Inflows into the New child 9 ETF fell greater than 50% over the previous week to $126 million from $254 million, in keeping with CoinShares' weekly report.

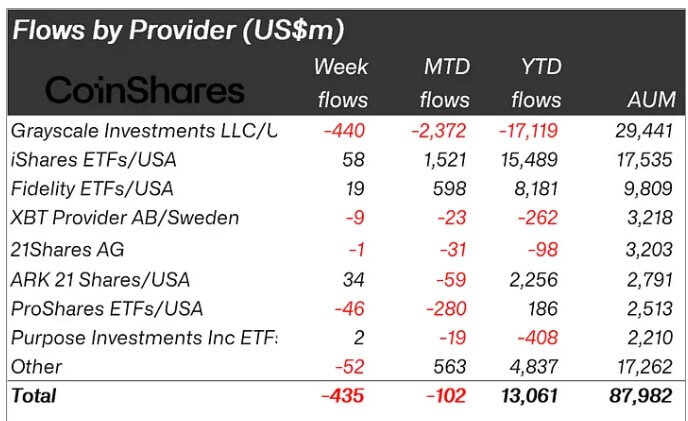

In accordance with the report, these diminished inflows contributed to $435 million in outflows – the biggest outflow since March – for the third week in a row seen by main cryptocurrency-related funding merchandise throughout the week.

Grayscale Management Regardless of 'Slowing Drain'

A breakdown of the flows confirmed that Grayscale's GBTC stays answerable for a lot of the outflows, with $440 million leaving the product final week.

Nonetheless, this marks the bottom weekly GBTC outflow in 9 weeks and an indication that outflows have been slowing. Nonetheless, complete GBTC outflows by the metric because the starting of the 12 months have exceeded $17 billion.

James Butterfill, head of analysis at CoinShares, added:

“Whereas Grayscale's outflows proceed to gradual, we additionally noticed a slowdown in inflows from new issuers, which solely noticed $126 million final week in comparison with $254 million final week.”

Weakening inflows additionally resulted in a decline in buying and selling quantity, which fell to $11.8 billion from $18 billion.

Final week, main ETF issuers reminiscent of BlackRock and Constancy noticed a number of days of zero flows. Market watchers interpreted this development as an indicator of waning investor curiosity within the asset class.

Altcoins appeal to curiosity

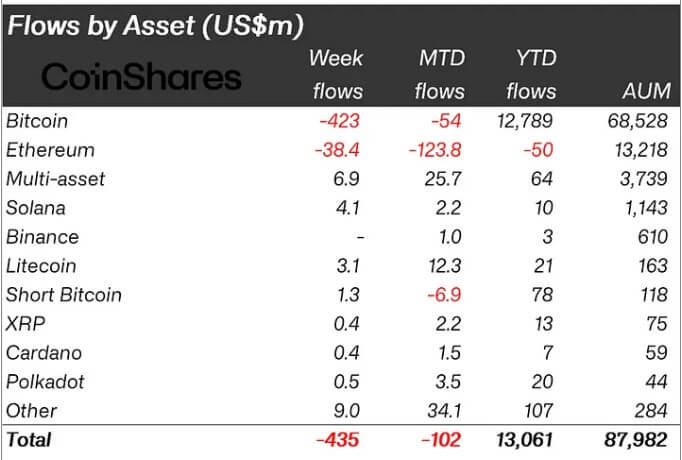

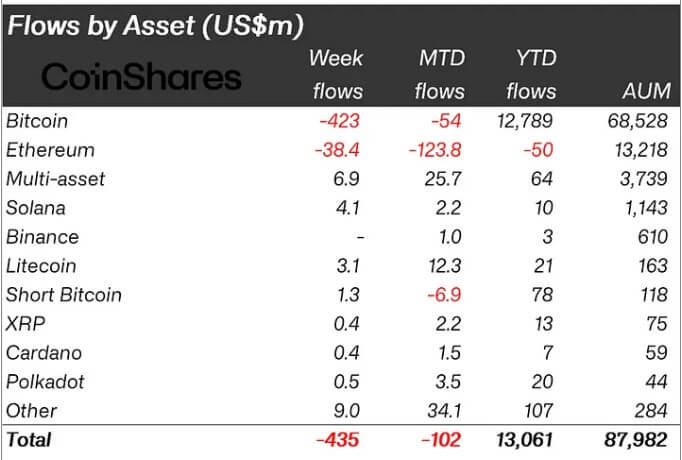

Funding merchandise associated to digital property reminiscent of Solana, XRP, Cardano, Polkadot and Chainlink noticed an inflow final week. The CoinShares report put the cumulative inflows into these property at greater than $25 million.

Ethereum, however, continued its outflow development, recording one other $38.4 million in outflows, bringing its complete for the month to $123.8 million. Move up to now is destructive $50 million.

Notably, the prevailing bearish sentiment available in the market attracted bears, who added $1.3 million to quick bitcoin funding merchandise.