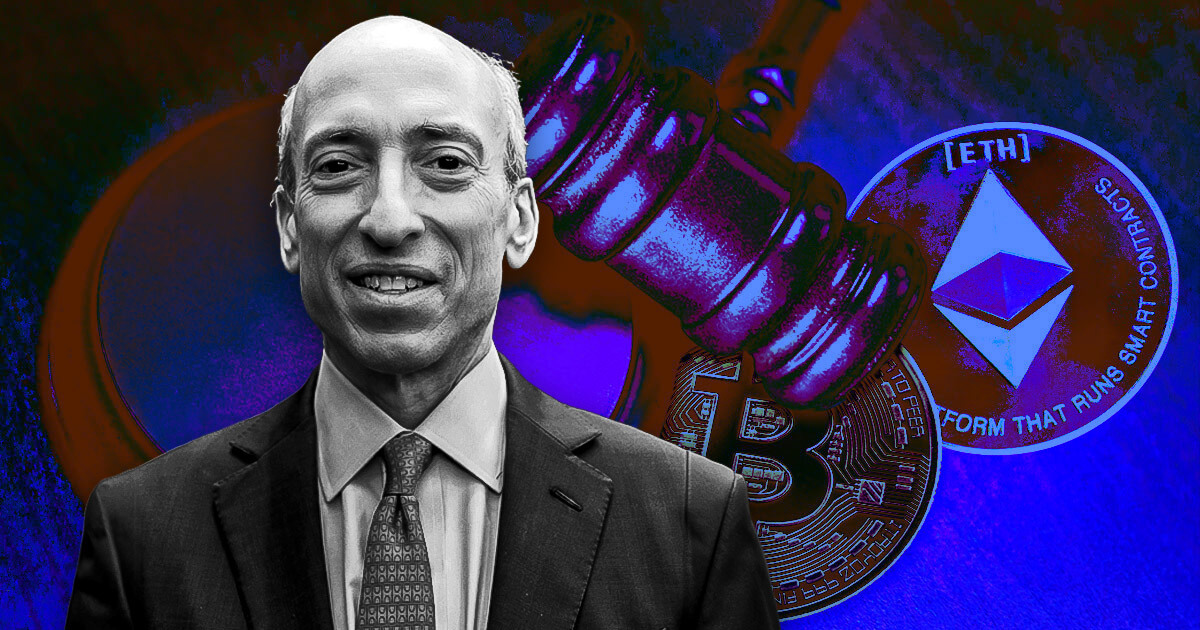

SEC Chairman Gary Gensler mentioned it can “take a while” to launch spot Ethereum ETFs, regardless of approving the associated 19-4b final month.

Gensler mentioned ETF purposes undergo regular procedures that may take a while. He was obscure in regards to the actual timetable for the launch.

The SEC chairman additionally criticized crypto exchanges for unsavory practices and mentioned the market continues to be stuffed with fraud and manipulation. He added that the SEC stays dedicated to making sure integrity throughout markets.

Gensler made the assertion throughout a June 5 interview on CNBC in response to Jim Cramer's questions on potential exchange-traded merchandise for cryptocurrencies exterior of Bitcoin and Ethereum.

Lack of correct disclosure

Regardless of the optimistic regulatory progress, Gensler expressed concern in regards to the lack of correct disclosure and regulation within the broader crypto market. He mentioned most cryptocurrencies don’t meet the “fundamental disclosure necessities” anticipated of a regulated asset class.

Based on the SEC Chairman:

“These tokens, whether or not well-known or unknown, don’t present the mandatory info required by regulation.”

The SEC chairman emphasised that traders usually are not getting the data they should make knowledgeable selections, which is a elementary precept of securities markets.

Gensler additionally addressed the potential dangers posed by crypto exchanges, which stand in stark distinction to conventional exchanges such because the New York Inventory Trade (NYSE).

The SEC chairman additionally criticized crypto exchanges for allegedly partaking in actions that will not be permitted beneath US regulation – reminiscent of buying and selling towards their prospects, which creates important conflicts of curiosity.

He mentioned:

“Crypto exchanges are partaking in practices that will by no means be allowed on the NYSE. Our legal guidelines don’t enable exchanges to commerce towards their prospects, but that is taking place within the crypto house.”

Gensler emphasised the significance of defending traders from fraud and manipulation, citing current high-profile instances such because the FTX and Celsius Community collapses. He added that such criminality stays a major a part of the crypto market and is a key space of focus for regulators.

He talked about ongoing enforcement actions and reiterated the SEC's position as a civil enforcement company dedicated to sustaining market integrity.

AI and honest competitors

Gensler's feedback additionally touched on synthetic intelligence (AI) and its implications for monetary markets. He described AI as probably the most transformative expertise of our time, however warned of the dangers related to its use.

Based on Gensler:

“AI can enhance capital markets, nevertheless it additionally poses the danger of battle, fraud and systemic issues if not correctly managed.”

The dialog additionally coated broader market subjects, together with the stability between the private and non-private markets and the necessity for honest competitors.

Gensler emphasised the significance of public markets in offering clear and accessible funding alternatives, whereas acknowledging the expansion of personal credit score markets.