The distribution of bitcoin provide amongst completely different cohorts—shrimps, crabs, fish, sharks, and whales—may help us perceive how every phase of the market behaves. Shifts in Bitcoin provide amongst these teams are extremely correlated with value actions and broader market developments, so understanding them is important when analyzing the market.

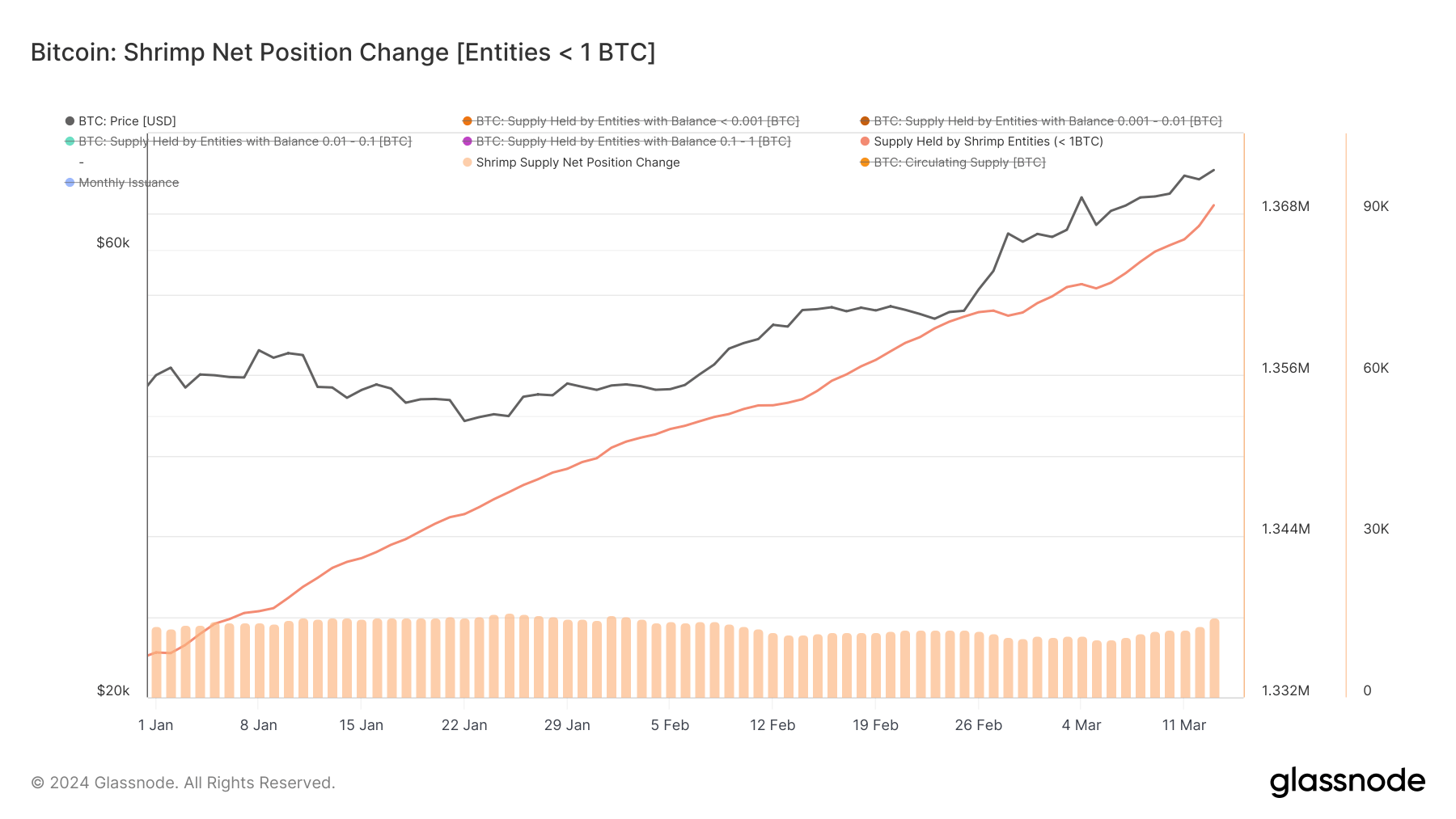

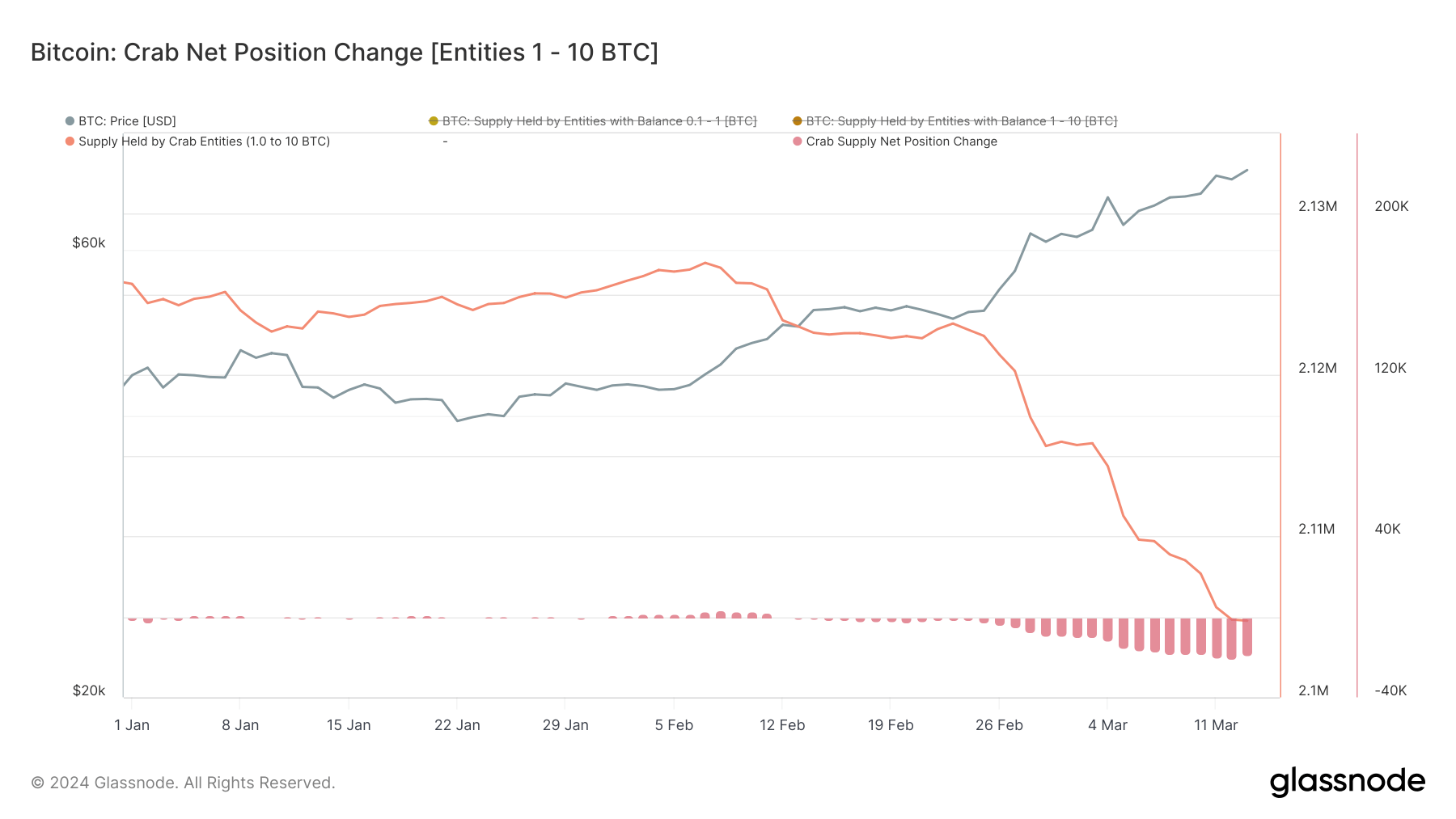

Shrimps characterize small buyers who maintain lower than 1 BTC, which is a measure of participation within the Bitcoin market. Crabs embody retail buyers holding between 1 and 10 BTC, typically thought of knowledgeable long-term holders.

