Bitcoin’s Realized Cap is a nuanced and progressive metric for evaluating Bitcoin’s valuation that differs considerably from conventional market capitalization.

In contrast to a market cap, which merely multiplies the present market worth of Bitcoin by the whole variety of cash in circulation, a realized cap presents a extra detailed and economically significant view of the Bitcoin market.

It does this by aggregating the worth of all bitcoins on the worth at which they have been final moved, not the present worth. This strategy can present a extra steady view of market valuations, much less vulnerable to the volatility related to speculative buying and selling and short-term market actions.

To calculate the realized cap, it’s essential to take the worth of every bitcoin on the time it final moved after which add these particular person values throughout all bitcoins. Because of this if a Bitcoin was final moved when its worth was $10,000, that specific Bitcoin contributes to the $10,000 restrict, whatever the present market worth.

A realized cap reveals issues in regards to the bitcoin market that aren’t instantly apparent by way of a market cap.

First, it might present perception into the funding habits of bitcoin holders. For instance, a rising realized cap signifies that Bitcoin is transferring at greater costs, indicating optimistic sentiment amongst traders. Conversely, a steady or falling realized ceiling could sign that the majority bitcoins will not be altering fingers, which can point out holder conviction or a scarcity of recent funding at greater worth ranges.

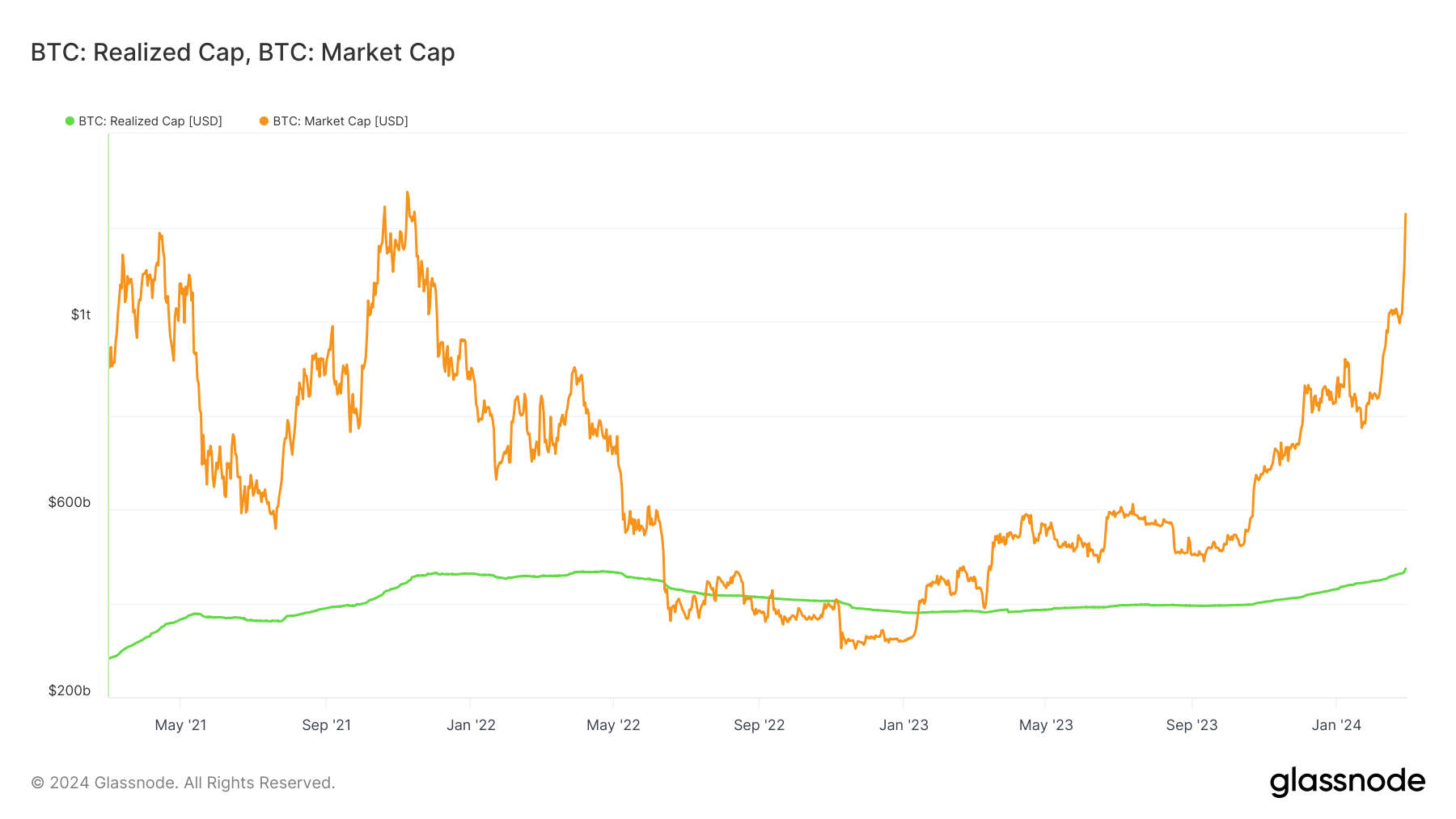

Furthermore, it might function an alternative choice to invested capital, which is much less delicate to speculative fluctuations. In periods of excessive volatility, market capitalization can fluctuate wildly, however the realized cap tends to maneuver extra easily, as seen within the chart beneath, reflecting a extra grounded evaluation of Bitcoin’s market worth. This stability makes it a invaluable software for traders trying to gauge the underlying well being of the market away from the noise of day by day worth actions.

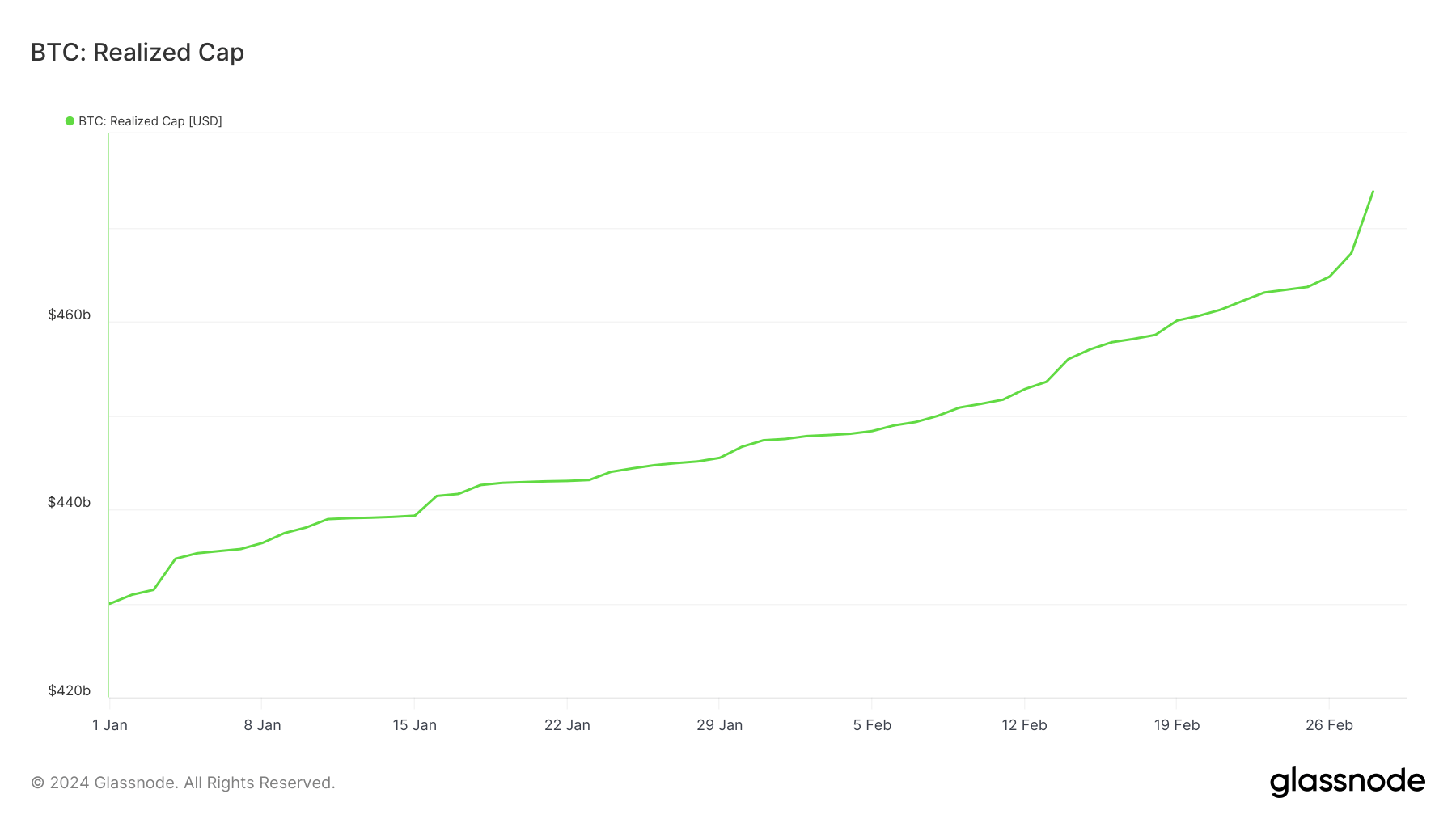

Bitcoin’s realized cap reached its all-time excessive on February 28, reaching $473.8 billion. Because of this, on common, the Bitcoin community and its individuals have by no means invested in BTC as economically as they’re now, primarily based on the costs at which most Bitcoins have been final traded.

Attaining ATH within the applied ceiling means widening and deepening of the market fundamentals.

In contrast to a market cap, which might rapidly inflate with speculative fervor, a realized cap grows because of transactions that replicate precise transfers of wealth, and thus a extra enduring perception in Bitcoin’s worth. Due to this fact, this ATH may very well be seen as a extra significant indicator of the rising adoption of Bitcoin and its integration into the monetary portfolios of a wider vary of traders.

