The entire charges generated from the highest 10 DeFi dApps by DefiLlama will probably be $4.8 billion per yr based mostly on the final 24 hours of exercise. $13.15 million in charges had been generated within the final day for betting, dexes, lending and wallets.

| identify | Class | 24 hour costs | 24 hour reception |

|---|---|---|---|

| Lido | Liquid Staking | $3.38 million | $337,749 |

| Uniswap | Dex | $2.62 million | $0 |

| PancakeSwap | Dex | 2.1 million {dollars} | $426,372 |

| Curve Finance | CDP | $1.54 million | 659,343 {dollars} |

| AAVE | Borrowing | 1.2 million {dollars} | $172,860 |

| Producer | CDP | $1.08 million | $545,105 |

| Raydium | Dex | $1.01 million | $124,524 |

| Dealer Joe’s | Dex | $623,784 | $69,357 |

| MetaMask | Wallets | $391,846 | $391,846 |

| Camelot | Dex | $271,722 | 63,802 {dollars} |

Nonetheless, the full income for the final day is simply $2.78 million, which is 21% of the full charges.

Lido tops the charge era chart, whereas Curve maintains the primary place by way of income, intently adopted by Maker and Lido. Two of the most important variations between charges and income could be seen with Aave and Raydium, which generated greater than $1 million in charges within the final day. Nonetheless, earnings had been $172,860 and $124,524.

Notably, whereas Uniswap ranks second in charge era, DefiLlama reviews $0 in income as a result of Uniswap facilitates charge assortment. Nonetheless, it doesn’t retain these charges as protocol earnings. As an alternative, charges enhance the worth of liquidity tokens and act as a payout to all liquidity suppliers in proportion to their share of the pool.

There have been discussions and ideas throughout the Uniswap neighborhood relating to the introduction of a “protocol charge” that might allow UNI administration. This charge would permit the Uniswap protocol to earn income by taking a proportion of swap charges that will in any other case go to liquidity suppliers.

The survey was step one, a “temperature test,” which handed at a fee of 55 million to 144, that means the improve had not but been carried out. Uniswap due to this fact doesn’t file it as a return.

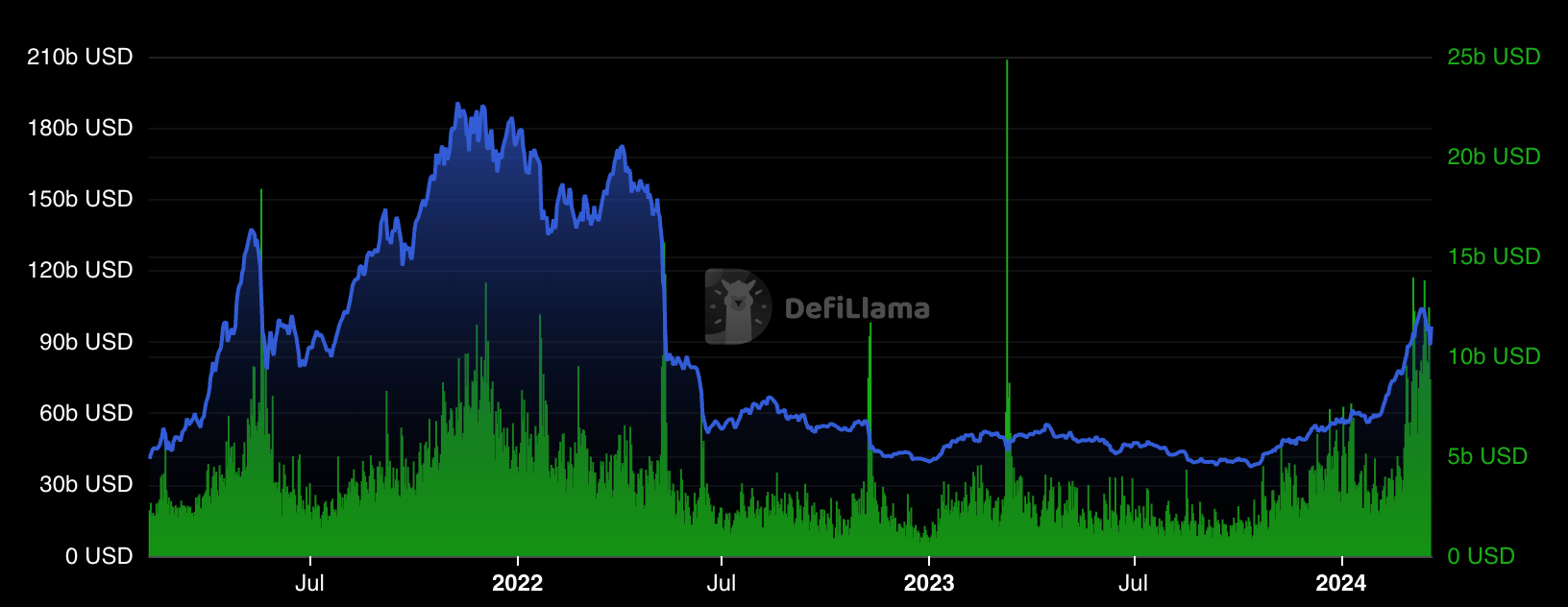

The DeFi market at the moment has a mixed market capitalization of $101 billion apiece fromcrypto knowledge, with the sector up 5% over the previous day. DefiLlam knowledge exhibits that the DeFi market cap restoration has not but reached its peaks in 2021. Nonetheless, volumes have grown to equal ranges and present a extra constant pattern. Over the previous month, volumes round $10 billion have been frequent because the yr approaches $5 billion.

The submit High 10 DeFi dApps that generate a median of $4.8 billion in charges yearly appeared first on fromcrypto.