The next is a visitor submit by Vincent Maliepaard, Advertising and marketing Director at IntoTheBlock.

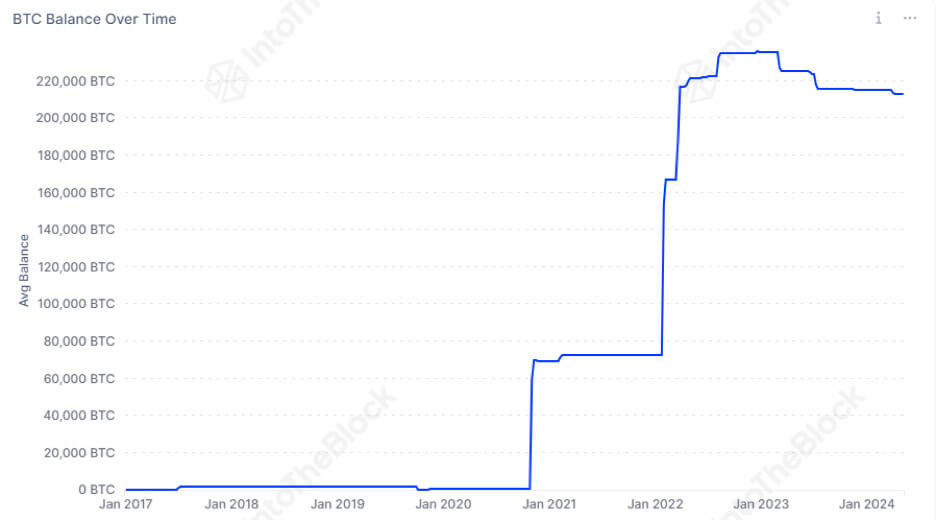

In line with the most recent information from IntoTheBlock, the US authorities holds greater than 1% of the Bitcoin provide, value a powerful $13.16 billion. These shares have tripled since 2021, demonstrating a gentle improve over time.

Why the US Authorities Holds Bitcoin

You will need to make clear that the US authorities's holding of bitcoins isn’t the results of purchases, however of enforcement actions. These interceptions normally happen in response to unlawful actions.

Will increase within the quantity of Bitcoin held by the US authorities are related to the most important enforcement actions associated to BTC. Notable examples embrace the Silk Street vase and the Bitfinex hack.

Silk Street (2013):

Some of the notable circumstances concerned the seizure of roughly 174,000 bitcoins from Silk Street, a darkish internet market. The FBI shut down Silk Street and arrested its founder, Ross Ulbricht. In a dramatic twist, the US authorities later seized over $1 billion value of Silk Street-linked bitcoins, present in a beforehand undiscovered pockets containing roughly 69,370 bitcoins.

Bitfinex Hack (2016):

In August 2016, hackers breached Bitfinex, a outstanding cryptocurrency trade, and stole roughly 120,000 BTC value round $72 million.

Just a few years later, in February 2022, the Division of Justice introduced the restoration of a good portion of the stolen bitcoins, value over $3.6 billion. This marked the most important restoration of stolen cryptocurrency in historical past.

Different notable suits

Whereas Silk Street and Bitfinex are among the many most outstanding circumstances, there have been a number of different notable seizures. In 2017, the US seized $4 million value of bitcoins (presently value over $60 million) from the BTC-e trade throughout a multi-agency investigation into alleged cash laundering. Alexander Vinnik, the alleged operator of BTC-e, was arrested.

One other notable case considerations the seizure of the property of the founders of the BitMEX trade in 2020 for violating the Financial institution Secrecy Act. Though particular bitcoin quantities haven’t been disclosed, BitMEX has been processing giant volumes of bitcoin transactions.

Implications of presidency holdings

Monitoring the holdings of huge Bitcoin stashes, corresponding to these held by the US authorities, is essential for a number of causes.

First, choices relating to whether or not and when the federal government strikes these bitcoins might considerably have an effect on market dynamics. The way during which they’re launched—whether or not by way of direct gross sales, auctions, or another method—can both mitigate or exacerbate the impression in the marketplace.

For instance, a coin public sale might entice institutional buyers who respect the transparency and legitimacy of “government-sanctioned” bitcoins. This reassurance is very vital for these involved in regards to the origin of their cryptocurrencies, as shopping for from respected sources will keep away from the dangers of getting funds tied up in unlawful actions.

Equally, the US authorities holds sufficient bitcoins to considerably have an effect on market costs after its holdings are launched, which might result in speculative conduct amongst smaller buyers attempting to anticipate or react to those strikes.

However there may be extra to the story. A good portion of the Bitcoin provide is managed by the federal government and ETF entities, which poses a possible menace. In line with Juan Pellicer, Senior Researcher at IntoTheBlock:

The present degree of bitcoin possession amongst US authorities entities and ETFs poses a possible threat to the notion of bitcoin as an asset exterior the management of presidency forces or giant monetary establishments. The US authorities holds greater than 1% of the Bitcoin provide, value over $13.16 billion, whereas Bitcoin ETF issuers management $50.6 billion, representing greater than 4% of the BTC provide. This excessive focus of holdings challenges the narrative of bitcoin decentralization and will have an effect on market dynamics and investor conduct sooner or later.”

So monitoring these important holdings is about understanding present market values and anticipating potential adjustments available in the market.

The submit Evaluation of US Authorities Bitcoin Holdings: What You Have to Know appeared first on fromcrypto.