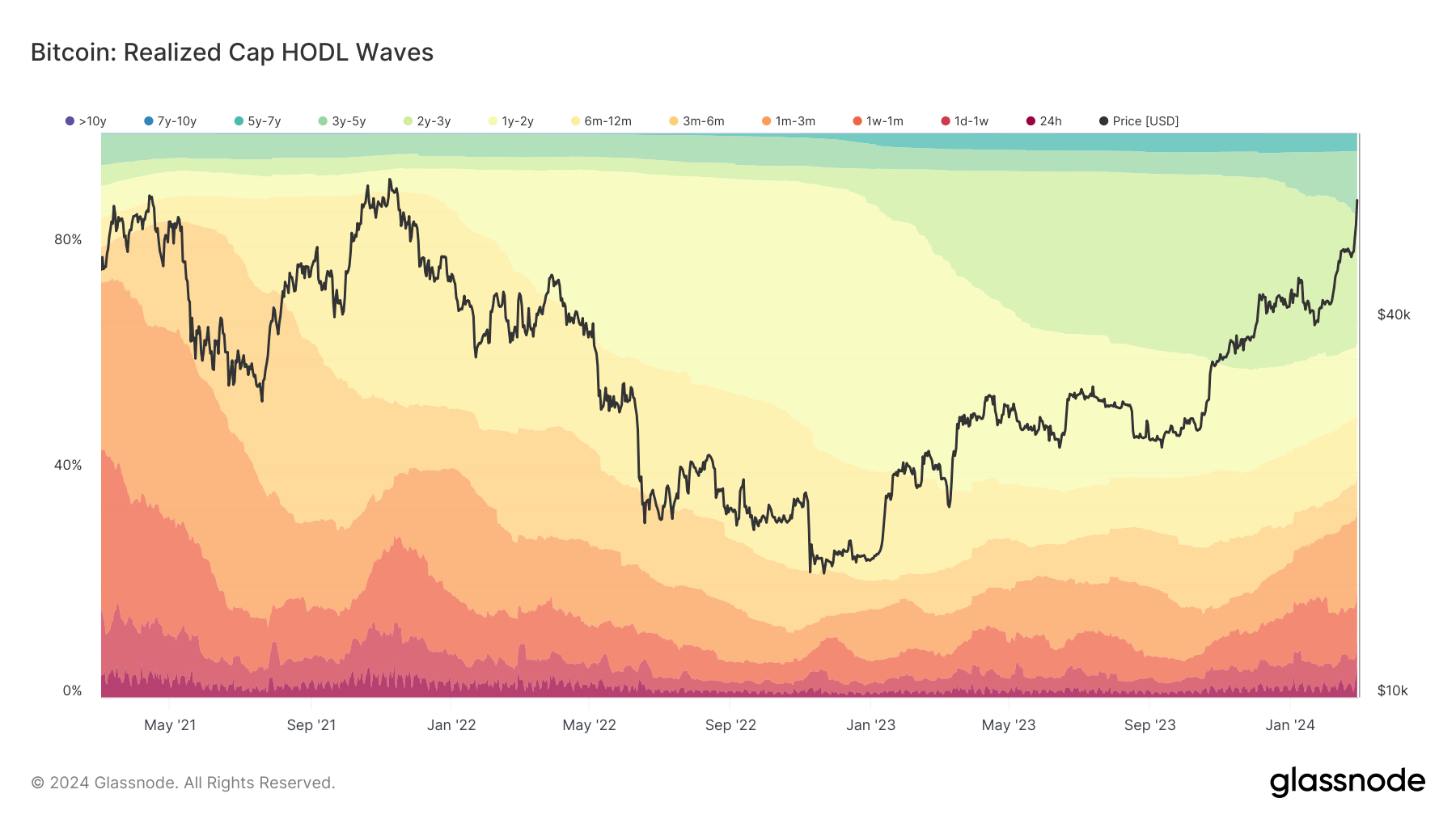

The Realized Cap HODL Waves knowledge gives fascinating perception into the habits of Bitcoin holders and their contribution to the realized cap improve. By analyzing modifications within the distribution of bitcoins held throughout totally different time-held cohorts over the previous three days, we will decide which group is essentially the most energetic and the way their actions have affected the realized restrict.

On February 25, the distribution was as follows:

- Bitcoins held for lower than 24 hours accounted for 0.856% of the realized cap.

- Bitcoins held between 1 day and 1 week contributed 5.8%.

- The 1 week to 1 month cohort accounted for 15.571%.

- Bitcoins held for 3 to six months accounted for six.318%.

- The 6 months to 1 12 months group was 11.818%.

- Lastly, Bitcoin held for 1 to 2 years contributed 12.438%.

By February 28, there was a big shift:

- The proportion of bitcoins held for lower than 24 hours surged to five.828%.

- The holding between 1 day and 1 week fell to 4.851%.

- The 1 week to 1 month cohort dropped considerably to eight.543%.

- The three to six month group was barely diminished to six.209%.

- Holding 6 months to 1 12 months fell to 11.338%.

- The one- to two-year cohort decreased to 11.975%.

From this knowledge, essentially the most important shift occurred within the 24-hour cohort, which elevated dramatically from 0.856% to five.828%. This means a big inflow of recent funding or buying and selling exercise, the place a big quantity of Bitcoin modified fingers rapidly and was seemingly offered or transferred at greater costs, contributing to the rise within the realized cap. Such short-term holdings point out speculative buying and selling or speedy reactions to market circumstances.

The lower in percentages for the 1 day to 1 week and 1 week to 1 month cohorts, together with a slight lower within the longer-term holding classes, suggests a consolidation or shift away from these teams both into very short-term holding (<24h) because of buying and selling or into longer-term holdings not specified right here. This might point out a reallocation of property available in the market, the place some short- to medium-term holders determined to take earnings or reallocate their investments, contributing to the realized cap improve.

Due to this fact, the rise in realized cap seems to be considerably pushed by short-term market exercise and buying and selling relatively than long-term holding methods, as evidenced by the dramatic improve within the <24h cohort. Though there may be exercise throughout all cohorts, the predominant contribution to the rise in realized cap throughout this era comes from these engaged in short-term buying and selling.

This habits displays a market the place worth actions and speedy buying and selling alternatives have an effect on the realized cap greater than the buildup methods of longer-term traders.

The submit File Excessive Realized Cap Exhibits Unprecedented Financial Funding in Bitcoin appeared first on fromcrypto.