Funding charges are an usually ignored however essential side of the crypto market. These charges are important for perpetual futures contracts — monetary devices that permit merchants to wager on the worth of bitcoin with out an expiration date.

Funding charges assist align the worth of those contracts with the true market worth of Bitcoin by common funds between patrons and sellers. Consumers pay sellers if the speed is optimistic, indicating bullish market sentiment. Conversely, a damaging price signifies bearish sentiment, with sellers paying patrons.

Funding charges point out the path of market leverage and total sentiment. Excessive funding charges point out sturdy bullish sentiment, with merchants prepared to pay extra to hedge their bets on rising costs. In the meantime, low or damaging charges point out a bearish outlook, the place expectations lean towards a decline in worth.

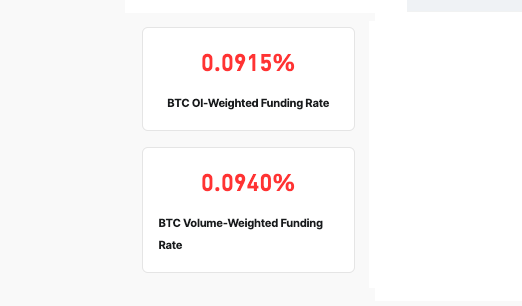

In accordance with CoinGlass information, an open interest-weighted funding price of 0.0921% and a volume-weighted funding price of 0.0942% confirmed excessive prices for merchants who held lengthy positions in perpetual futures previous to the March 5 Bitcoin correction. The slight distinction between these charges comes from the unfold of open curiosity and quantity at totally different worth factors or occasions, displaying a slight distinction in market sentiment and leverage.

These excessive prices of holding lengthy positions present that many of the market anticipated costs to rise additional within the close to future. That is notably important as BTC has struggled to recapture its ATH of $69,000. Bitcoin briefly breached $69,000 on a number of exchanges on March 5, however a fast correction despatched its worth again to $59,500 earlier than recovering to round $67,000.

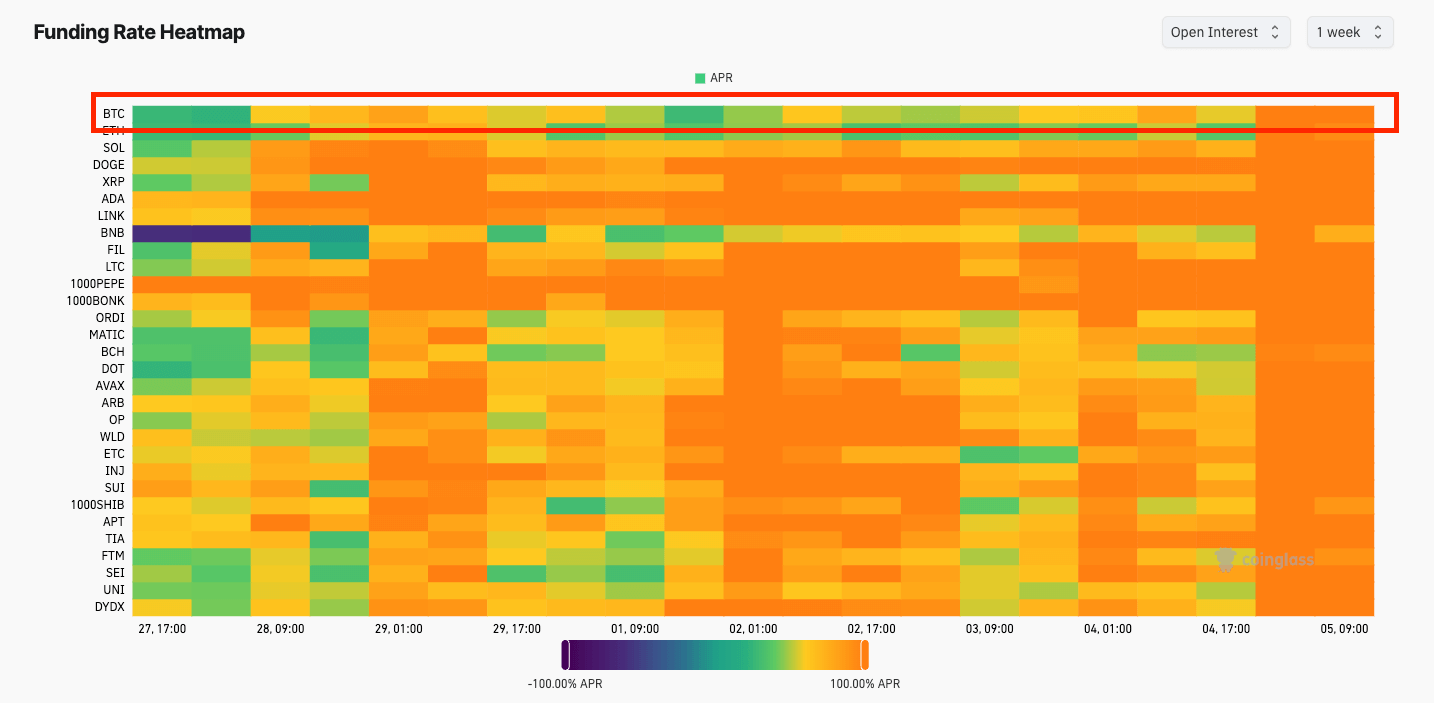

The bullish sentiment was seen within the dramatic improve in Bitcoin APR. On March 1st, the worth of Bitcoin was $61,480 and the APR financing price was 27.72%. And whereas the rise in RPSN was seen in the previous couple of days of February, it solely gained momentum in early March. The development from April’s 27.72% on March 1st to a pointy rise to 117.52% by the morning of March fifth adopted Bitcoin’s worth improve from $61,480 to $68,296 over the identical time-frame.

The rise in APR funding charges, notably the leap seen on March 5, exhibits that bullish sentiment amongst merchants has intensified. The market is more and more prepared to pay greater premiums to carry lengthy positions in anticipation of additional worth appreciation.

The speedy escalation in April between March 1 and March 5, notably the hourly spike between 01:00 and 09:00 on March 5, represents the peak of speculative enthusiasm that could be pushed by FOMO as merchants rush to capitalize on the bullish pattern. This situation usually results in a extremely leveraged market the place the price of holding lengthy positions is extraordinarily excessive, which is mirrored within the rising APR. On account of the March fifth worth correction, Open Curiosity’s weighted funding price was right down to 0.0504% at press time following $309 million BTC liquidations within the final 24 hours.

Such circumstances improve the market’s vulnerability to volatility and corrections. An overleveraged market is liable to sudden worth drops, the place even minor sell-offs can set off a cascade of liquidation of leveraged positions, resulting in sharp worth corrections. Traditionally, corrections have typically been preceded by important will increase in costs and financing charges.

The publish Funding charges rise as merchants wager on future bitcoin positive aspects forward of correction appeared first on fromcrypto.