- Bitcoin addresses with 10-10,000 BTC have amassed 133,300 cash previously month amid market uncertainty.

- Bitcoin holdings in public corporations have grown almost 200% over the previous yr, from $7.2 billion to $20 billion.

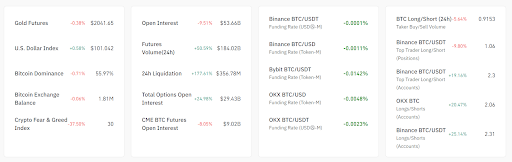

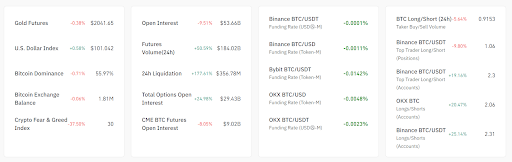

- The Crypto Worry & Greed Index exhibits concern at 30, whereas Bitcoin dominance drops barely to 56%, indicating cautious sentiment.

BTC whales and sharks (addresses with 10-10,000 BTC) are amassing bitcoins whilst the general market faces indecision. Analytics firm Santiment reviews that these whales and sharks have collectively amassed a further 133,300 cash over the previous month. In the meantime, smaller merchants bought off their holdings and transferred them to those bigger wallets.

Publicly listed corporations have additionally considerably elevated their bitcoin reserves. Over the previous yr, bitcoin quantity amongst these corporations has grown by almost 200%, from $7.2 billion to $20 billion.

Information from Bitbo signifies that 42 publicly traded corporations at present maintain roughly 335,249 bitcoins, price roughly $20 billion. In line with Nickel Digital Asset Administration, this represents a 177.7% improve within the worth of their bitcoin reserves in comparison with the earlier yr.

Regardless of the whales piling up and institutional curiosity, market sentiment stays combined. Crypto Worry & Greed Index at 30, indicating concern. Bitcoin's dominance decreased barely to 56%. Moreover, the 137.9% improve in 24-hour liquidations highlights vital exercise in futures and choices.

Whereas Bitcoin-Tether (BTC/USDT) funding charges are shifting virtually neutrally between exchanges, the lengthy/brief ratios paint a special image. This distinction highlights the varied methods utilized by merchants on completely different platforms. Moreover, the US greenback index rose 0.56%, which can influence cryptocurrency and gold costs, with gold futures barely decrease at $2,041.65.

Moreover, open curiosity and buying and selling volumes stay excessive within the futures and choices markets, indicating continued volatility. The market stays extremely lively and dealer sentiment varies throughout exchanges and monetary devices.

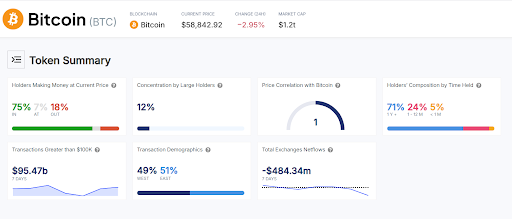

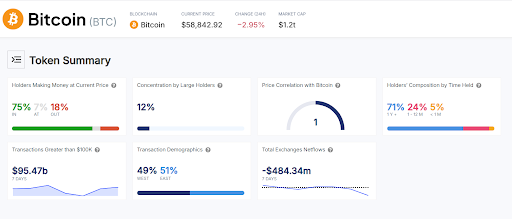

The Token Abstract chart reveals key dynamics within the cryptocurrency market, displaying that 75% of holders are at present worthwhile and 71% have held for greater than a yr. As well as, the token exhibits a low focus amongst massive holders at 12%, indicating a extra distributed possession construction. Consequently, the token's worth is completely correlated with Bitcoin, indicating that it carefully follows broader market developments.

Transaction knowledge exhibits outstanding exercise with $95.47 billion in massive transactions final week, break up evenly between Jap and Western markets. Moreover, a damaging internet alternate movement of -$484.34M in seven days signifies an accumulation pattern as tokens transfer off exchanges.

General, this knowledge paints an image of a unstable crypto market with unsure course, excessive buying and selling exercise and combined dealer sentiment throughout completely different exchanges and devices.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shall not be chargeable for any losses incurred on account of using stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.