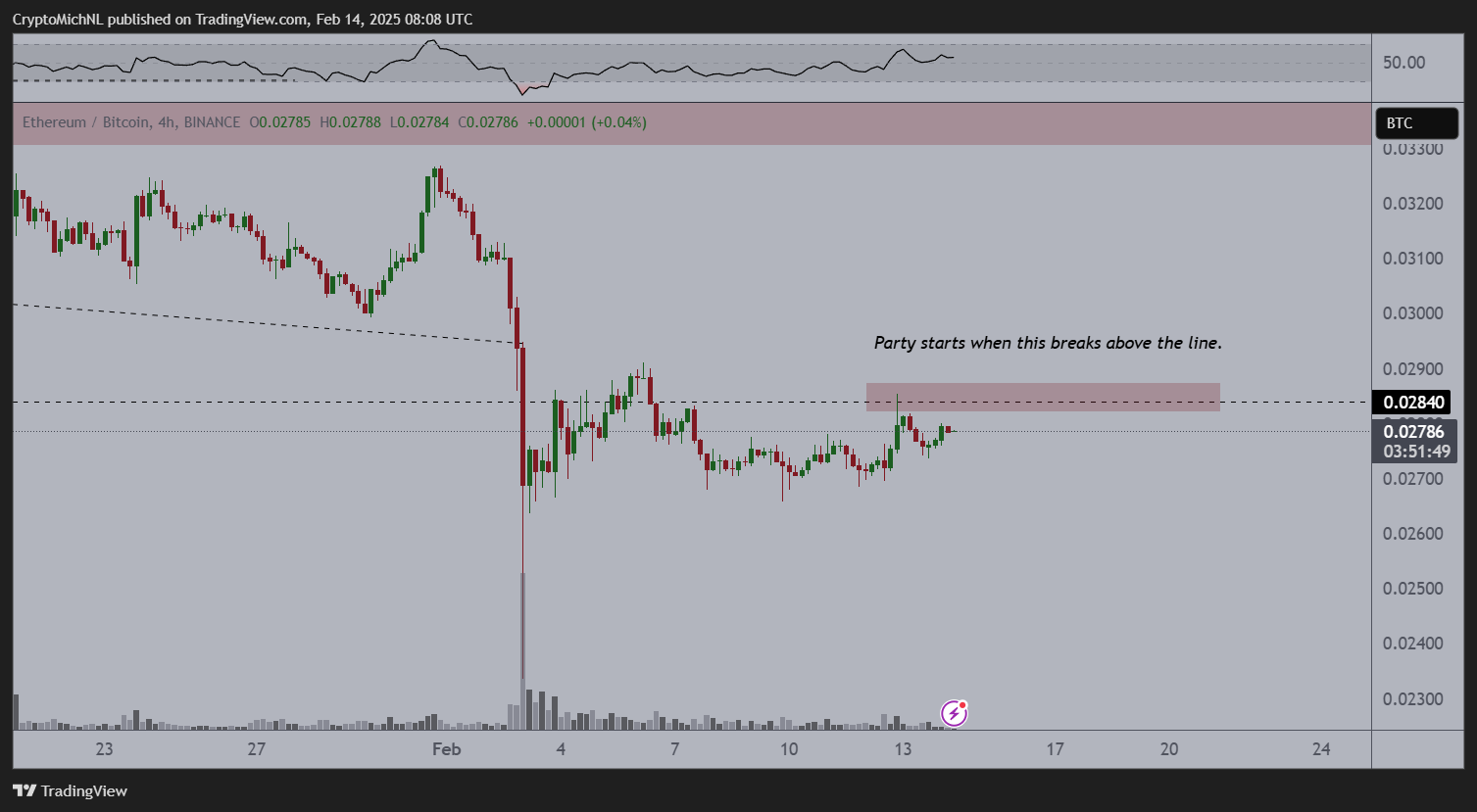

- The Ethereum BTC is near the extent of resistance 0.0285 BTC with a possible escape on the horizon.

- Analyst Michael van de Poppe predicts a 10-30% improve in altcoins if ETH breaks over this degree.

- Macroeconomic elements might act as a catalyst for this step, whereas merchants rigorously monitor improvement.

The Ethereum In opposition to Bitcoin is approaching a essential degree of resistance, and market analysts predict escape that would trigger a wider altcoin rally.

Crypto analyst Michael van de Poppe emphasised the extent of 0.0285 BTC as a key threshold for ETH/BTC. Available in the market replace, he mentioned: “The primary bounce to ETH is occurring when it breaks 0.0285.”

He additionally talked about that new macroeconomic messages might add to this sentiment. The necessary factor is that they assume altcoins can quickly bounce by 10-30%.

The ETH/BTC pair is consolidated after a pointy decline to start with of this month. Escape over 0.0285 BTC might point out renewed power for Ethereum and shift within the momentum of the market preferring altcoins.

Macroeconomic elements might have an effect on motion

Van de Poppe touch upon macroeconomic experiences means that wider monetary developments reminiscent of inflation, rate of interest selections or regulatory updates might have an effect on the Ethereum motion.

Associated: The worth of the Ethereum set for a break -up of $ 4,000, as upgrades drive rally

Ardour Crypto Market Conduct reveals that it responds to federal reserves' feedback, CPI experiences and international financial traits. This makes the exterior forces a doable set off for additional motion of ETH.

Altcoin rally in sight?

If the Ethereum efficiently breaks resistance, merchants anticipate to vary capital from bitcoins to altcoins, main to 2 -digit share earnings on the broader market.

Traditionally, ETH/BTC Breakouts typically marked the start of altcoin intervals. At the moment, altcoins are doing higher for some time than bitcoins.

Associated: Does the Ethereum comeback? The analyst predicts the brand new ATH in February

Sentiment volatility and investor Ethereum

At first of this week, analyst Markus Thielen identified that Ethereum has been extra unstable in current weeks than bitcoins, exhibiting much less pricing costs. It believes that this volatility might signify important alternatives for buyers, particularly with important occasions reminiscent of ETF approval, on the horizon.

Regardless of the potential escape of ETH, the sentiment stays largely detrimental available on the market. Van de Poppe has beforehand famous that brief positions on ETH are on the highest degree, indicating the bear's view between merchants.

However Thielen claimed that such excessive pessimism traditionally created alternatives to purchase. “Ethereum just isn’t a coin to which he’s to be emotionally hooked up.” Historical past reveals that alternatives seem when the sentiment turns into tremendously pessimistic, ”Thielen mentioned.

Renunciation of accountability: The knowledge on this article is just for data and academic functions. The article doesn’t signify monetary recommendation or recommendation of any sort. Coin Version just isn’t chargeable for any losses on account of using the content material, services or products. It’s endorsed that the readers ought to proceed with warning earlier than taking any measures with the corporate.