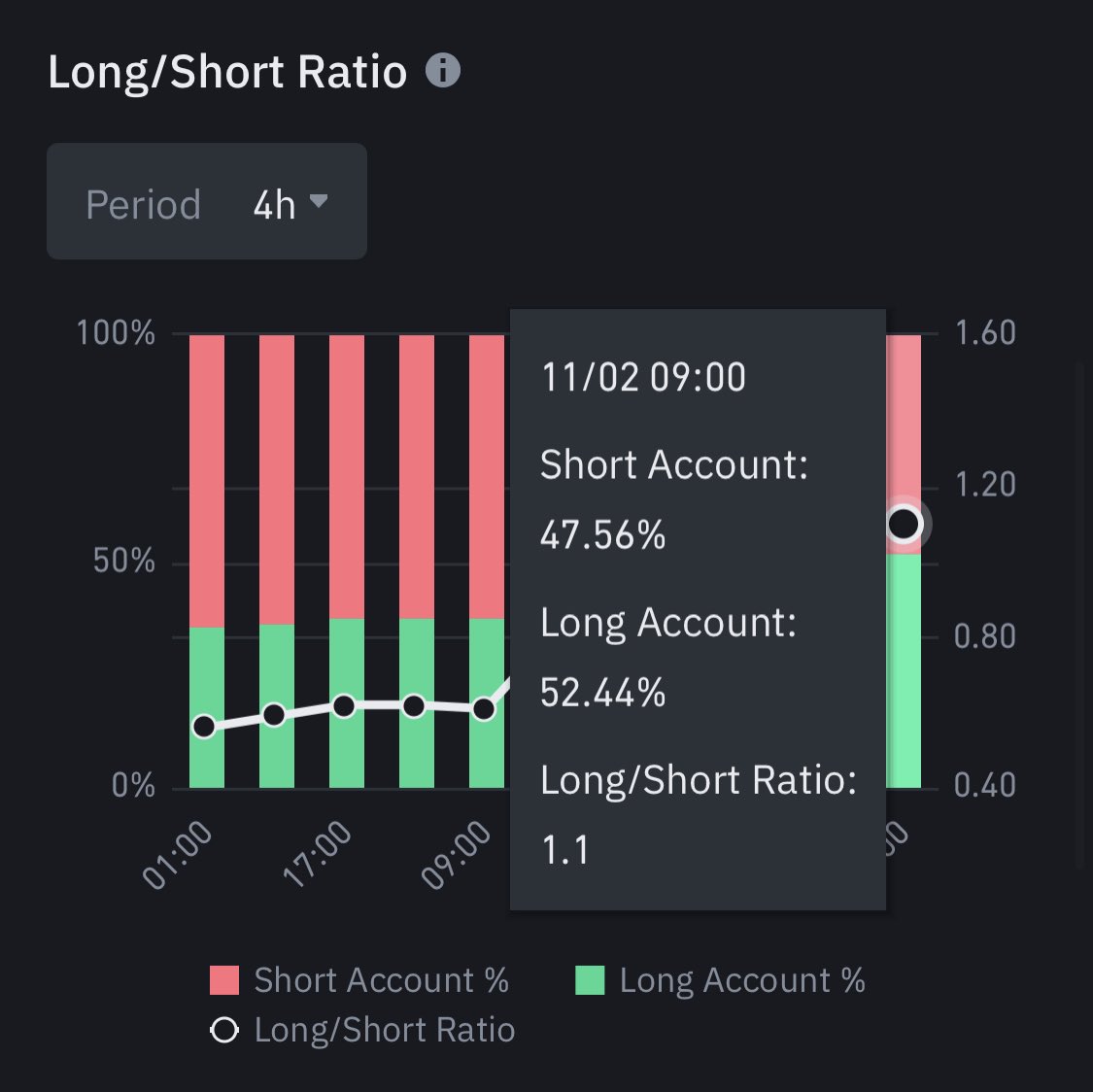

In a current put up on X, Ali Martinez revealed that Bitcoin futures merchants on Binance have began closing out their quick positions. In accordance with an on-chain analyst, 52.44% of Binance futures merchants are actually devoted to the flagship cryptocurrency.

Supply: Ali_charts/X

The rise in lengthy positions means that extra buyers are backing Bitcoin's worth to rise within the close to future. So this newest commentary alerts a major shift in sentiment, with the market seemingly leaning in direction of a extra optimistic outlook simply days earlier than the US election.

It’s price noting that this transformation in positions of Binance merchants could also be a response to the current dips within the worth of Bitcoin. It’s doable that buyers are “shopping for the dip” and see the present worth as the proper entry level.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView