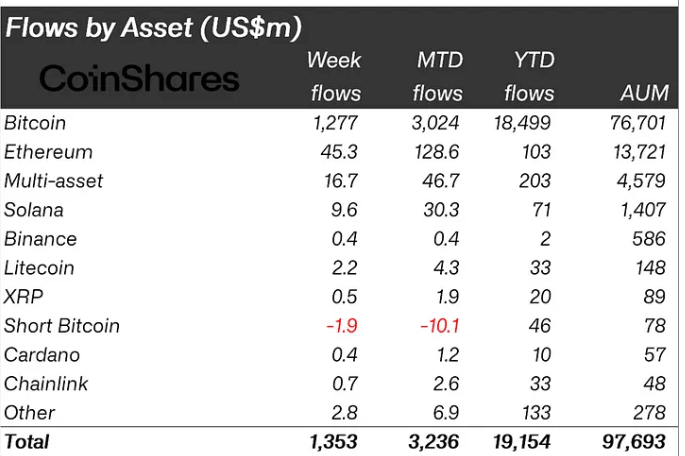

Crypto funding merchandise noticed inflows final week for the third week in a row, reaching $1.35 billion. That pushed complete inflows for July to surpass $3 billion, in accordance with CoinShares' newest weekly report.

Notably, ETP commerce volumes additionally elevated considerably final week, rising 45% week-on-week to $12.9 billion. Nevertheless, this vital quantity represents solely 22% of the entire crypto market quantity.

Optimistic moods

Bitcoin-related merchandise led the inflows, contributing 95% of the $1.27 billion complete. Flows had been dominated by BlackRock's IBIT and Constancy's FBTC, whose BTC ETF noticed inflows of almost $1 billion final week.

Conversely, short-bitcoin ETPs noticed outflows of $1.9 million, bringing complete outflows since March to $44 million, representing 56% of property beneath administration (AuM).

James Butterfill, head of analysis at CoinShares, defined that the development signifies continued constructive investor sentiment since bitcoin accomplished its halving occasion in April.

Ethereum-related merchandise additionally noticed constructive motion, with $45 million inflows final week. That introduced its year-to-date (YTD) inflows to $103 million, overtaking Solana.

Ethereum's surge in inflows is linked to the anticipated launch of its spot exchange-traded funds (ETFs). Final week, the Chicago Board Choices Trade (Cboe) introduced that 5 merchandise—21Shares' CETH, Constancy's FETH, Franklin Templeton's EZET, Invesco's QETH and VanEck's ETHV—will start buying and selling on July 23, pending regulatory approval .

Solana noticed $9.6 million in inflows final week, however trails Ethereum with $71 million year-to-date. Litecoin was the one different altcoin with inflows over $1 million, posting $2.2 million final week. Chainlink, Cardano, and Binance noticed a mixed influx of $1.5 million.

Butterfill added that blockchain shares confronted $8.5 million in outflows final week, regardless of most ETFs outperforming international inventory indexes.

Regionally, the US and Switzerland had vital inflows of US$1.3 billion and US$66 million respectively. In distinction, Brazil and Hong Kong noticed smaller outflows of US$5.2 million and US$1.9 million respectively.