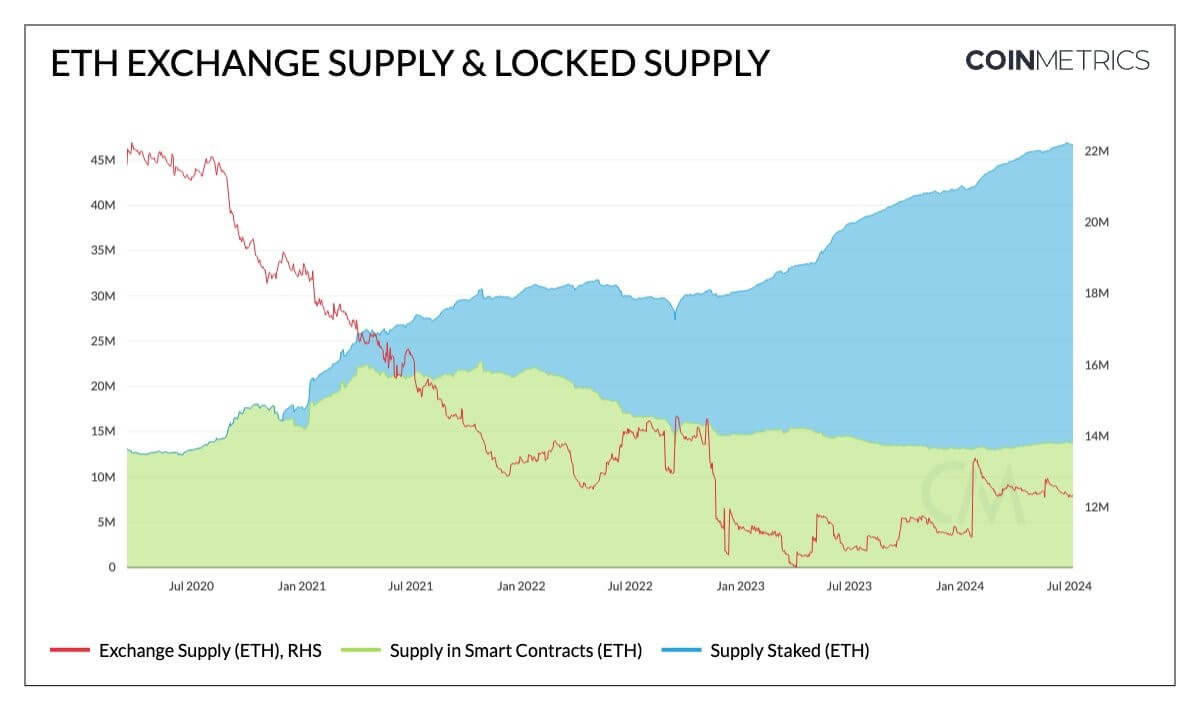

About 40% of Ethereum's provide is blocked because the market awaits remaining approval of ETH spot-based exchange-traded funds (ETFs).

A breakdown of this “locked provide” reveals that there are greater than 33 million ETH staked on the community, which represents round 28% of Ethereum's whole provide, based on Dune Analytics.

Proof-of-stake networks like Ethereum require customers to “lock down” their digital belongings to help their safety and operations, and in return obtain rewards.

As well as, 12% of the availability is tied to good contracts and bridges, which have been getting quite a lot of adoption lately. For instance, AJ Warner, Director of Technique at Offchain Labs, famous that ETH within the Arbitrum One bridge has been steadily rising over the previous three years.

Market watchers imagine that this substantial block of ETH and the upcoming approval of the ETF will enhance ETH costs. Tom Dunleavy, Managing Companion at MV Capital, identified that the approval of spot Ether ETFs will considerably have an effect on the market. said:

“ETH ETF spot flows will transfer this market shortly.”

ETF approval

In the meantime, anticipation continues to develop across the remaining approval of the spot Ethereum ETF in the USA.

On July 9, Bitwise's chief industrial officer, Katherine Dowling, stated that the ETF is near approval, noting that the Securities and Alternate Fee (SEC) is addressing just a few remaining points.

Dowling steered the merchandise might be authorized over the summer time, a sentiment echoed by Bloomberg ETF analyst James Seyffart.

Seyffart speculated that approval might come by the tip of the month regardless of his low confidence in precisely predicting the launch date. He stated:

“I’ve pretty low confidence in these launch date predictions at this level.” There is no such thing as a deadline and the SEC's Corp Fin is taking their time right here (I don't blame them). However these modifications had been very minimal and (I don't know) why the ETFs wouldn't be able to launch inside a couple of weeks.

In the meantime, crypto punters on Polymarket count on the merchandise to launch by the tip of the month, with an 87% probability of being listed for buying and selling by July 26.