The funding fee for perpetual futures serves as a proxy for market sentiment and reveals the stability between lengthy and brief positions. Vital deviations from the common funding fee throughout exchanges can sign potential placement imbalances. A rise in funding charges on a selected alternate signifies numerous lengthy positions, which might result in a possible squeeze or lengthy liquidation if the market turns.

One other statement that may be drawn from adjustments in funding charges is arbitrage alternatives. A big distinction between exchanges or contract varieties permits merchants to capitalize on short-term market inefficiencies. Because of this even the smallest adjustments in funding charges could be essential as they’ll act as early warning indicators of potential market strikes or adjustments in sentiment.

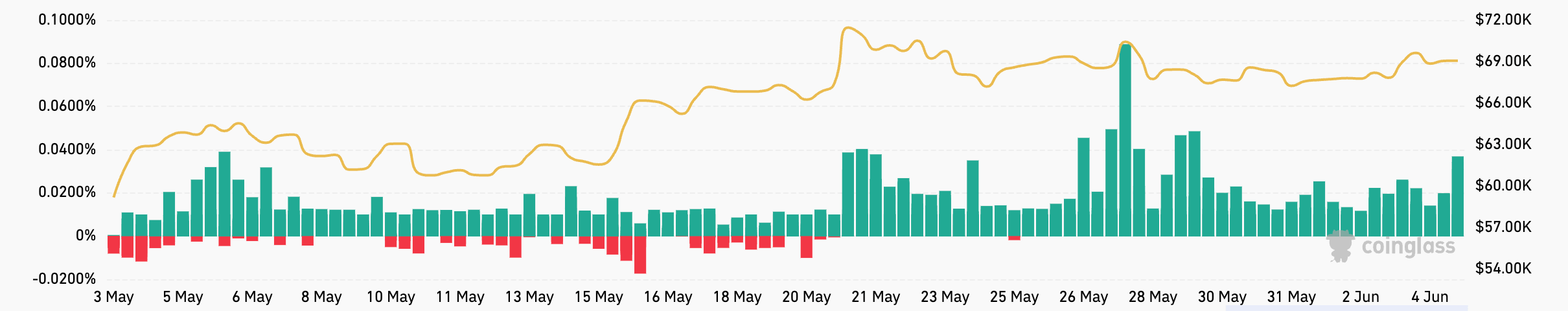

Funding charges for USDT and USD perpetual margin futures have been comparatively steady all through Might. This means a comparatively steady market that’s biased in the direction of bullish development. This stability was briefly disrupted on Might 27, when the USDT funding fee and USD perpetual margin futures on dYdX rose to 0.0889%. This was a major departure from the common fee of round 0.0120% throughout different exchanges, indicating a major imbalance between lengthy and brief positions. Extra merchants in lengthy positions might have been the results of a short rally within the value of Bitcoin to over $70,000. Nonetheless, as different exchanges noticed much less volatility within the funding fee, there might have been some inefficiencies that dYdX merchants have been fast to take advantage of.

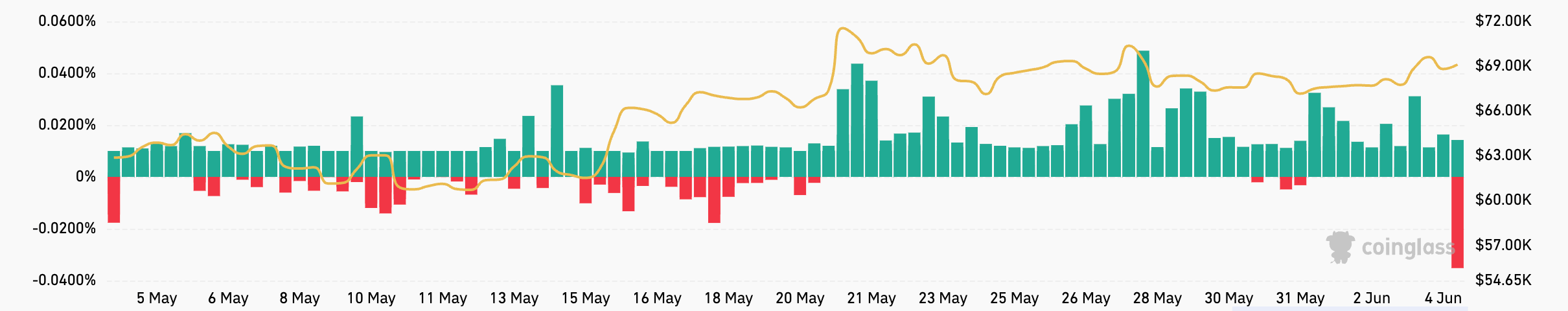

The token margin perpetual futures funding fee has seen comparable stability over the previous 30 days, ranging between 0.0100% and 0.0140% throughout Might. Within the early hours of June 4th, Bitmex noticed a major drop within the funding fee for perpetual token margin futures from a steady 0.0100% to -0.0352%. Such a pointy drop in 24 hours confirmed a powerful bearish sentiment amongst merchants. Nonetheless, with different exchanges seeing their charges regular at 0.0100%, the bearish sentiment appears to be concentrated solely amongst Bitmex customers. Bitmex's morning funding fee was near the ground of -0.0375% set by many exchanges that confirmed excessive positions in these contracts in comparison with USDT or greenback margin contracts.

Over the course of the day, the funding fee managed to consolidate to round -0.0150%, additional indicating the short-term nature of volatility.

A few of this volatility could be attributed to the speculative nature of token margin contracts. Exchanges providing perpetual token margin futures usually present increased leverage than USDT or USD margin contracts. Whereas increased leverage can amplify potential income, it additionally will increase losses, making token margin contracts riskier and extra appropriate for speculative buying and selling methods.

Perpetual token margin futures have a tendency to draw the next proportion of outlets and speculators who’re extra danger tolerant and should search increased returns. Institutional traders {and professional} merchants, who sometimes favor danger administration and capital preservation, usually tend to gravitate in the direction of USDT or USD margin contracts, that are perceived to be extra steady.

One other essential issue that might have led to such a pointy drop in funding charges on Bitmex is the depth of the market. Perpetual Token Margin Futures sometimes have decrease liquidity than their USDT or USD Margin counterparts. Decrease liquidity results in wider bid-ask spreads, making these markets extra liable to hypothesis and volatility.

Steady charges on most exchanges over the previous 30 days, mixed with comparatively restricted Bitcoin value motion, point out a interval of uncertainty and indecision out there. Remoted declines and spikes in funding charges on particular exchanges in latest weeks due to this fact point out inside tendencies and adjustments greater than market-wide ones.

The publish Funding Charge Volatility Exhibits Localized Commerce Imbalances Regardless of Market Stability appeared first on fromcrypto.