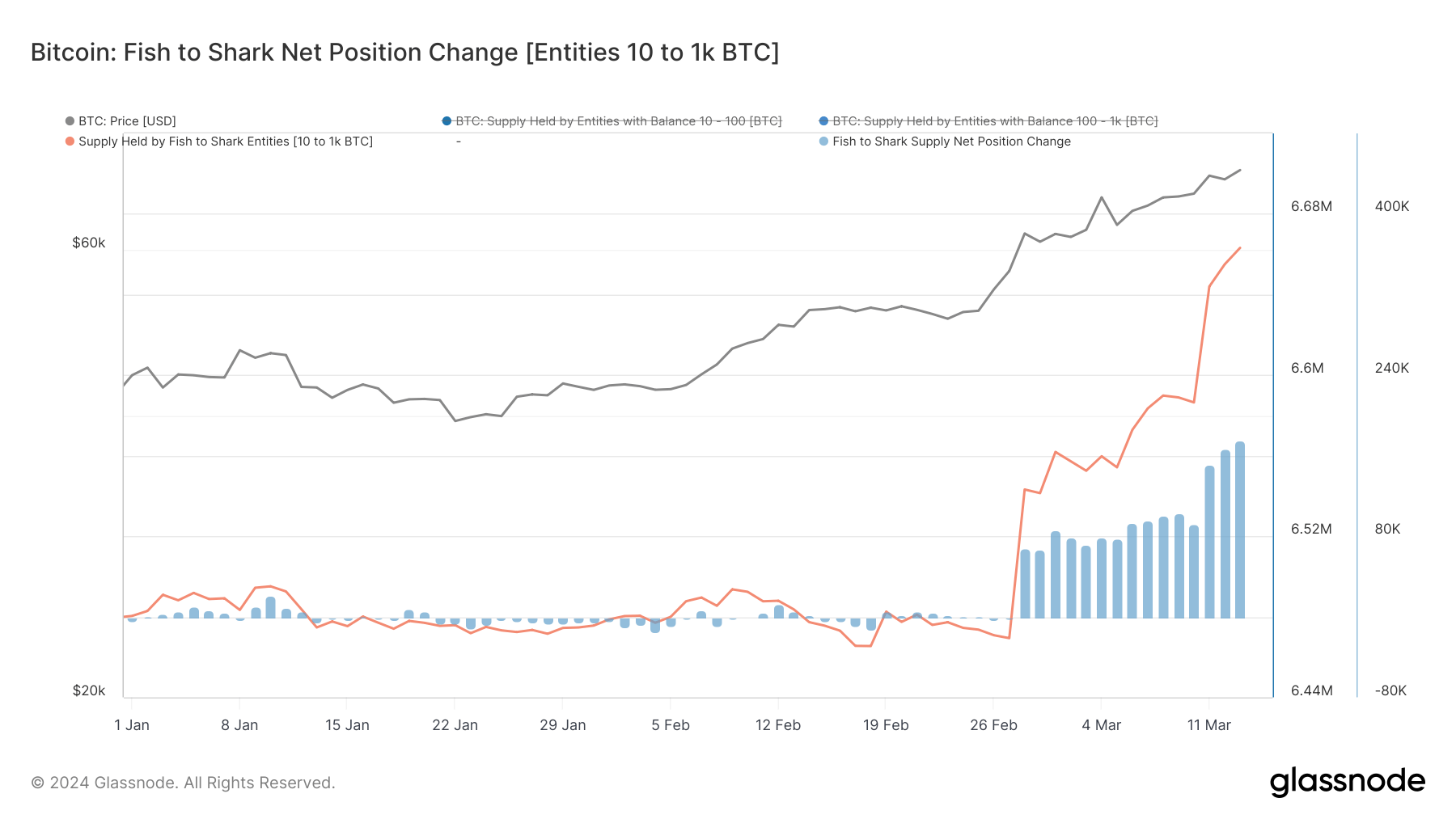

The fish and sharks embody increased internet price people and institutional buyers with holdings starting from 10 to 1,000 BTC, a class that displays each early adopters {and professional} buying and selling operations.

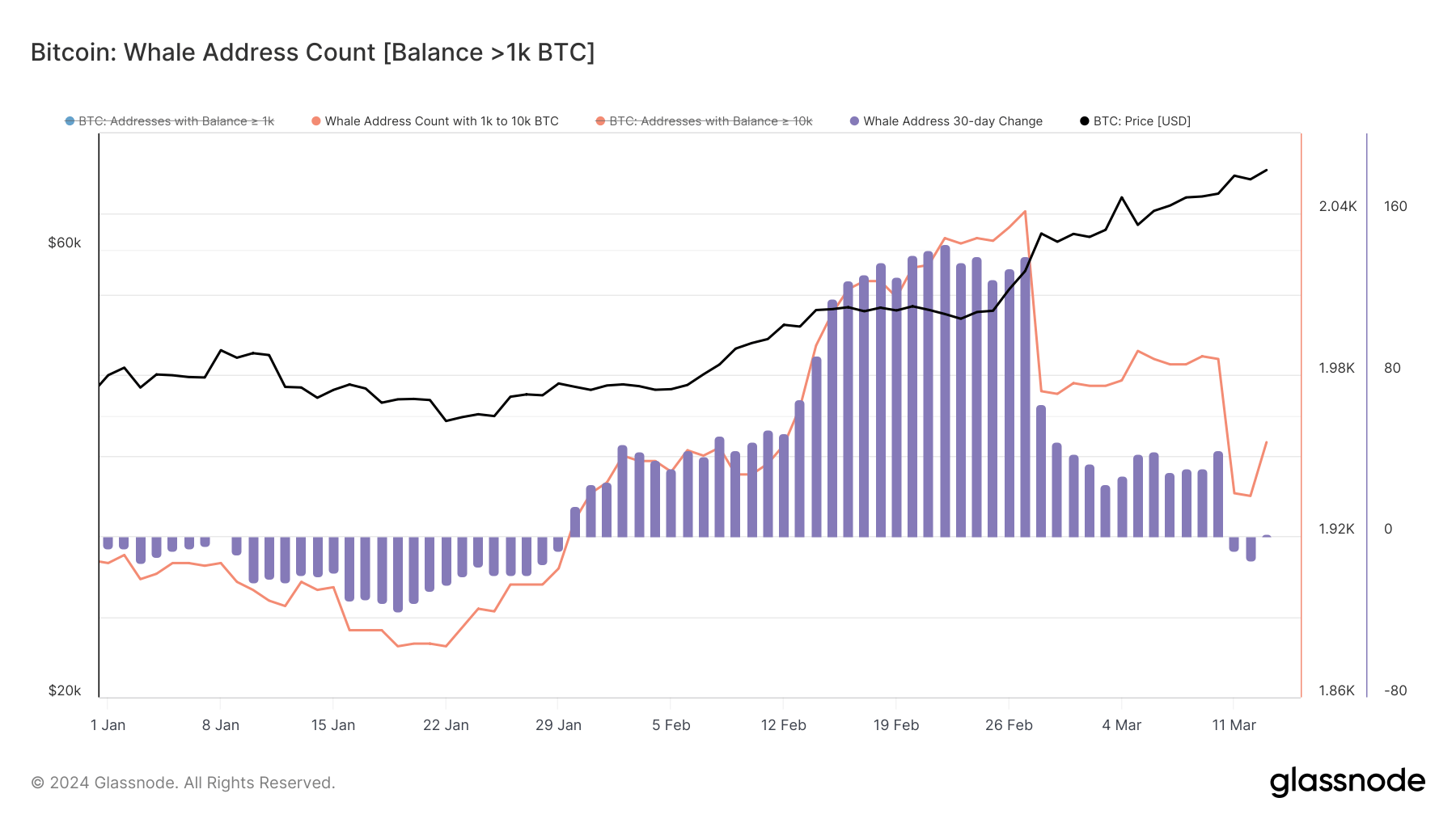

Lastly, whales maintain between 1,000 and 10,000 BTC, whose actions are intently watched because of their important impression available on the market.

Monitoring modifications in provide distribution throughout these cohorts offers invaluable perception into bitcoin’s liquidity and the strategic positioning of various courses of buyers.

From January 1 to March 13, the shrimp elevated their Bitcoin holdings from 1.335 million BTC to 1.368 million. This constant progress, regardless of value volatility, suggests a greenback value averaging technique the place small, common purchases are made whatever the asset’s value.

This conduct suggests a deep-seated perception within the long-term worth of Bitcoin amongst retail buyers, seen via their continued funding regardless of market uncertainty.

The crab cohort – normally small buyers with extra capital or those that have collected over time – noticed their holdings drop barely from 2.125 million BTC to 2.104 million BTC.

A decline, particularly round March 12, exhibits a response to cost fluctuations, probably taking earnings or minimizing losses. It means that whereas the crabs are dedicated to their Bitcoin investments, they continue to be delicate to market fluctuations and are ready to regulate their positions in response to perceived dangers.

The fish-to-shark group noticed its holdings enhance from 6.480 million BTC on January 1 to six.663 million BTC by March 13, with a major constructive change over the course of the month.

This means strategic accumulation by increased internet price people and establishments, which can make the most of the introduction of spot bitcoin ETFs and anticipated market progress. The conduct of this group displays the actions of financially important gamers whose confidence can affect the market.

Whalers have seen their numbers fluctuate, peaking at 2,041 in February earlier than falling to 1,955 on March 13. This modification suggests profit-taking or portfolio changes in mild of a bullish market pattern.

Whale actions are essential to market route because of their important holdings and the affect they’ve on market liquidity and sentiment.

Information from Glassnode confirmed completely different methods throughout these cohorts, indicating their completely different perceptions of threat, funding horizon and response to market actions.

Surprisingly, shrimp have proven unwavering religion in Bitcoin and have steadily elevated their holdings. In the meantime, crabs, who’re typically steady, have proven a willingness to answer market indicators and modify their place sizes in response to cost actions.

Fish and sharks seem to have been the cohort that cashed in probably the most on the launch of US spot ETFs. The market optimism that adopted the long-awaited buying and selling product considerably modified the scale of the availability held by these cohorts, indicating the rising confidence of establishments and high-net-worth people in Bitcoin.

In the meantime, whales confirmed attribute strategic flexibility, with a slight decline of their numbers pointing to a cautious strategy in a bullish state of affairs.

The put up From shrimp to whales: Who’s shopping for and promoting throughout this rally? appeared first on fromcrypto.