- Ethereum's RSI at 38.49 suggests it could be oversold, signaling a potential worth reversal if different indicators affirm this.

- Combined sentiment within the Ethereum derivatives market exhibits a drop in open curiosity however a rise in choices buying and selling quantity.

- Massive holders management 89% of Ethereum's provide, creating potential volatility if there’s a important selloff available in the market.

Based on a brand new CryptoQuant evaluation, Ethereum's realized worth has held regular despite the fact that the market has skilled a big decline over the previous 5 months. This worth degree has traditionally acted as robust assist, and when Ethereum outperforms it, it usually indicators the beginning of altcoin bull markets. Merchants are watching these developments carefully, in search of any indicators of an upward shift.

Ethereum is at present priced at $2,500.09 with a 24-hour buying and selling quantity of $13.78 billion. It has fallen 2.37% within the final 24 hours and its market capitalization is valued at $300.76 billion. There are roughly 120.3 million ETH cash in circulation.

The Relative Power Index (RSI) on the each day chart stands at 38.49, indicating that Ethereum may very well be oversold and a worth reversal may happen. Merchants monitor different technical indicators and market circumstances to verify potential developments earlier than making buying and selling selections.

Moreover, Ethereum's MACD (Shifting Common Convergence Divergence) indicator is barely above the sign line, indicating a possible bullish pattern. This technical setup may current a shopping for alternative for merchants trying to make the most of a possible worth rally.

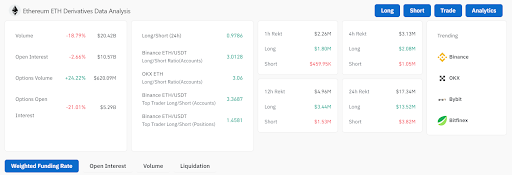

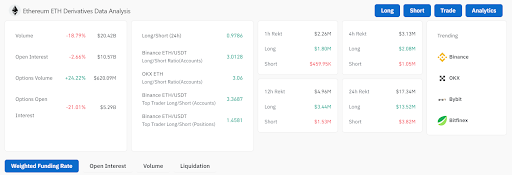

Nonetheless, sentiment within the Ethereum derivatives market is combined, with latest information exhibiting a 18.79% drop in buying and selling quantity to $20.42 billion. Open curiosity additionally fell 2.66% to $10.57 billion, reflecting cautious market habits.

Alternatively, choices buying and selling exercise noticed progress, with quantity growing by 24.22% to $620.09 million. Nonetheless, open curiosity in choices fell 21.01% to $5.29 billion. Lengthy/brief ratios point out a slight desire for shorts total, however exchanges akin to Binance and OKX present a robust lengthy bias.

Liquidations within the final 24 hours totaled $17.34 million, with $13.52 million coming from lengthy positions. Regardless of these remarkably lengthy liquidations, merchants stay bullish on main platforms, with exchanges akin to Binance and OKX enjoying a key position in buying and selling Ethereum derivatives.

A more in-depth have a look at Ethereum market dynamics exhibits that solely 8% of holders are at present in revenue whereas 71% are in loss, highlighting difficult market circumstances. Massive holders dominate with 89% possession of Ethereum, indicating potential volatility if these entities resolve to promote.

Moreover, Ethereum's robust correlation of 0.73 with Bitcoin means that its worth actions are sometimes tied to Bitcoin. The vast majority of Ethereum holders (64%) have held their positions for 1-12 months, whereas 35% are newer buyers.

Excessive-value transactions above $100,000 reached $3.6 billion final week, indicating robust curiosity from excessive web price people. As well as, web flows on exchanges reached $1.86 million, indicating energetic buying and selling. Geographically, buying and selling participation is balanced, with 52% coming from the West and 48% from the East.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shall not be accountable for any losses incurred because of the usage of stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.