- Over eight years, Bitcoin has generated returns in extra of seven occasions the returns of gold and eight occasions the returns of shares.

- DCA (greenback value averaging) is an effective alternative for each freshmen and specialists, however it isn’t with out flaws.

- It’s the popular funding technique for many crypto traders, with 59% utilizing it as their main strategy.

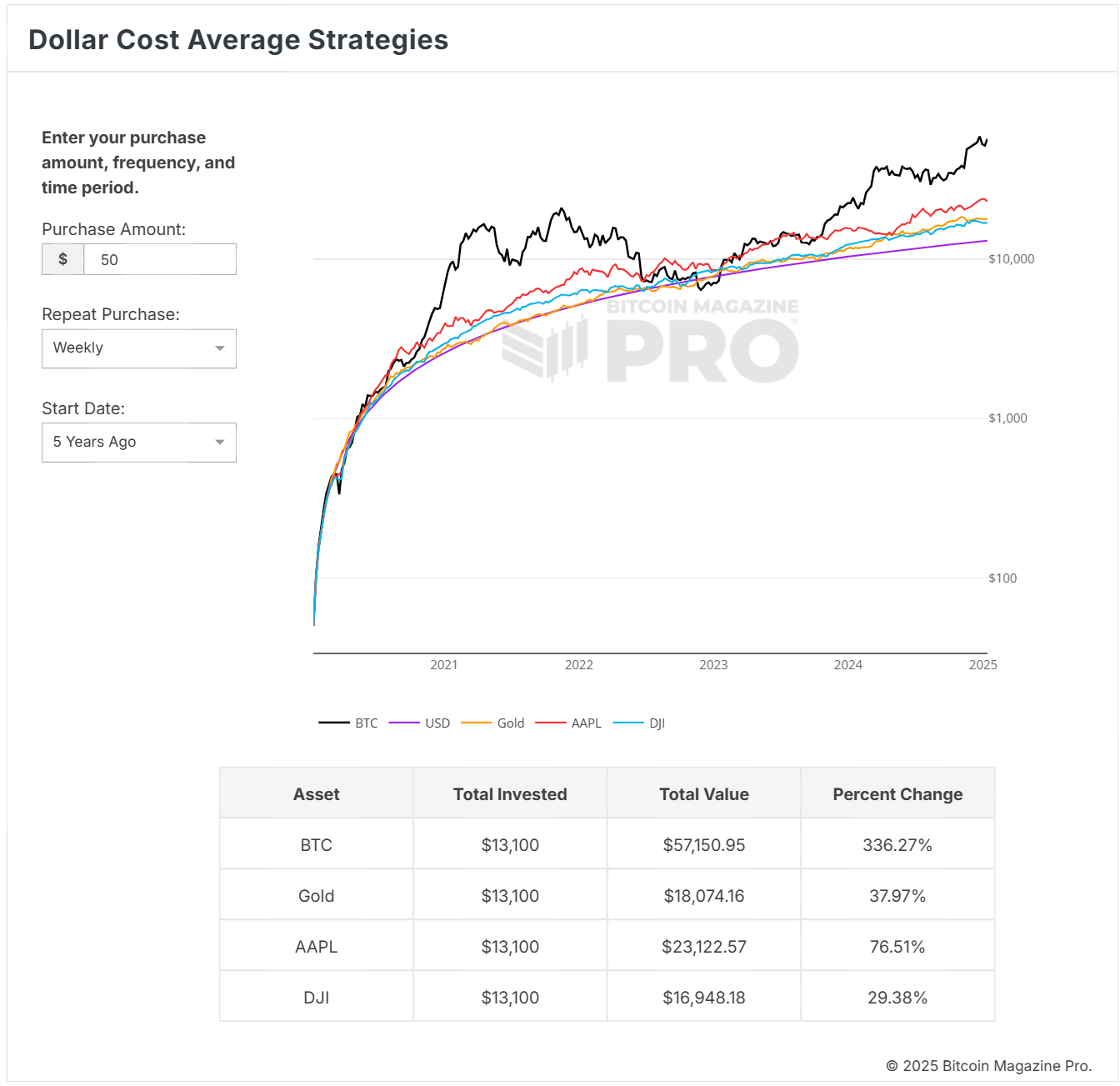

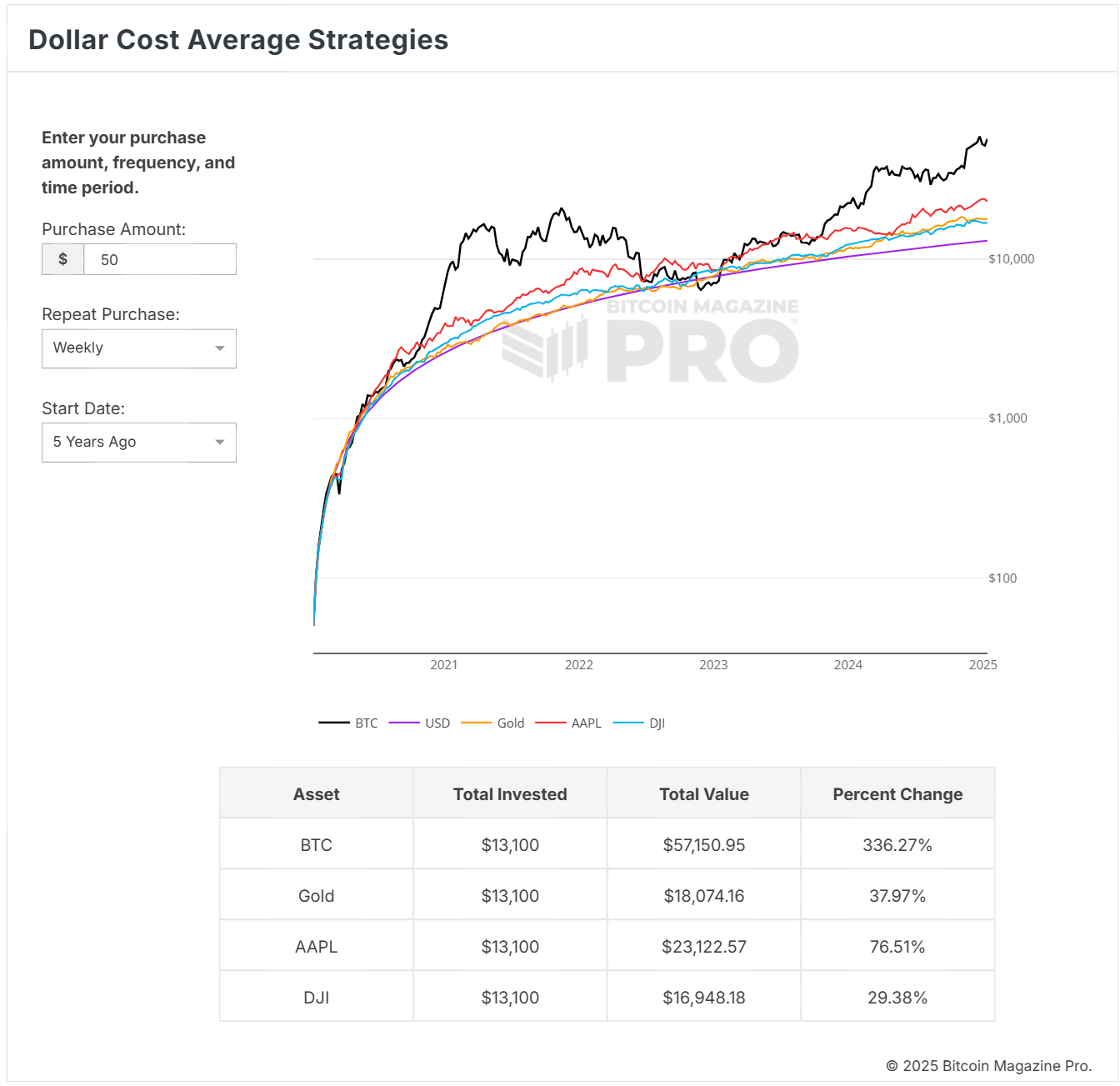

With the worth of Bitcoin hovering round 93k, there is no such thing as a scarcity of speak about its ever rising worth. So what when you jumped on board in 2017 and DCA'd (constantly investing a predetermined amount of cash in a particular asset, no matter its present market value) $25 each week?

Spoiler alert: you'd have some huge cash by now. What's extra, in these 8 years, Bitcoin would beat gold and shares in ROI.

Let's break it down. As of 2017, when you had been to earn $25 every week, you’d now have roughly $10,450 invested. Your funding would thus return roughly $16,946.00 in gold or roughly $15,358.23 in shares.

Nevertheless, in Bitcoin it could be a whopping $133,689.39! That is 8 occasions greater than inventory returns and seven occasions extra in comparison with gold. Whereas it is a “what if” scenario, it exhibits the great development of Bitcoin over time and the potential for greenback value averaging.

If you wish to see for your self and mess around with totally different time frames and funding ranges, try this chart right here.

What’s DCA good for?

The principle use of DCA is to cut back market volatility as investing a hard and fast quantity at common intervals helps to offset the influence of market fluctuations.

It’s also appropriate for newbies because it simplifies investing and makes it accessible even to these with out intensive market information or expertise. Moreover, DCA eliminates the necessity to consistently monitor the market and obsess over whether or not the market is doing effectively.

As such, it has change into a well-liked technique, with a survey final yr exhibiting {that a} substantial 59% of crypto traders favor greenback value averaging as their main funding technique.

Nevertheless, do not forget that DCA presents no ensures and it’s potential that you can miss out on increased returns if the market continues to rise throughout your funding interval. That's why it's not for everybody.

That being mentioned, when you determine to experiment with DCA in cryptocurrencies, begin by selecting which cryptocurrency you wish to spend money on. Subsequent, decide your funding price range and the frequency of your contributions. As well as, ensure you do a radical evaluation of your monetary scenario, in addition to any vital analysis.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shall not be chargeable for any losses incurred because of using mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.